Will GMT be the next token to gain up to 70%?

- GMT could make gains of 44%-70% in the coming weeks.

- Despite bullish metrics, investors must practice strict risk management.

The altcoin market has added $274 billion in market capitalization since the 24th of January. Altcoins have been making massive gains in recent weeks, and finding the next setup could net traders a tidy profit.

Stepn [GMT] was one such candidate.

AMBCrypto took a closer look at the token and its on-chain metrics. The Web 3.0 application with a focus on “move to earn” showed bullish signs – but should investors seek to buy now?

The bulls are gathering strength

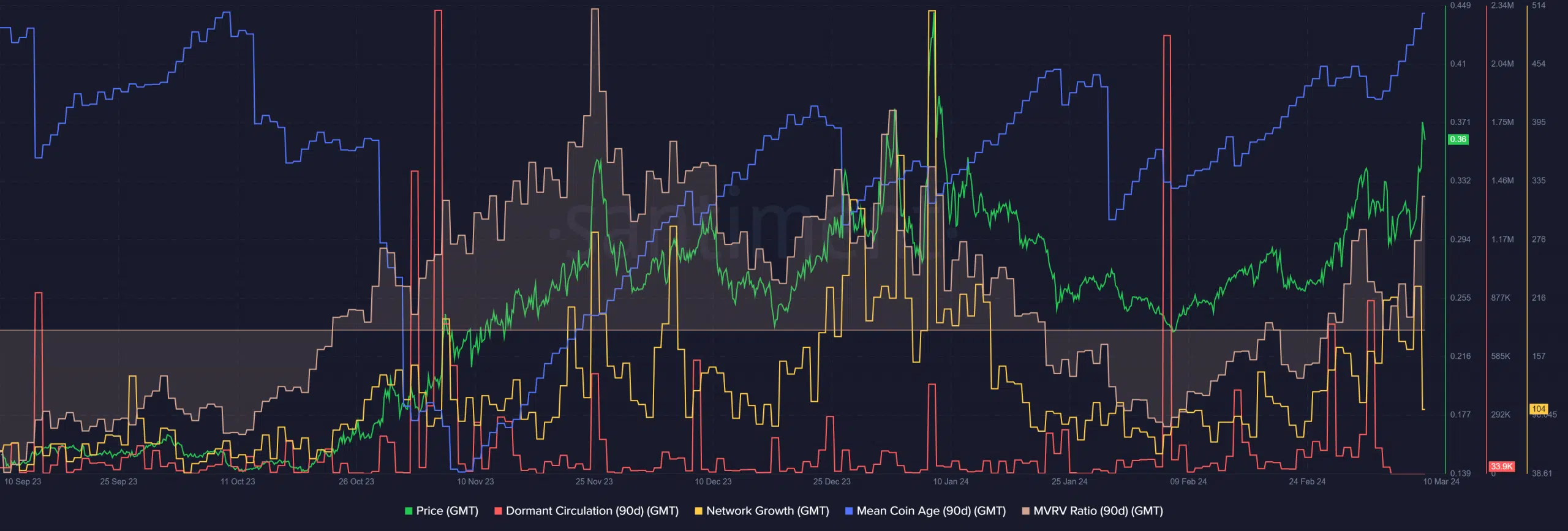

Source: Santiment

The mean coin age has trended higher since November. This was a strong sign of accumulation, although December and January saw sizeable drops in this metric.

It resumed its upward trend over the past six weeks. So too did the network growth.

This suggested that new addresses were being created and holders continued to amass the token.

The dormant circulation saw a large spike on the 3rd of March, followed by a price correction from $0.33 to $0.29 on the 5th of March. The circulation did not note significant surges since then.

The MVRV ratio was rising higher over the past three weeks alongside prices to reflect that holders were at a profit. This raised some concerns about selling pressure in the form of profit-taking.

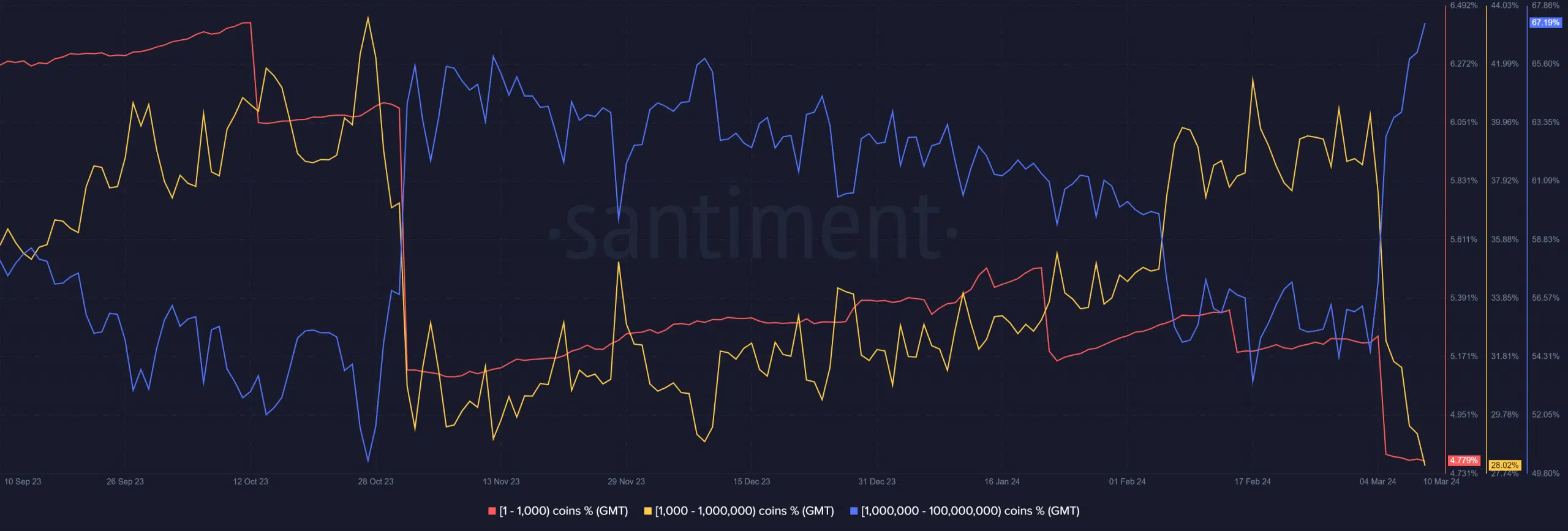

Source: Santiment

Analysis of the balance of addresses holding the GMT token showed that whales were on a buying spree.

Wallets with 1 million to 100 million GMT saw a remarkable uptick in early March, while small address balances dwindled as a percentage. Some well-informed whales might be loading up for a rally.

Highlighting key areas on the price chart

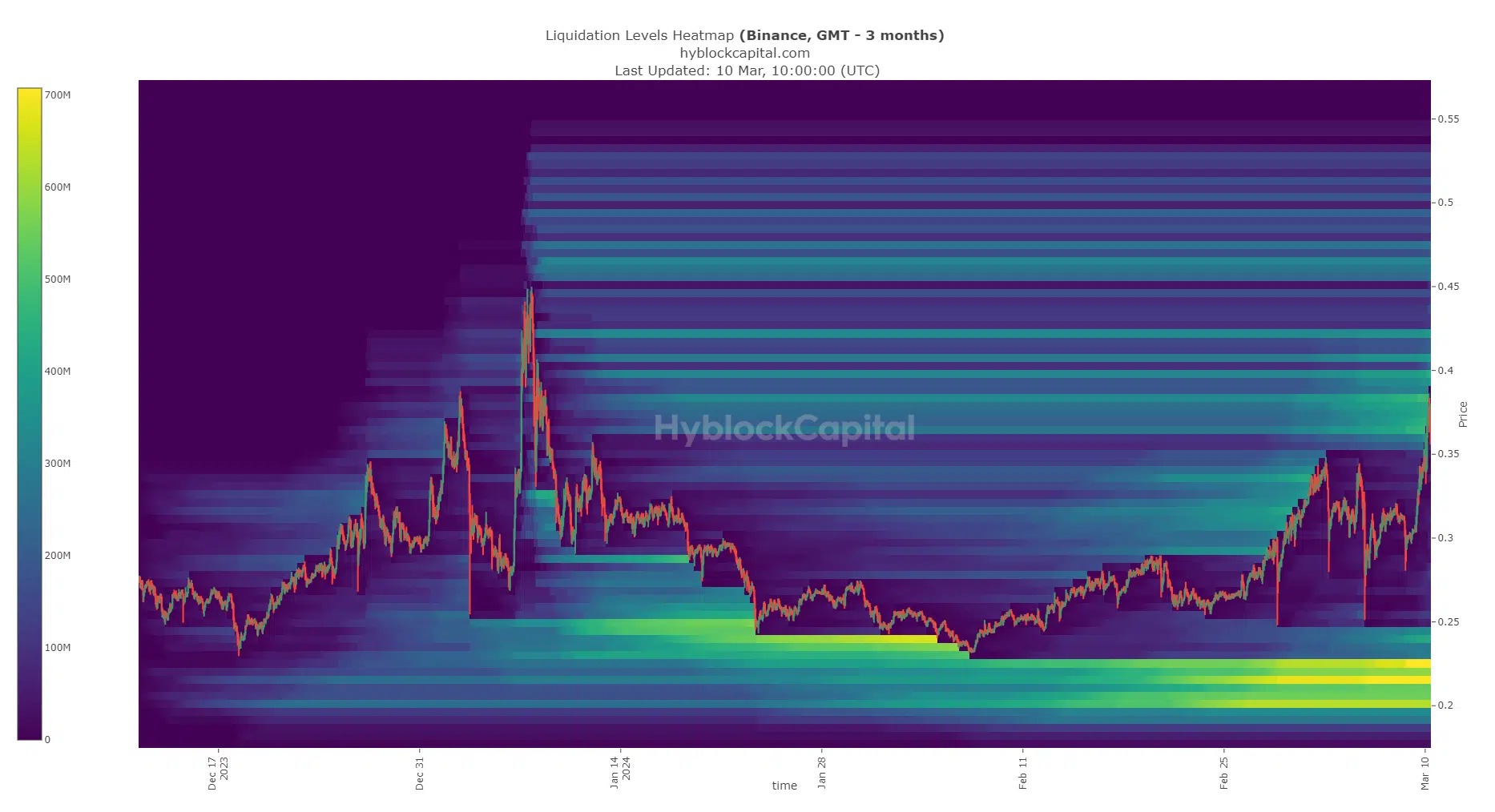

Source: Hyblock

The metrics supported the idea of healthy demand and accumulation of GMT. AMBCrypto also looked at the liquidation levels heatmap from Hyblock.

There were several levels with an estimated $300 million or more in liquidations to the north.

The $0.398, $0.407, $0.422, and the $0.465 populated this list. Therefore, prices are expected to climb to these levels one after another, based on the strength of the demand.

At the same time, investors must be vigilant of the lower timeframe price charts to make sure the bullish structure remains in place.

A shift in structure on the lower timeframes could suggest that GMT has grabbed the liquidity overhead and is preparing to dive lower.

A drop below $0.254 would signal the onset of a bearish trend on the lower timeframes.

Therefore, traders and investors must be cautious and should manage risk properly.

Looking at the rewards, the Fibonacci extension levels (white) showed that the higher timeframe uptrend has remained in place throughout 2024.

Moreover, the $0.2295 level has been established as the key swing low and an important demand zone.

Is your portfolio green? Check out the GMT Profit Calculator

The OBV has formed a range over the past 10 weeks, showing that buying pressure has not been dominant. The RSI showed bullish momentum with a reading of 66.

Overall, given the bullish structure and the metrics, GMT presented a buying opportunity if prices retest the $0.3-$0.34. A break above the $0.375 would signal that the $0.45 and $0.61 levels were the next targets.