Will Solana’s [SOL] new validator client cement it as ‘Ethereum killer’?

- Firedancer delivered good results in initial performance tests, hitting 1 million TPS.

- SOL dropped 10% since SEC’s claim that the altcoin was security.

Scalability is one of the most significant barriers to blockchain progress in current times. Networks are continuously looking for new, innovative ways to improve transaction throughput so as to gain an upper hand in the competitive environment.

While most entities opt for the modular approach i.e, splitting the functions across sidechains and layer-2 chains (L2), the Solana [SOL] network opted for a monolithic way of improving scalability at layer-1 itself, according to on-chain analytics firm Messari.

The initiative to develop Firedancer, Solana’s second validator client, represents an important step in this direction.

1/ Scalability is a key factor in the crypto space, with the modular approach gaining popularity. However, @Solana has taken a contrarian stance.@kelxyz_ explains how @jump_firedancer, a validator client developed by @jump_ aims to enhance Solana's monolithic approach.? pic.twitter.com/zRc3Q5wSeT

— Messari (@MessariCrypto) June 6, 2023

Is your portfolio green? Check out the Solana Profit Calculator

Solana on ‘Fire’

Solana got into a partnership with Web3 infrastructure developer Jump Crypto in August 2022. This was to create a new validator client Firedancer, separate from the one originally built by Solana Labs. With the ambition of boosting network throughput, the project delivered good results in initial performance tests, hitting 1 million transactions per second (TPS).

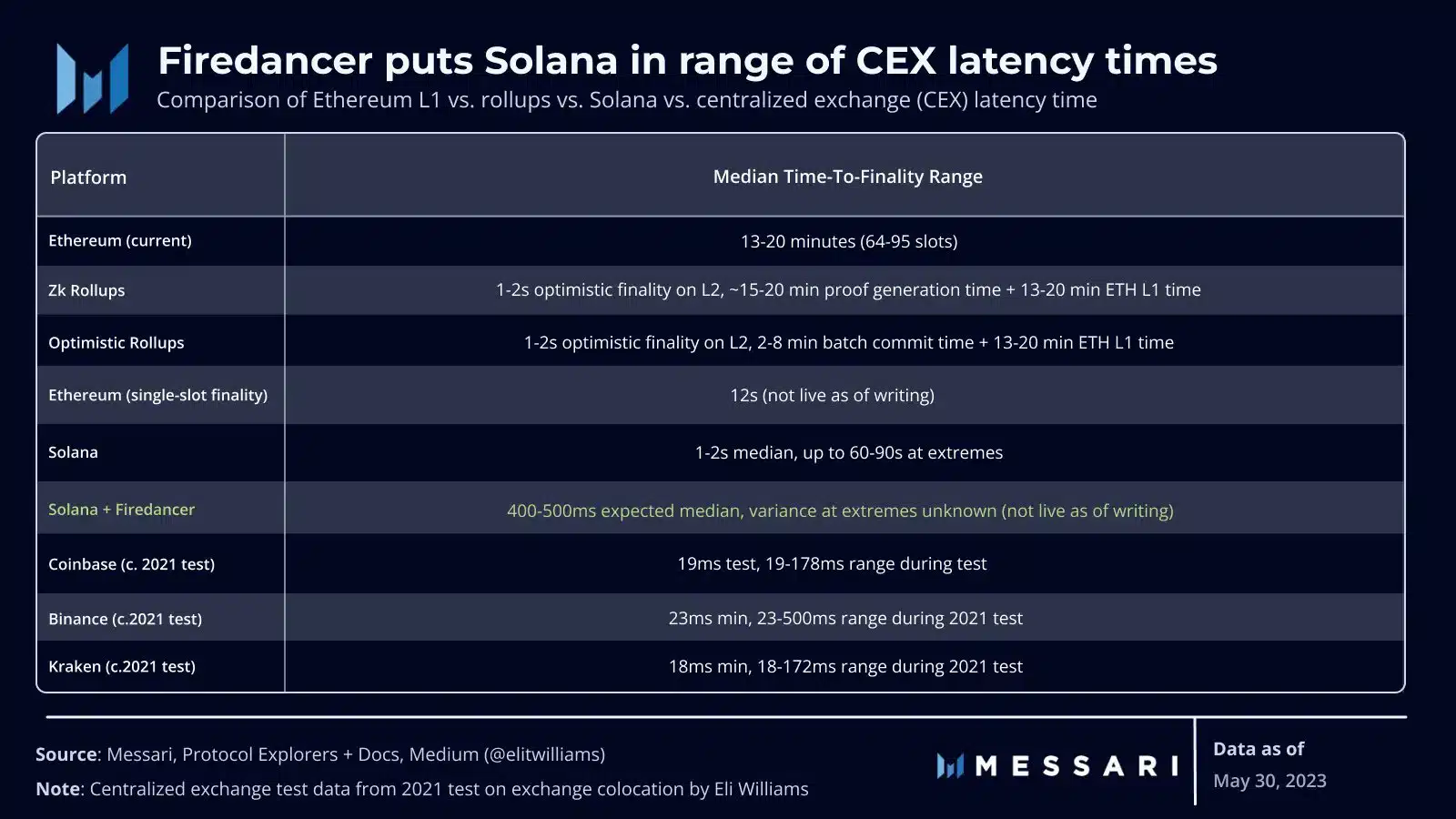

Among other potential benefits of Firedancer, the first and foremost was reducing Solana’s latency times significantly. This made the network conducive for decentralized finance (DeFi) applications and attracting high-frequency traders. Messari stated that Solana’s latency times might be reduced to 400-500 milliseconds, putting it on par with centralized exchanges (CEXs).

Messari’s research highlighted that if it clicks the right boxes, Firedancer had the potential to open up unexplored market space and create new demand for the Solana chain. For example, if it manages to clock 1 million TPS, Solana could attract Web2 applications like social media and financial platforms.

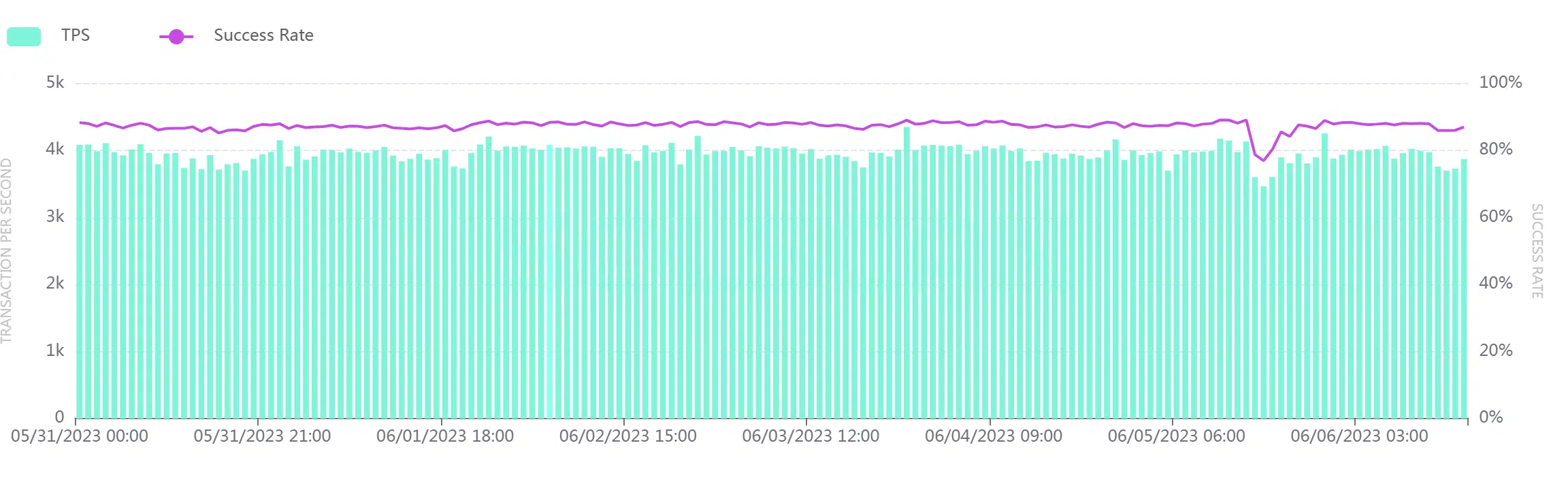

At the time of writing though, the ‘Ethereum killer’ processed an average of 4,000 TPS over the last seven days, per data from Solscan. The total transaction fees paid to validators to secure the network was 39.256 in the last 24 hours.

Realistic or not, here’s SOL’s market cap in BTC terms

SOL suffers but…

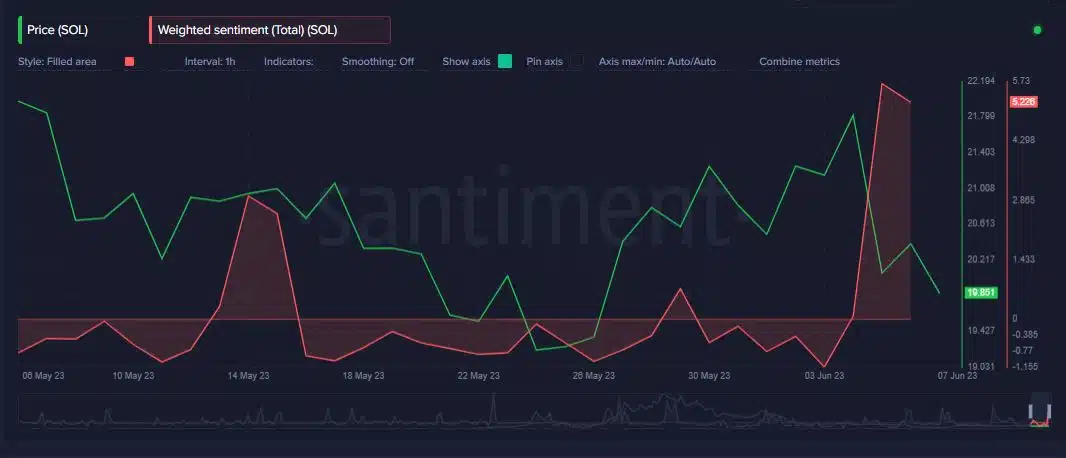

SOL was yet to recover from the Securities and Exchange Commission (SEC)’s latest blow labeling the ninth-largest crypto asset in the market as a security. At press time, it exchanged hands at $19.85, having dropped 10% since SEC’s claim, according to Santiment.

Surprisingly, market sentiment for the coin turned favorable as a result of this development, going into the positive zone after a week of trading.