With this Bitcoin development, here’s what you can expect

Bitcoin’s second layer payment protocol, Lightning network has been rapidly expanding its capacity in the past few years. Ever since it was introduced, it has been enabling faster transactions on Bitcoin, thus addressing the network’s scalability issue.

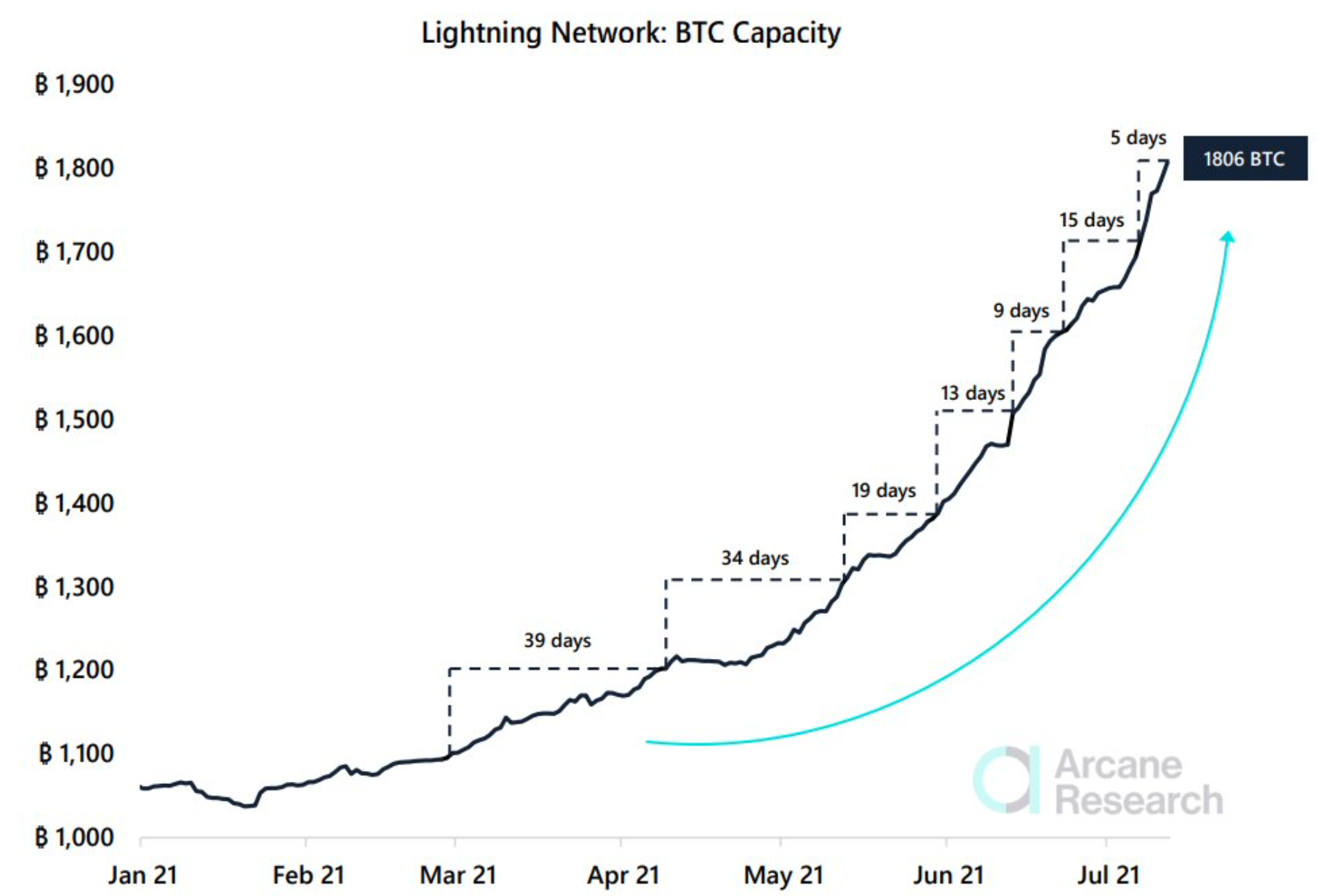

Since its launch, the network’s capacity has nearly doubled from under 1,000 BTC to 1,806 BTC. This year, especially, saw an impressive surge, as noted in a report by Arcane Research, 806 BTC were added to its capacity since January.

Source: Arcane Research

As seen in the above illustration, it took 39 days for the Lightning Network to go from 1,100 to 1,200 BTC and 5 days to go from 1,700 to 1,800. The network capacity increased 20% to 1,871.95 BTC locked in across more than 57,000 channels considering this month alone.

According to Lightning Labs’ Ryan Gentry, the recent growth came from 4 main aspects. To begin with, collaboration of the three companies, Umbrella, RaspiBlitz, and Voltage with a host of nodes and liquidity management guides produced by Leo Weese and Hannah Rosenberg made it “stupid easy to get a node online and connected.” Furthermore, he said,

“(This) laid the groundwork for some super vibrant communities of node runners to pop up a la Ring of Fire and Plebnet. These groups are the primordial soup out of which the next wave of LN startups will emerge IMO… lots of tinkering and lots of great memes.”

In addition to this, the significant volume growth saw a major chunk of capital influx to/from popular nodes as seen by the largest growers over the last 30 days. As per Gentry’s tweet, the popular nodes accounted for one-third of the 300 BTC in the past month.

According to him, the Bitcoin adoption development in El Salvador played a crucial role for the Lightning network.

Importantly, many users are not willing to wait for their local exchange or mobile wallet to integrate LN, but are downloading @Breez_Tech, @MuunWallet or @bluewalletio to get the benefits of instant low-fee remittances today. @KalKassa has the receiptshttps://t.co/D0IdWyOJeC

— Ryan Gentry (@RyanTheGentry) July 16, 2021

Lastly, people and companies started to acknowledge the Bitcoin Lightning Network as more than just a payments network. “it’s an incentivized private data network where satoshis are just one kind of data,” he added, and further stated,

“Every routing node has four natural resources it can monetize: bitcoin liquidity, storage, bandwidth, and compute. We’ve already started building a marketplace for allocating liquidity with Lightning pool.”

Hence, these resources will be offered in a marketplace in the future. Gentry also said that the aforementioned factors combined into a “flywheel that’s starting to spin.” With this development within the Bitcoin space, one can expect:

- more users on the network

- more volume flowing through it

- more fees to capture more people running nodes

- more devs tinkering

- more users on the network