Will Litecoin’s bleeding prices stabilize?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Litecoin’s third halving was completed successfully.

- Price action remained muted in the last few hours after the event.

Litecoin’s [LTC] third halving event revamped the network’s security against infiltration threats as hash rates hit a new high. However, price action was muted before and after the event. LTC dipped below $84 post-halving amidst increasing uncertainty around Bitcoin [BTC].

Read Litecoin’s [LTC] Price Prediction 2023-24

At press time, LTC still had a strong positive correlation with BTC, at 0.8, according to IntotheBlock. This meant that the king coin’s price action could still significantly impact LTC.

At the time of writing, BTC was below its previous range-low of $29.5k.

LTC sustains price slump

The Relative Strength Index retreated from the overbought zone at the end of July to the oversold zone at the time of writing (post-halving). It underscores the sustained selling pressure before and after the halving event.

On the liquidity and capital inflows front, the Chaikin Money Flow (CMF) dipped below zero over the same period. The negative reading at -0.03 suggests that capital inflows remained low post-halving.

The negative readings and a weak BTC below $29.5k could delay a short-term solid rebound. As such, the $84 level could be flipped to immediate resistance and hurdle. Bulls must clear the $84 hurdle to show bullish intent toward $95.

To the south, the $80 and $76 were vital support levels to watch in the next few hours/days if BTC records more losses.

LTC recorded network-wide accumulation

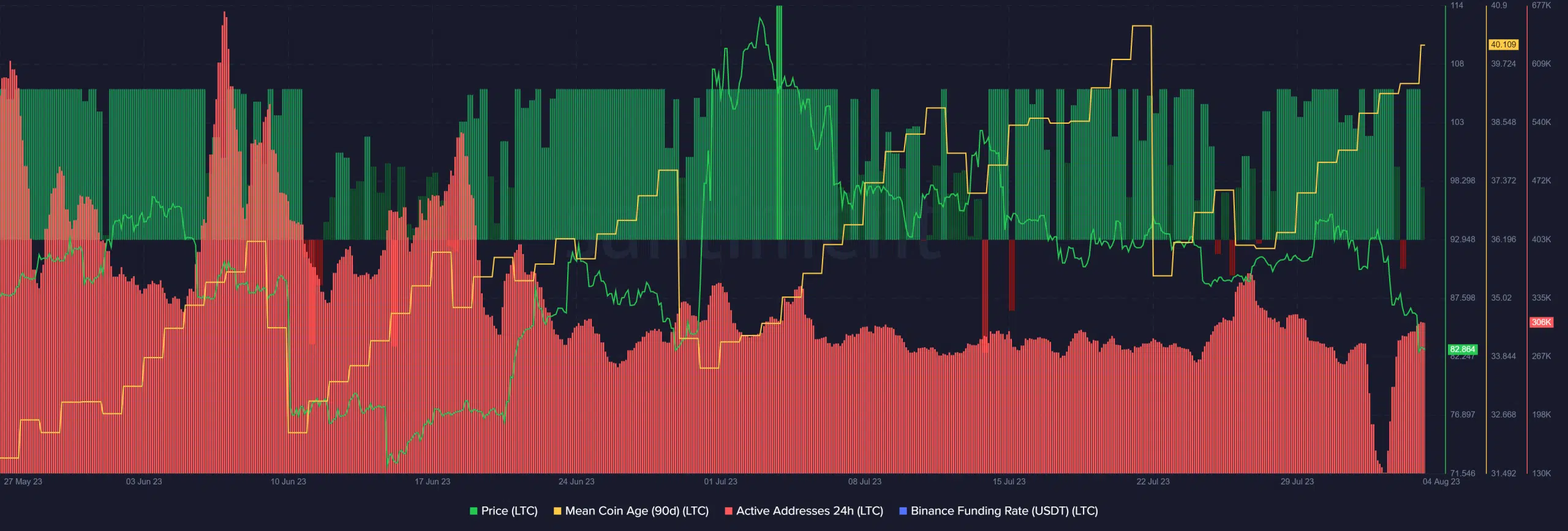

There was another leg of network-wide accumulation from end-July, as demonstrated by the rising slope of the 90-day Mean Coin Age.

Is your portfolio green? Check out the LTC Profit Calculator

However, user activity dipped significantly to around 130k on 2 August from a peak of >350k at the end of July. But the metric improved to >300k at press time. The funding rates also remained positive overall over the past few days.

Although the above on-chain metrics conjecture a positive landing for LTC in the short term, a strong rebound could rely on BTC price reversal.