Explaining XRP’s outflows from Binance hit 75M

- XRP’s price climbed to $0.62 after a wave of exchange withdrawals.

- The CLLD spiked negative, indicating a bullish bias.

The number of Ripple [XRP] tokens that have been retired from Binance has exceeded 75 million, AMBCrypto confirmed after reviewing the large transactions Whale Alert reported in the last 24 hours.

According to Whale Alert, these transactions happened in batches.

But for XRP’s price, this could be good news. One reason for this projection is that large withdrawals from exchanges meant fewer sell-offs.

Also, if buying pressure comes in during this period, the cryptocurrency’s price might soar. However, XRP’s price over the last few days has been underwhelming compared to its peers.

XRP grabs the bull by the horn

At press time, we observed that the token had lost 1.89% of its value in the last seven days while trading at $0.62.

While the development with Binance could be a great one, it is also important to confirm the state of the exchange activity on-chain.

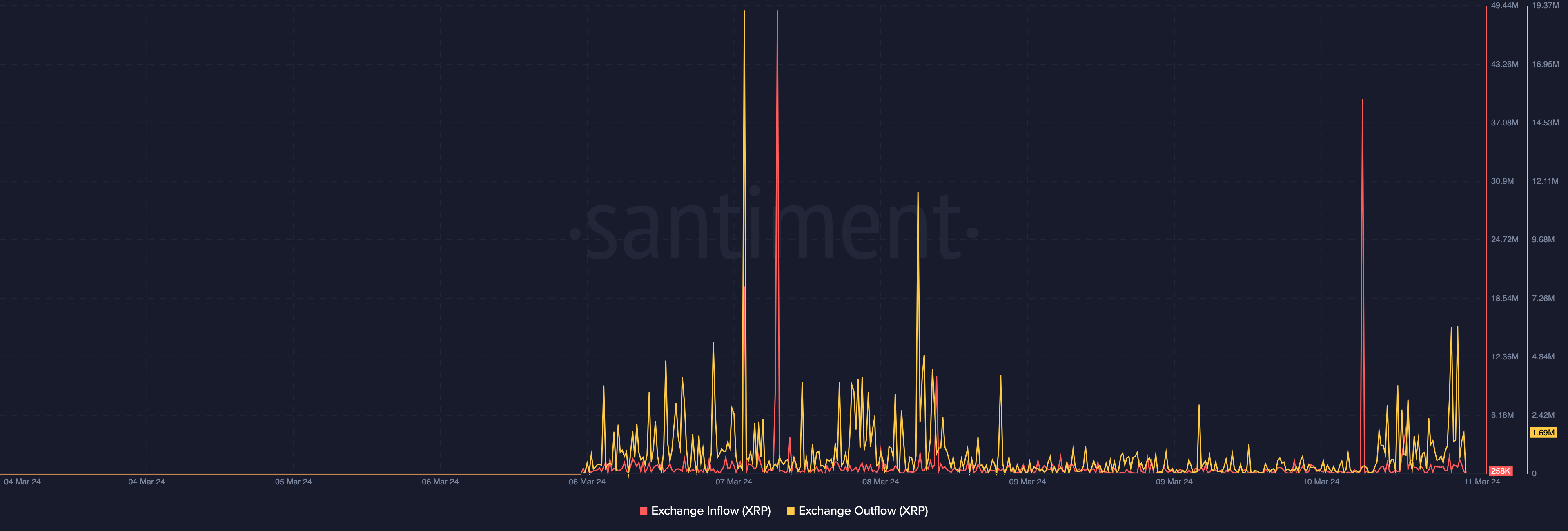

Using Santiment, AMBCrypto noticed that the exchange inflow was 258,000. Conversely, the exchange outflow was a total of 1.69 million within the first few hours of the 11th of March.

This disparity implied that more tokens have left exchanges than they have flowed into them. Therefore, the chances of an XRP price increase remained high.

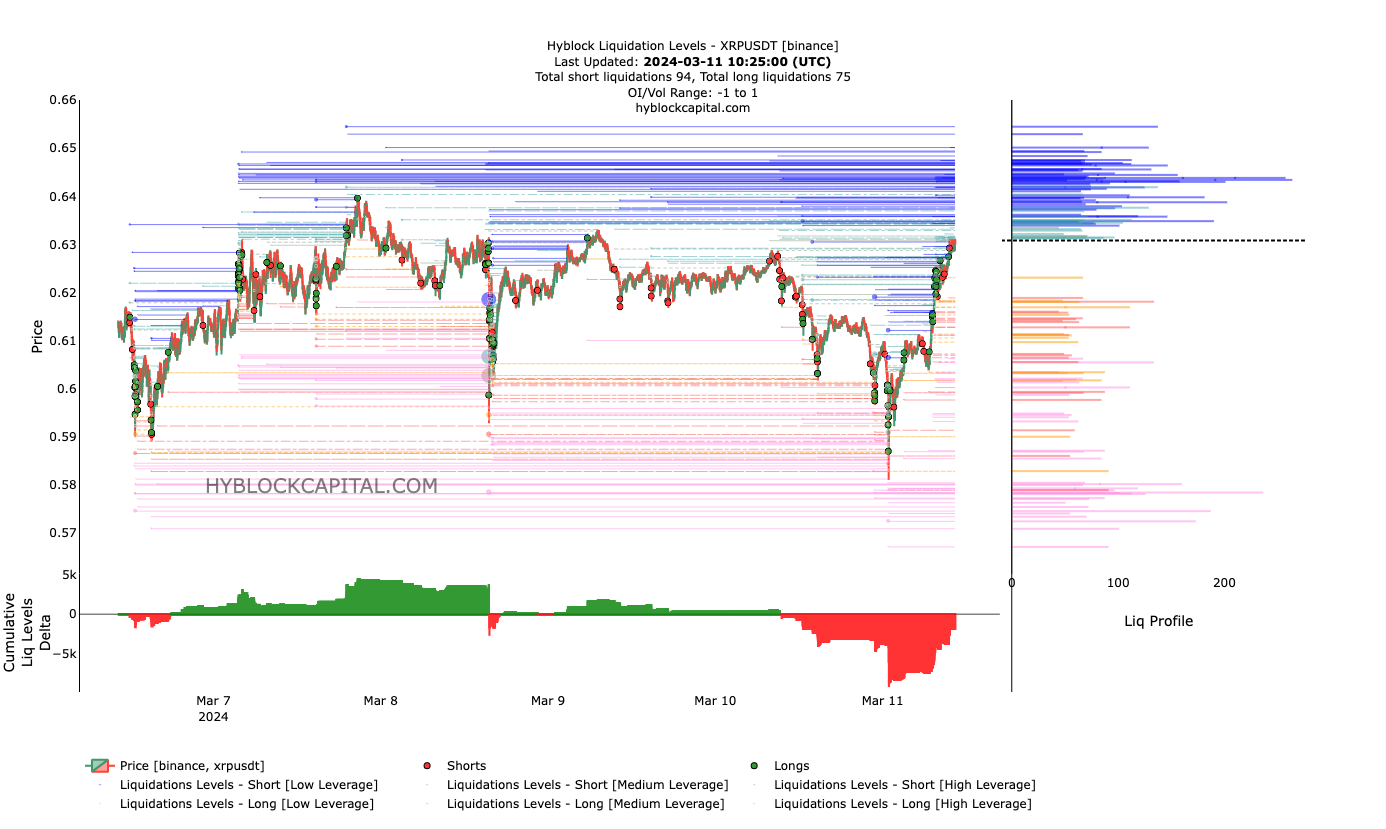

Besides the on-chain activity, we also checked out the liquidation levels. For context, liquidation levels are estimated price levels where liquidation events might occur.

The moon could be the starting point, but first…

From AMBCrypto’s analysis, aggressive buying was taking place at $0.62, indicating that many shorts could be liquidated if XRP’s price rises higher than that.

HyblockCapital’s data also gave us an idea of the Cumulative Liquidation Levels Delta (CLLD).

The CLLD can tell if a cryptocurrency has bullish or bearish potential. As of this writing, the CLLD had spiked in the negative direction. This was the case as XRP’s price sharply declined earlier.

But traders who decide to short at this point might be liquidated, as mentioned above. Concerning the price, the CLLC indicated a bullish bias.

Therefore, the forthcoming days could see XRP’s price rise toward $0.65, provided the market conditions remain bullish.

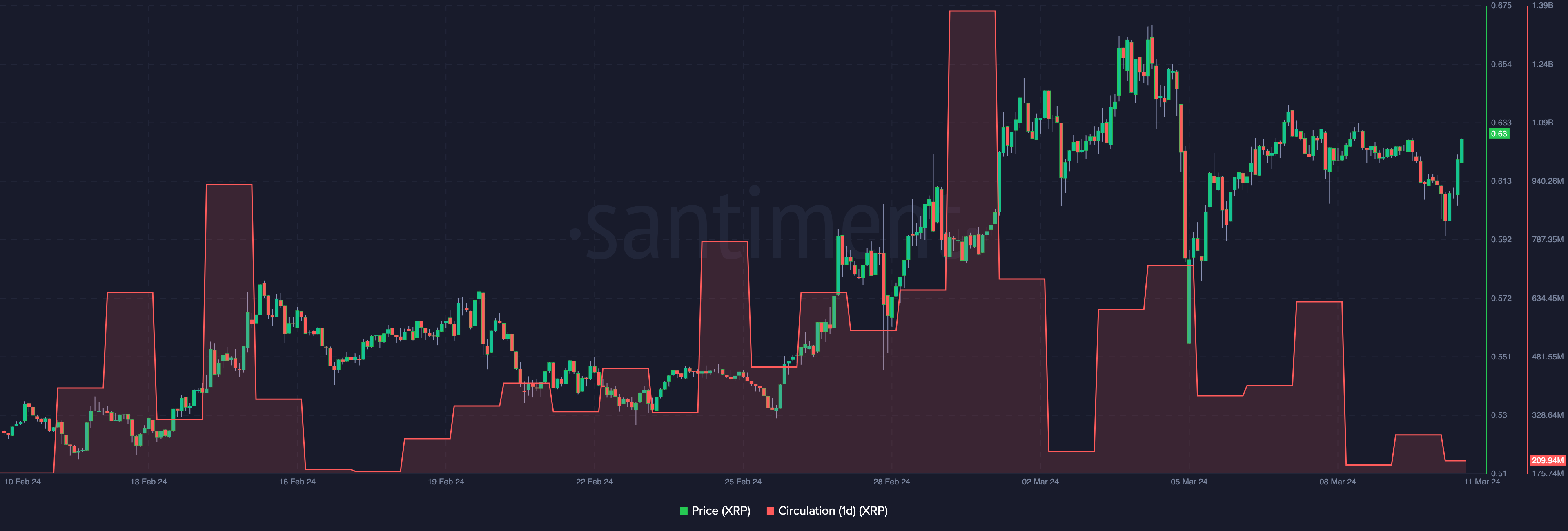

In addition, on-chain data from Santiment showed that XRP circulation fell. At press time, the one-day circulation was down to 209.94 million.

This decline indicated that tokens used in transactions had decreased.

Read Ripple’s [XRP] Price Prediction 2024-2025

In terms of the price action, the decline in circulation reduced the possibility of selling (like the exchange outflow). From a bullish point of view, the price of the token could rise as high as $0.70.

But this would require a lot of buying pressure. Should bears neutralize bullish dominance, XRP’s price might return to consolidating between $0.58 and $0.61.