XRP, LINK whales switch sides: What’s going on?

- LINK’s market cap outpaced the volume, suggesting that the network was overvalued.

- The difference in XRP’s exchange inflow and outflow indicated that the price might climb.

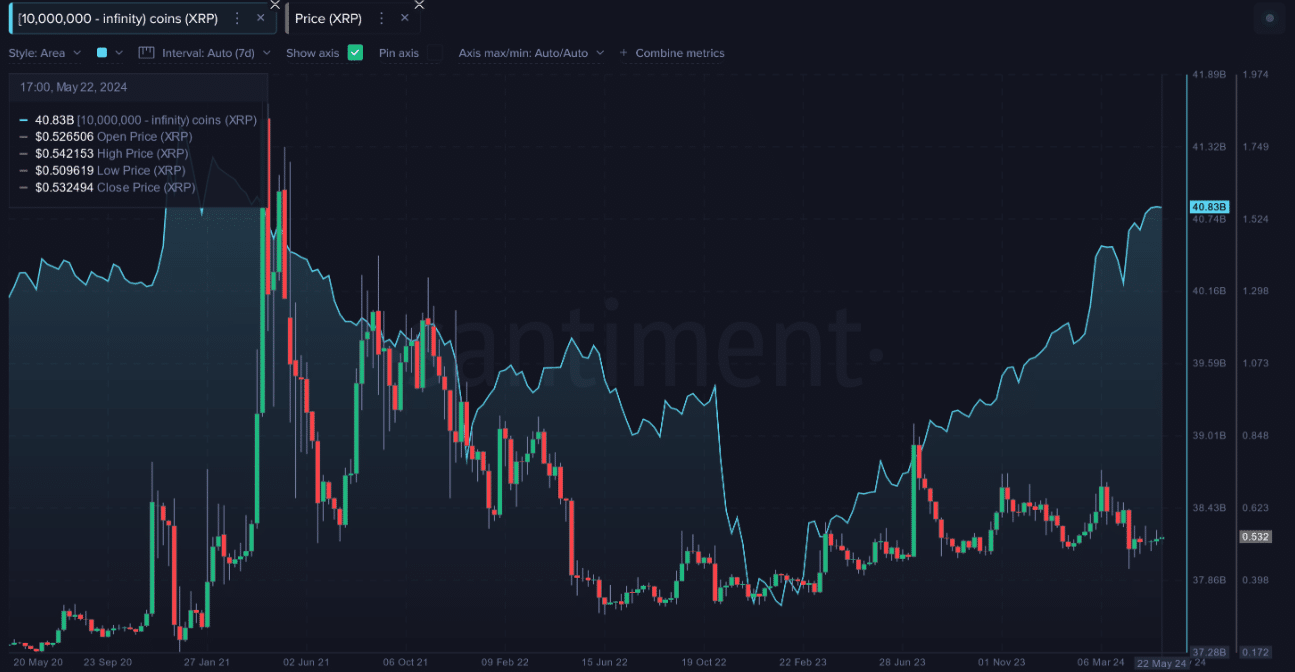

In the last 16 months, Ripple [XRP] whales have accumulated more tokens far above that of Chainlink [LINK], AMBCrypto confirmed.

Within the mentioned period, wallets holding 10 million XRP or more have purchased 3.17 billion tokens, valued at $5.1 million.

Such an increase is supposed to boost the price of the cryptocurrency. But for XRP, that has not been the case due to some factors outside of the occurrences on-chain.

The whales go different ways

At press time, XRP’s price was $0.52— an 11.28% increase within the last 365 days. Compared to the way other altcoins have performed, this was underwhelming.

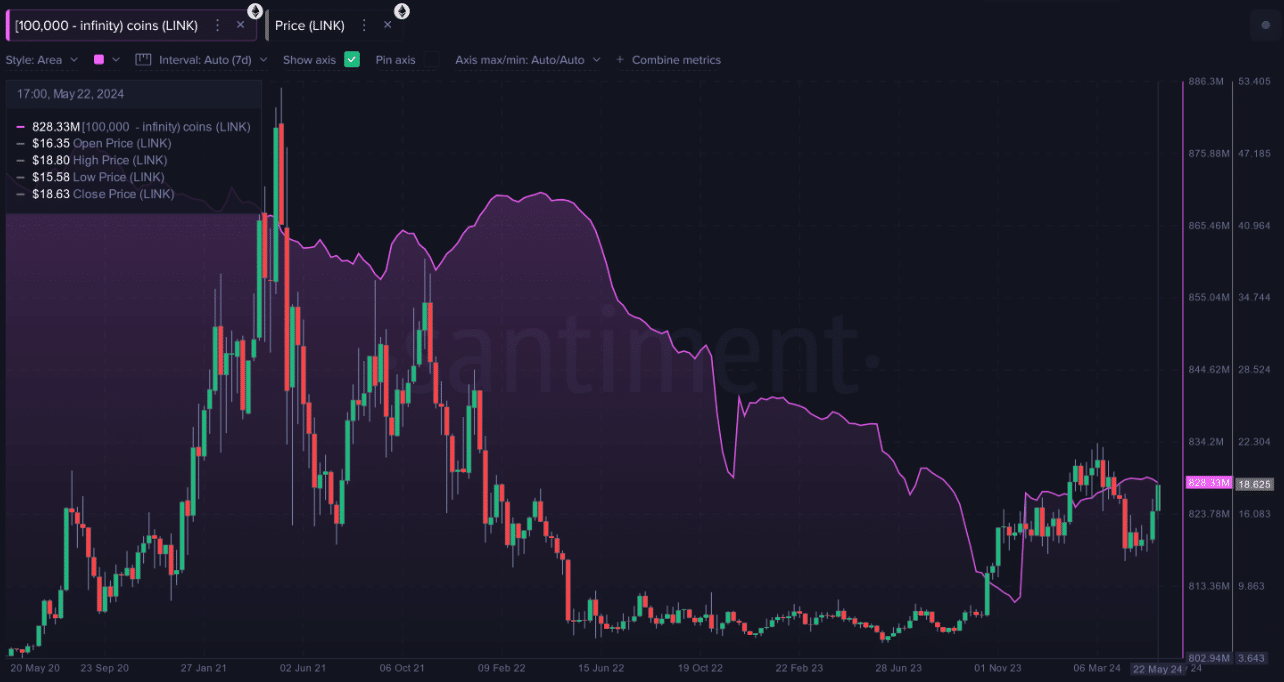

Now to Chainlink, the price was $18.11 at press time. This value represents a 178.21% increase within the same period, XRP registered the aforementioned increase.

Surprisingly, LINK whales did not amass as many tokens as their XRP counterparts.

On-chain analytic platform Santiment, in a recent analysis, mentioned that the number declined for most of the past four years.

However, things seemed to have changed in the last six months with the insight explaining that,

“There has been a bit of an accumulation rebound from them in the past six months (+17.27M LINK), but we’d like to see a bit more of a bode of confidence from these key stakeholders to justify continued rises.”

Going by the analysis above, it seemed that LINK whales’ impact on the price action was more significant than how XRP has reacted to the long-term accumulation.

LINK eyes a decline but XRP wants its high

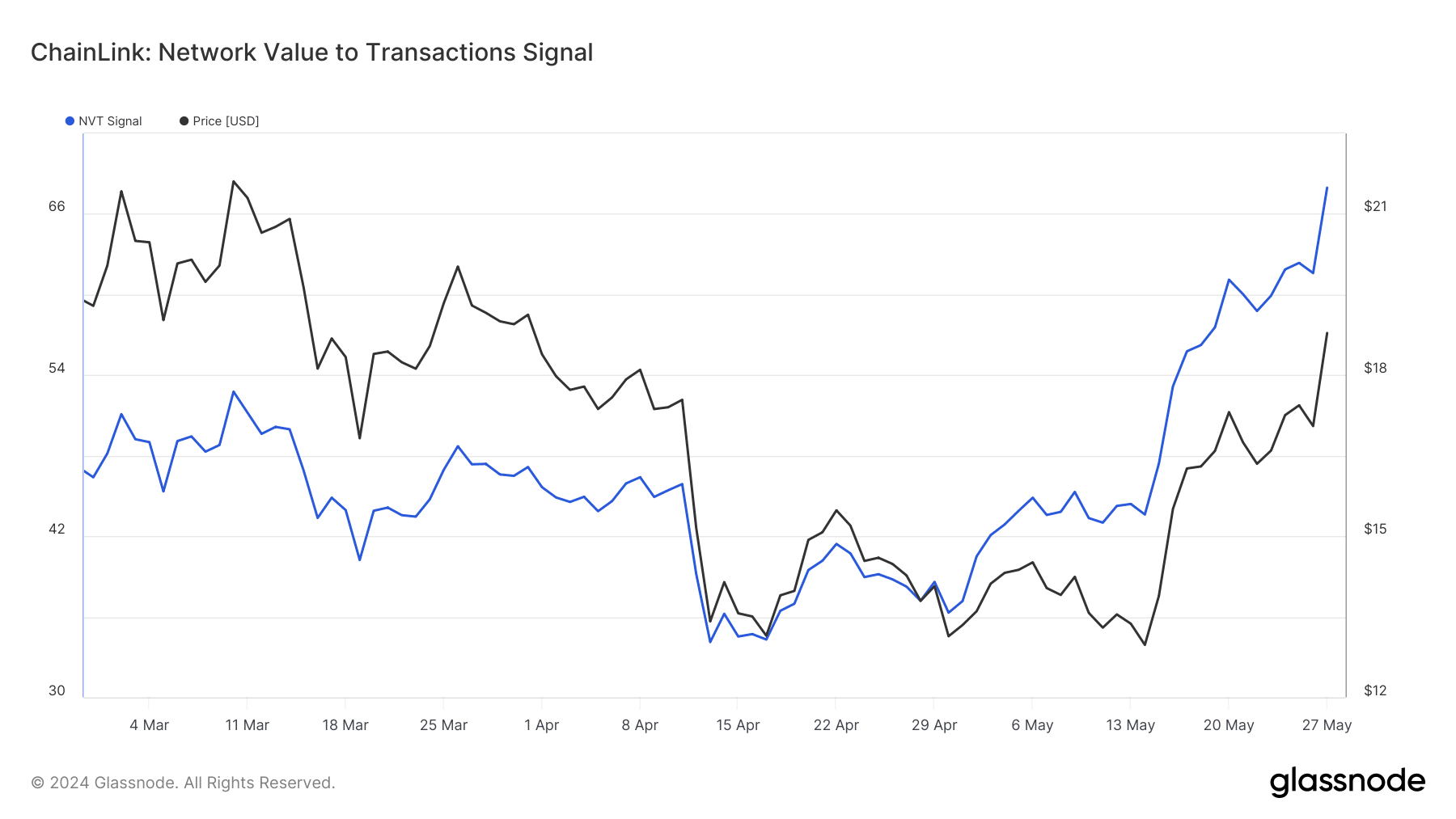

However, LINK’s recent uptrend might soon hit the stop button according to indications AMBCrypto obtained from Glassnode.

At press time, the Network Value to Transaction (NVT) signal had hit a ceiling of 67.95.

A low NVT signal often coincides with the period transaction value outpaces the market cap.

If this were the case, Chainlink would have been said to be priced at a discount, and this would have been bullish for the price.

However, the high reading of the NVT suggests that the network was overvalued. Hence, this was bearish for LINK and a decline toward $13 or $14 could be next.

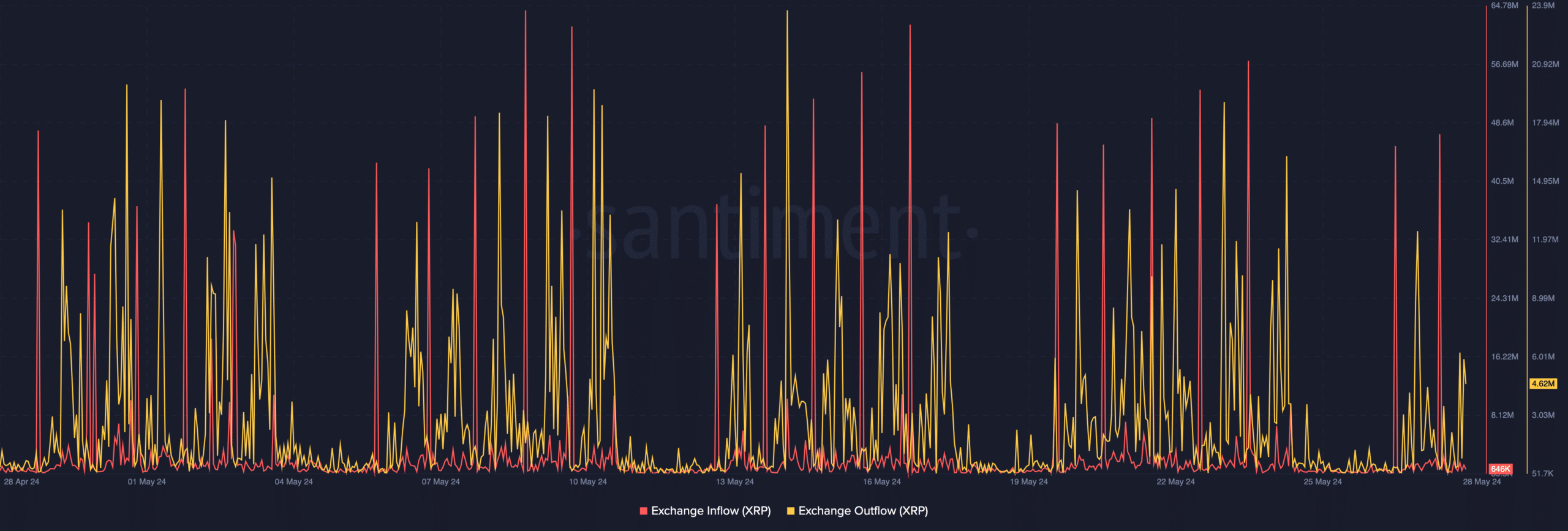

To check out XRP’s potential price movement, AMBCrypto looked at the exchange flow.

At press time, XRP’s exchange inflow was 646,000. This number represents the number of tokens sent into exchanges.

On the other hand, the exchange outflow was higher at 4.62 million. This means that there were tons of XRP heading for non-custodial wallets than those lined up for possible sale.

Realistic or not, here’s LINK’s market cap in XRP terms

This difference implies that there are more holders with a strong conviction in the bullish potential of XRP.

Should this position stay the same in the coming weeks, XRP’s price might increase, and a rise to $0.60 could be an option.