XRP price prediction – Time to sell or buy after 8% drop?

- XRP has declined by close to 8% in the last seven days.

- OI shows positive moves from buyers.

Ripple’s XRP was not able to kick off the month with significant momentum, as suggested by an analysis of its price chart. Its price has been downward over the last few days, experiencing consecutive declines.

XRP declines continue to dominate

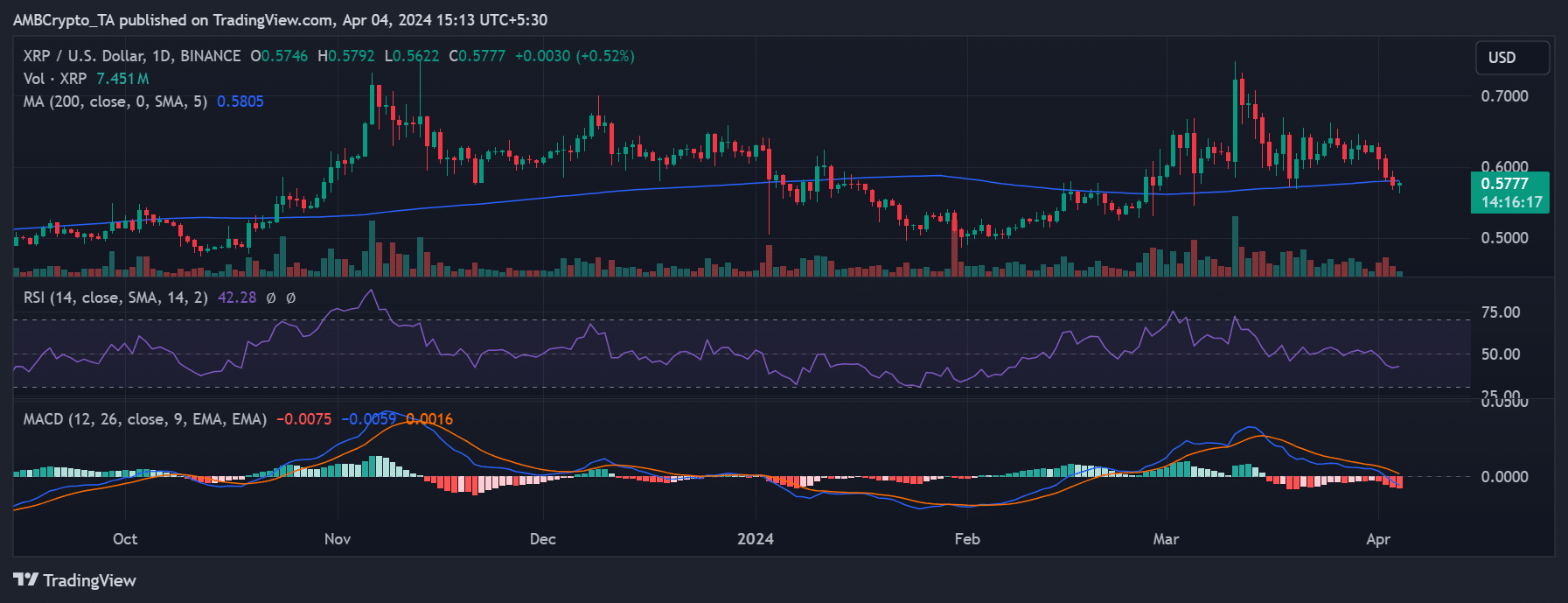

Analysis of XRP on a daily timeframe showed a consistent decline in price since 1st April. On 1st April, it experienced a 2.84% decrease, bringing its price to around $0.61.

The following day saw a more significant decline of over 4%, pushing the price to the observed zone of $0.58. Although the decline on 3rd April was marginal, at 1.89%, it lowered the price to around $0.57.

These consecutive declines have impacted the Relative Strength Index (RSI), causing it to fall below the neutral line to approximately 40.

However, a slight recovery has been noted at the time of writing, with the price increasing by less than 1%, though still trading within the $0.57 range.

Despite this, the RSI remained below the neutral line, indicating that XRP continued to exhibit a bearish trend. Additionally, the Moving Average Convergence Divergence (MACD) also showed trends below zero, confirming the bearish trend identified by the RSI.

XRP posts highest decline among top-seven

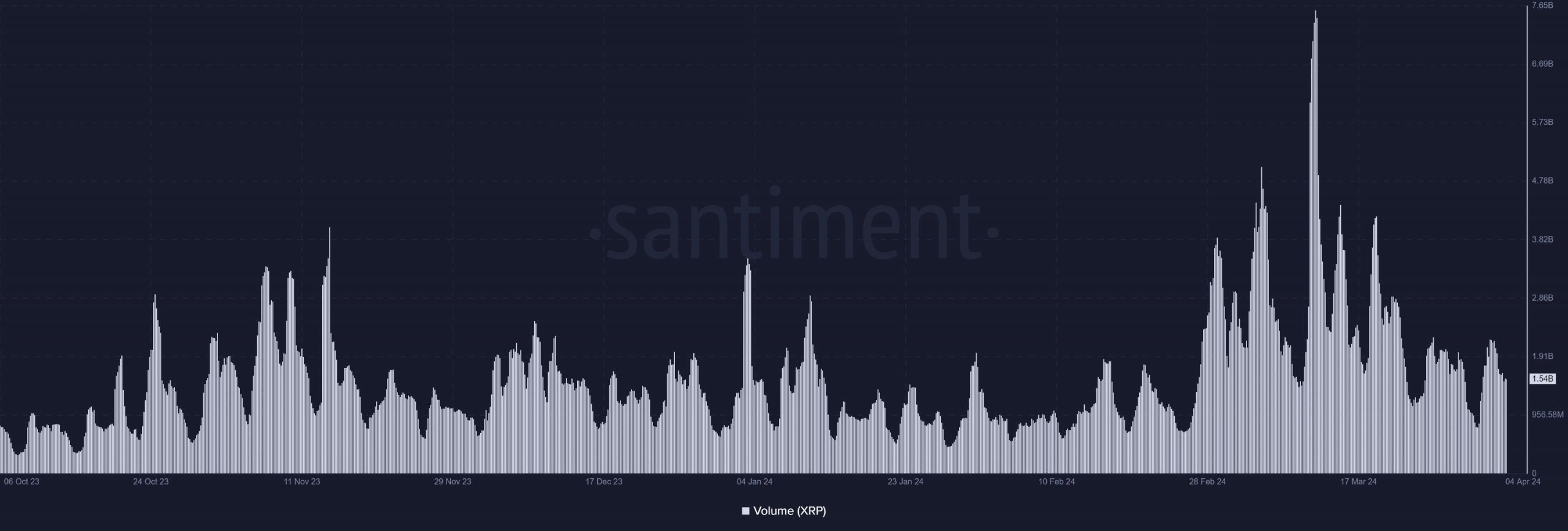

The XRP daily volume analysis on Santiment showed a decline over the past few days. As of 2nd April, the volume was over $2.1 billion.

However, it has since decreased to approximately $1.5 billion at the time of writing. This decline suggests reduced trading activity, potentially contributing to a slowdown in price movements.

Furthermore, according to data from CoinMarketCap, XRP experienced the highest decline among the top seven assets over the past seven days. As of this writing, it had decreased by over 7.4%. Additionally, within the last 24 hours, it declined by over 2.6%.

With the current trend, its market capitalization stands at around $31 billion, positioning it as the seventh-largest asset in terms of market capitalization.

Buyers remain hopeful

Despite the ongoing decline in XRP’s price, data from Coinglass indicates that the Open Interest (OI) remains relatively high. Analysis reveals that at the current moment, the open interest is hovering close to $900 million.

Realistic or not, here’s XRP market cap in BTC’s terms

Further examination of the OI trend indicates that this figure is consistent with the region observed in the previous month.

Additionally, an analysis of the funding rate indicates that it remains positive despite the apparent decline in XRP’s price. This suggests buyers are still optimistic and betting on a future price increase.