Will partnerships be enough to pave the way for Algorand’s rally

The wider market’s depreciation didn’t spare Algorand’s trajectory on the charts. In fact, at the time of writing, the altcoin seemed to be recovering on the back of the recent BTC gains.

In the context of institutional inflows, Algorand, over the past year, has seen some high-end partnerships. This has kept the #21 ranked coin in the news too. Furthermore, despite its latest price consolidation, ALGO’s social volumes have maintained high levels.

But, the question here is – Will that be enough for a strong recovery?

Partnerships and ecosystem growth

Over a month ago, the Algorand Foundation announced the launch of the Algorand Virtual Machine. This made the ecosystem more robust in the creation of Dapps. Thus, establishing Algorand as a strong contender in the layer-1 platform race.

Also, in September, Algorand launched a $300 million DeFi fund focused on bootstrapping innovative Defi-centric protocols while supporting infrastructure and applications that foster ecosystem utility, liquidity, and growth.

By building a robust DeFi ecosystem through partnerships, institutional interest in the platform has seen a decent spike. More recently, Hivemind Capital Partners founded by Matt Zhang announced its inaugural $1.5 billion venture fund to invest in blockchain and digital asset ecosystems. In fact, Hivemind selected Algorand as a strategic partner to provide technology and network ecosystem infrastructure.

Here, it is worth noting that occasionally, there have been major upticks in the alt’s large transaction volumes. It is indicative of institutional interest pouring in, as highlighted in a previous article. But, would the same be enough to keep Algorand’s price afloat?

Is price action still sloppy?

Notably, ALGO’s +460.16% yearly ROI v. USD looks impressive. However, it is to be kept in mind that the crypto last saw an ATH in 2019. Since then, it has failed to cross the $3-mark, let alone hit a new ATH.

Algorand’s 2019 ATH was $3.24, but during this cycle, the altcoin has barely managed a run-up to the $2.8-mark. Despite the consistent institutional interest, the alt lacked retail euphoria and high network participation – Both essential for alts’ rallies.

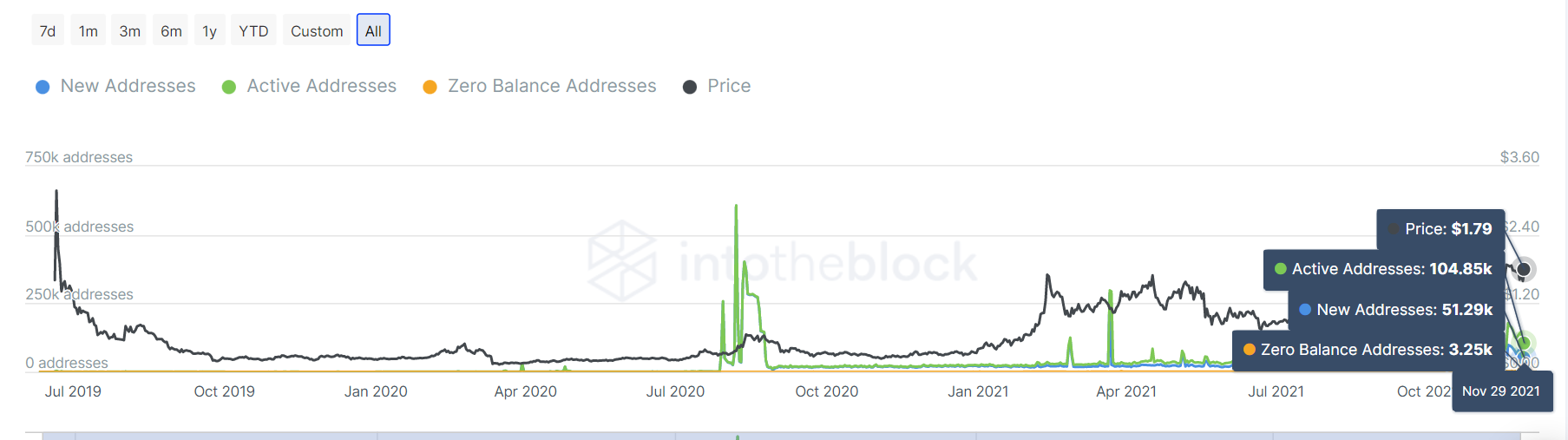

Interestingly, Algorand’s active addresses and new addresses, which were on a rise till 20 November, saw a decline over the last week. While active addresses fell from around 163k to approximately 100k at the time of writing, new addresses fell from over 90k to around 50k over the last week itself.

Finally, the alt’s development activity has also been falling on the charts.

A push from developers could be key for a sustained rally ahead. Especially since high development activity has often corresponded with local tops for ALGO.

Now, HODLers have been missing in action from ALGO’s scene – Indicative of a lack of intent to HODL among the alt’s investors. The lack of retail euphoria, combined with a low number of HODLers, could be one of the reasons for Algorand’s rather slow price movement of late.

For the altcoin to get back on track, establishing itself above the $2-level would be crucial, apart from backing from HODLers as well as retail traders.