Worldcoin halts iris-scanning in India, Brazil and France – Why?

- Worldcoin has suspended its Orb-verification program in India, Brazil and France.

- WLD’s price recently touched an all-time high.

Worldcoin [WLD], the crypto project co-founded by OpenAI CEO Sam Altman, has halted its controversial Orb-verification system in three major markets – India, Brazil and France.

This sudden retreat comes just months after the project launched the helmet-shaped eyeball-scanning device in these countries.

In a statement to TechCrunch, Tools for Humanity, the foundation overseeing Worldcoin development, claims the suspension is due to the Orbs being offered in these markets for a “limited time” only.

This move comes a week after the project announced the launch of “World ID 2.0,” – an upgrade to the protocol – and integrations with other platforms, including Reddit, Telegram, Minecraft, Shopify, and Mercado Libre.

WLD’s recent rally to an all-time high

On 17th December, WLD’s price clinched an all-time high of $4.70, according to data from CoinMarketCap. An on-chain assessment of the token revealed that the demand for WLD had climbed to a four-month high a day before this.

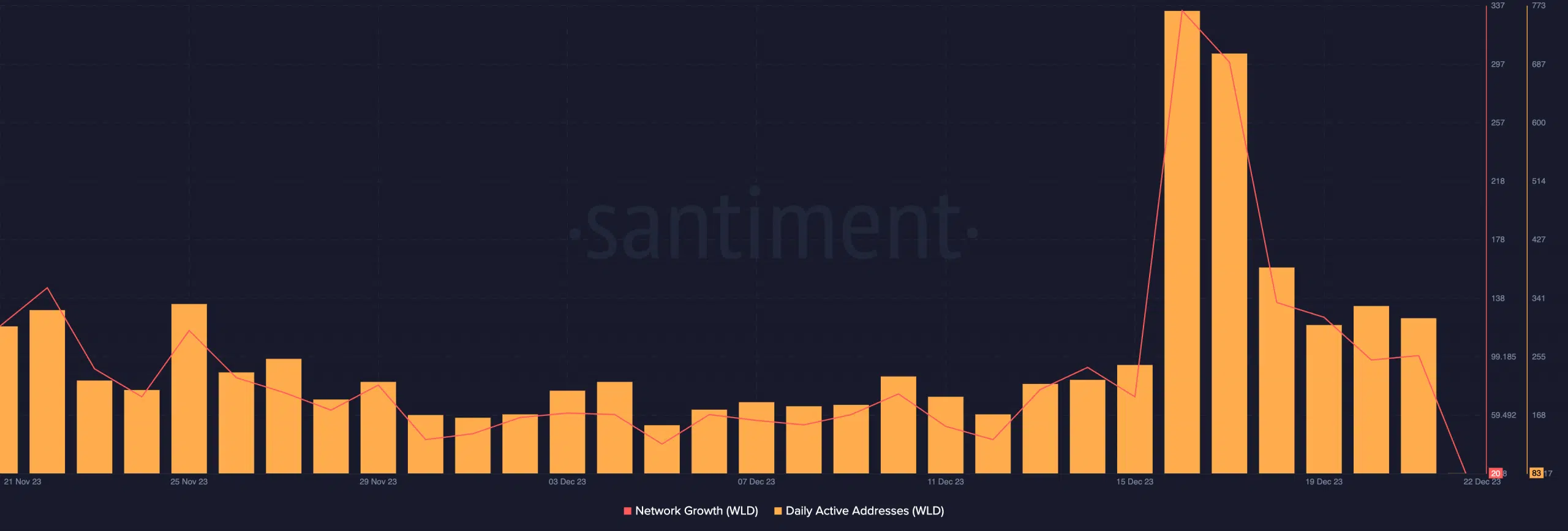

AMBCrypto found that on 16th December, the daily count of active addresses that completed at least one transaction involving WLD totaled 766 addresses, seeing a 215% uptick from the 76 addresses recorded the previous day.

Likewise, there was a surge in new demand as the day saw growth in the number of new addresses created to trade WLD.

According to data from Santiment, the number of new WLD addresses on that day was 334, rising by 363% from the previous day’s 76 new addresses.

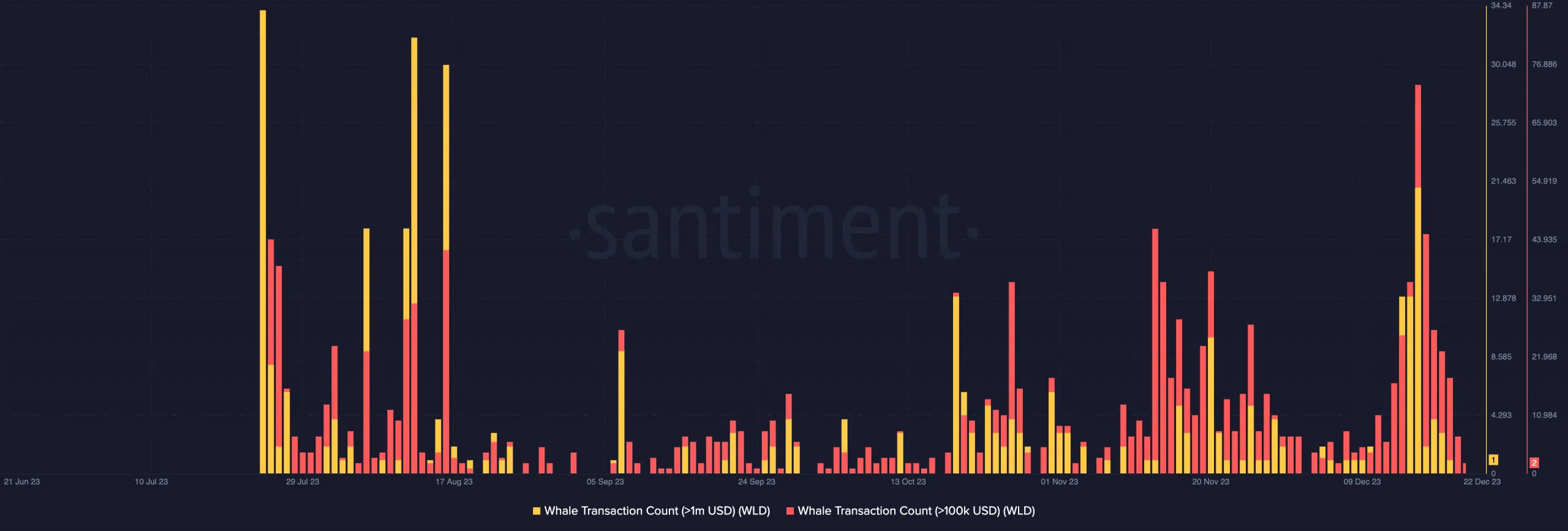

WLD whales were not sidelined, as they also completed a high number of transactions involving the altcoin.

According to Santiment, on 16th December, the number of WLD whale transactions exceeding $100,000 totaled 73. This marked the token’s second-highest single-day whale transaction count since it launched.

Regarding whale transactions above $1 million, the day saw 21 of those, the highest recorded since August.

Realistic or not, here’s WLD’s market cap in ETH terms

Further, as the altcoin steadied at $4.70 on 17th December, the daily ratio of transaction volume in profit to loss increased to a 30-day high. On that day, for every WLD transaction that ended in a loss, 5.36 transactions returned a profit.

Currently trading at $3.74, WLD has shed 23% of its value since the 17th December high, data from CoinMarketCap showed.