Will Dogecoin restart its run-up to tag $0.17 this time

Dogecoin’s price shows signs of incoming buying pressure that could be the key in triggering another run-up that retests a previously tagged level. This move is important since a flip of the hurdle could catalyze a further up move.

Dogecoin price to retrace its steps back higher

Dogecoin price has crashed a whopping 85% from its all-time high and is currently hovering around $0.14. From 29 September 2021 to March 23, it formed three distinctive lower highs and lower lows, which when connected using trend lines reveals a falling wedge pattern.

This technical formation forecasted a 34% upswing, which is obtained by adding the distance between the first swing high and swing low to the breakout point. The said breakout took place on 24 March at roughly $0.130, revealing the target at $0.178.

While the initial move after a breakout and retest was impulsive, it shattered the $0.161 hurdle and tagged the first target at $1.78. However, a further upswing was not possible as investors began to book profits and the market structure for the big crypto deteriorated. As a result, DOGE triggered its corrective move to 0.13 forming a base around this level.

A resurgence of buying pressure is pushing the meme coin back above the $0.144 hurdle in an attempt to retest the $0.178 barrier. This run-up could constitute a 23% ascent, but a flip of the said ceiling could extend the rally to $0.216, bringing the total gain to 50%.

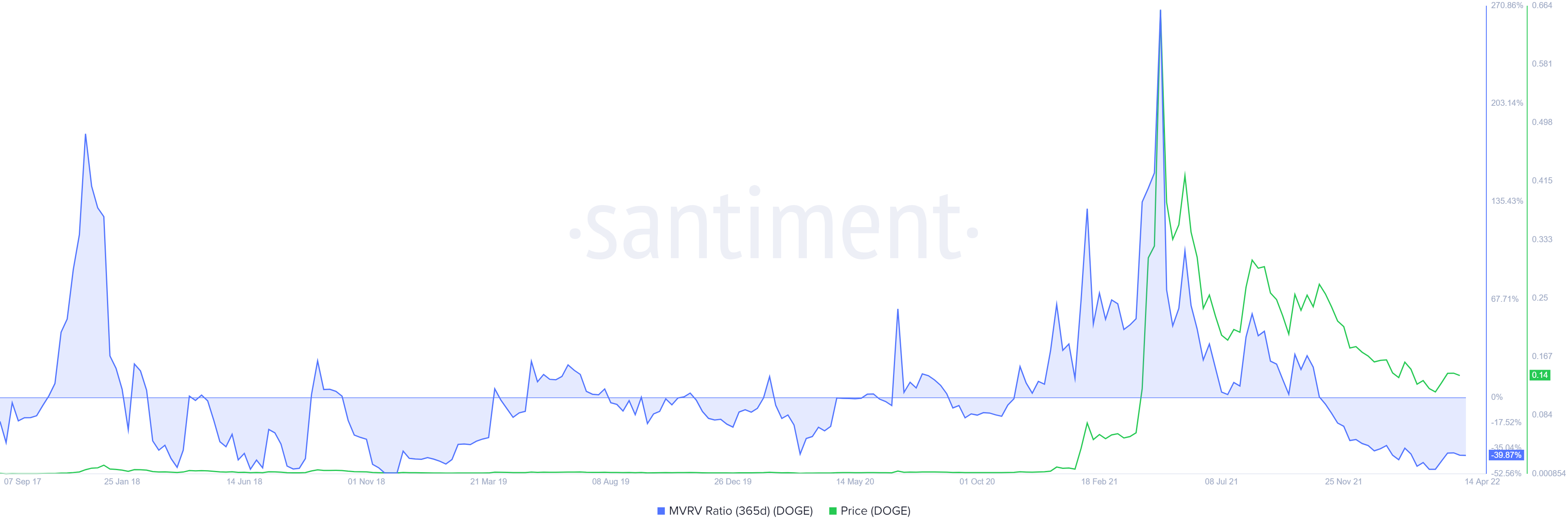

Further adding a tailwind to the bullish outlook for Dogecoin price is the 365-day Market Value to Realized Value (MVRV) model. As mentioned in previous articles, this indicator is used to assess the average profit/loss of investors who purchased DOGE tokens over the past year.

A value below -10% indicates that short-term holders are selling at a loss and is typically where long-term holders tend to accumulate. Therefore, a value below -10% is often referred to as an “opportunity zone,” since the risk of a sell-off is less.

For DOGE, this indicator has been hovering below the zero line since Q4 of 2021 and is currently at -38%, suggesting that many investors are underwater. Therefore, long-term investors could scoop up the DOGE tokens at a discount further propping up the price of the meme coin and triggering a quick run-up.