XRP worth $5M on the move: Has the ‘zombie token’ spooked investors?

- Millions of XRP pulled off exchanges.

- Ripple remained in a bear trend despite positive signs.

Ripple [XRP] recently found itself included in the list of blockchains labeled as having no utility, a less-than-desirable distinction. Despite this characterization, outflow volume surpassed the inflows.

Ripple sees more outflow from exchanges

Analysis of exchange flow data on Santiment revealed a recent decrease in the inflow and outflow of Ripple. However, on the 27th of April, the outflow volume slightly surpassed the inflow.

Specifically, inflows on the 27th of April were around 3.4 million XRP, while outflow exceeded $5 million.

This indicated that more XRP left exchanges than entered them, which could suggest bullish sentiment among holders anticipating price increases.

However, it’s also possible that these movements represent a redistribution of holdings by whale wallets. At the time of this writing, no significant movements have occurred.

Also, outflows continued to surpass inflows at press time, with over 2.7 million XRP leaving exchanges compared to over 2.6 million entering.

XRP is yet to see a ripple in price

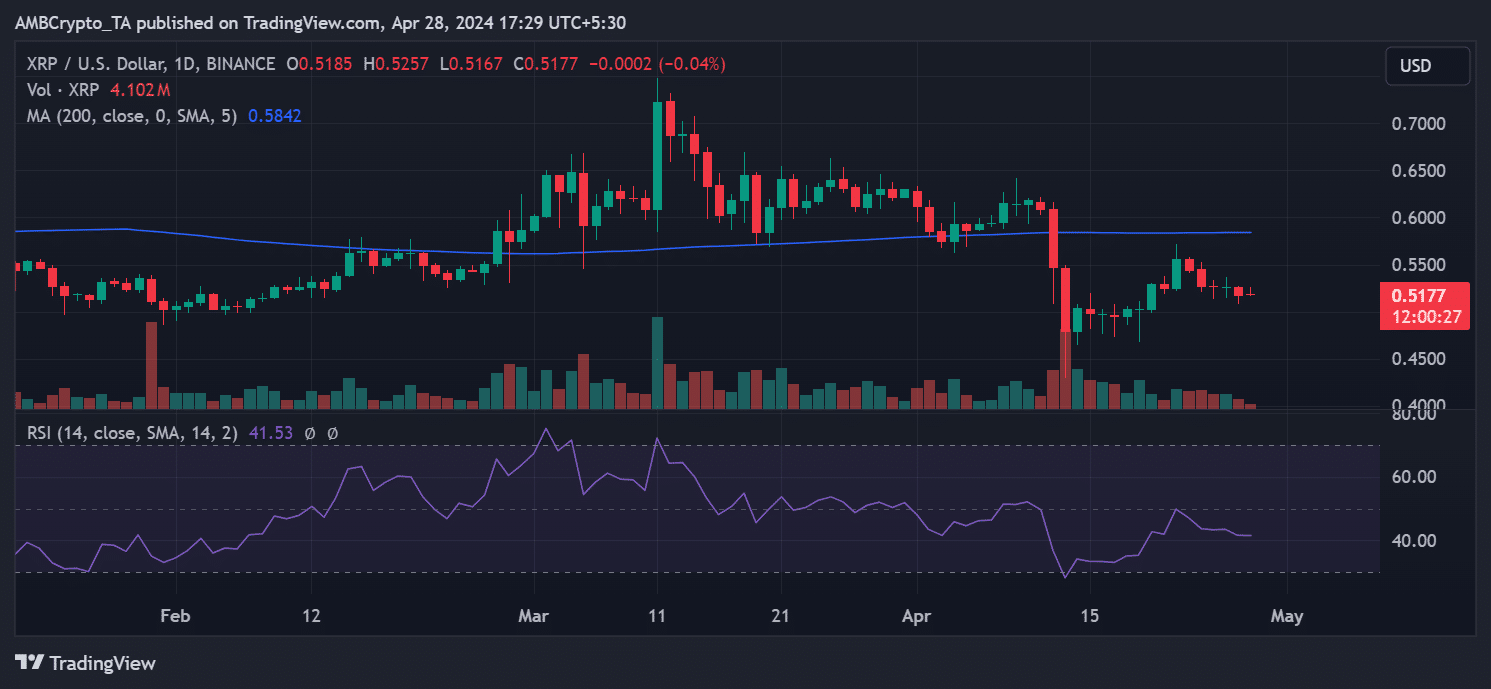

AMBCrypto’s analysis of Ripple’s price trend indicated a continuation of the decline observed on the 27th of April. That day, the price was around $0.52, representing a decline of over 1.5%.

At the time of this writing, it was trading at around $0.51, with a slight decline of less than 1%. The long moving average (blue line) continued to act as immediate resistance at approximately $0.58.

Additionally, the Relative Strength Index (RSI) remained at 40, suggesting a bearish trend since around the 11th of April, with the price unable to cross the neutral line.

Ripple’s lukewarm sentiment

AMBCrypto’s analysis of Coinglass data revealed that Ripple’s sentiment remained low at the time of writing. The Funding Rate was around 0.0092%, indicating that buyers were in control.

Realistic or not, here’s XRP’s market cap in BTC’s terms

It also meant that there was an expectation of a price rise.

However, this also suggests low activity from traders. Confirming this trend, the Open Interest was around $535 million, indicating a lack of significant trading activity.