Worldcoin whales keep WLD in the picture: Here’s how

- Whales now own almost 70% of the total WLD supply.

- Active addresses decreased but WLD seems closer to the bottom than the top.

In the last 30 days, the price of Worldcoin [WLD] has increased by 48.28%, according to CoinMarketCap. However, from AMBCrypto’s findings, the price increase would have been impossible if not for the role whales played.

Using Santiment’s balance of addresses metric, AMBCrypto discovered that wallets holding 100,000 to 1 million coins have increased their WLD holdings. It was also the same situation with the 10,000 to 100,000 cohort.

At press time, the 100,000 to 1 million group accounts for 68.52% of the total WLD supply.

WLD needs more than large players

Such dominance implies that actions by the group have a significant impact on the price action. So, this data showed that the rise in accumulation had a notable impact on how WLD moved within the period.

At press time, WLD’s price was $3.70. Considering the 4-hour analysis of the token, the Exponential Moving Average (EMA) showed that the cryptocurrency might keep trading around the same range for a while.

This was because the 20 EMA (blue) and 50 EMA (yellow) closed in on one another.

A position like this suggests sideways movement. So, depending on who makes the first move, Worldcoin might either nosedive or rise afterward. The Relative Strength Index (RSI) also confirmed the sentiment.

As of this writing, the RSI was 54.12, indicating indecisiveness in momentum. Should buying pressure increase, then WLD might reclaim $4.

But failure for that to happen could result in a fall below $3.58 where the 50 EMA point was.

However, the Awesome Oscillator (AO) signals revealed that WLD’s potential to rise was more than the possibility of falling. As of this writing, the AO was 0.11, indicating an increasing upward momentum.

From the reading, the only thing needed to confirm a bullish thesis is a surge in buy orders.

Challenges brew opportunity

From the external view, the Worldcoin project has not found it easy. On several occasions, many have questioned its goals concerning privacy and user data.

However, AMBCrypto reported about its adoption in Singapore a few days back. Interestingly, this seemed to have brought some calm to the Worldcoin camp.

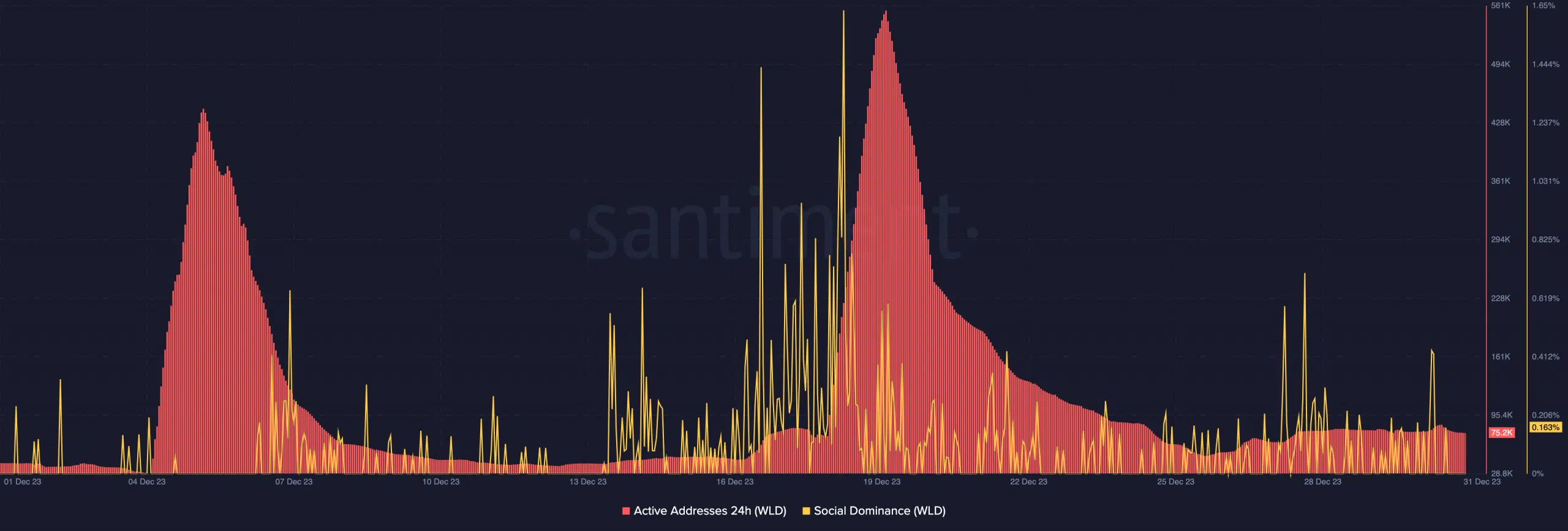

Regardless of that positive development, WLD still had some struggles. One of the noteworthy notes is the decline in Active Addresses. Active Addresses show the daily level of speculation or crowd interaction with a project.

At press time, the 24-hour active addresses on the Worldcoin network was down to 75.200.

This number was a significant decrease from the traction on the 19th of December. A look at Social Dominance also showed that eyes were no longer on WLD as they previously were.

Read Worldcoin’s [WLD] Price Prediction 2023-2024

In the meantime, the declines in these metrics could be an opportunity for those on the sidelines to scoop WLD at a discount. A reason for this is Social Dominance, whose rise could signal a market top.

But since it was down, it means WLD was closer to its bottom than it was to an overheated state.