Will SOL’s 21% pullback intimidate traders? This data suggests…

- Solana’s network performance report stated that the network didn’t have an uptime of 100% only in February 2023.

- SOL’s price action sees a cooling down but sell pressure has been low so far.

Not so long ago, the Solana [SOL] blockchain had amassed an unfavorable reputation, mostly because of multiple instances of network downtime. Fast forward to the present and such disruptions have become rare.

Is your portfolio green? Check out the Solana Profit Calculator

The Solana network released its latest network performance stats and network downtime analysis was among the key observations. The report, which looks into the blockcain’s performance in the first half of 2023 confirmed an improvement in network performance.

1/ The Solana Foundation has released the most recent @Solana Network Performance report.

The Solana network’s performance has improved through H1 2023, as measured by uptime, the ratio of non-voting-to-voting transactions, & more.

Read the full report: https://t.co/naOftyknLA pic.twitter.com/yI9Q8swWdT

— Solana Foundation (@SolanaFndn) July 20, 2023

According to the report, February was the only month of 2023 that Solana did not achieve 100% uptime. It pulled off a 97.19% uptime in February. This confirmed that the network has so far improved. For perspective, Solana registered less than 100% downtime in five months between April and October 2022.

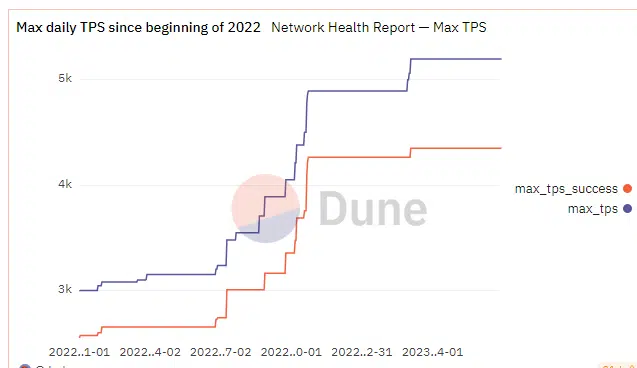

The network report also evaluated Solana’s TPS. A look at the maximum daily TPS revealed robust improvement since the start of 2022. Both the maximum TPS and maximum successful TPS, at press time, stood at their highest point in the last 18 months.

SOL price recap

Solana’s native cryptocurrency SOL’s price action indicated selling pressure took off some of the recent gains. It exchanged hands at $25.46 at press time, which represents a 21% pullback from its highest price point in the last four weeks.

The selling pressure was expected considering that SOL had been on a bullish uptick since the second week of June. In addition, the recent profit-taking occurred after the price dipped into overbought territory. SOL’s Relative Strength Index (RSI) confirmed that there have been outflows since mid-July.

SOL holders and enthusiasts should note that the cryptocurrency maintained healthy relative strength despite the profit-taking. This could be a sign that most SOL holders have a long-term focus. Some on-chain data collaborated with this observation.

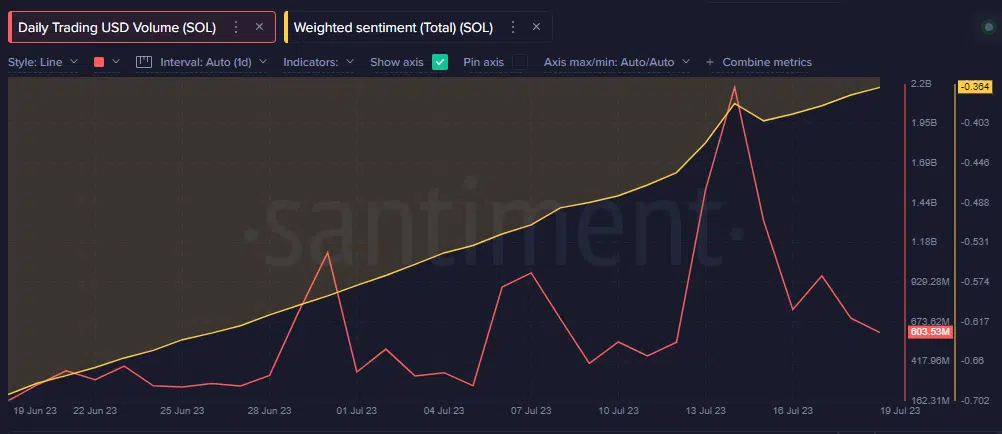

For example, SOL’s weighted sentiment maintained an upward trajectory despite the selling pressure.

SOL still maintained healthy daily trading USD volume although it dropped substantially since mid-July. However, a further drop could send SOL volumes back to the lower monthly range. These findings further confirmed that the cryptocurrency’s trading activity was down substantially.

Read about Solana’s [SOL] price prediction 2023-24

On the other hand, it was experiencing very low sell pressure and was holding on to recent gains quite well. As far as SOL’s performance for the remainder of July, the market conditions will determine the overall outcome. Nevertheless, there are clear signs of optimism among investors.