XRP’s 7% jump fails to convince bulls, now analysts warn this…

- One day after hitting $0.65, XRP dropped to $0.60.

- Funding Rate was positive while CLLD was negative, indicating a possible rebound.

Moments after the price of Ripple [XRP] rose by 6.98%, the price fell to $0.62. During the intra-trading hours of the 21st of March, XRP climbed to $0.65. When this happened, the prices of other assets in the top 10 including Bitcoin [BTC], and Solana [SOL] struggled to match the token’s momentum.

However, press time data showed that most of the cryptocurrencies were moving at the same pace. As of this writing, XRP has lost hold on the gas pedal and lost 4.13% of its value. BTC dropped below $63,000 while SOL’s fall was harder as the price plunged by 10.35%.

Correction first, respite later

The decline in prices was a sign that the market could be on the verge of another correction. If this is the case, it would be the second time in a week that the values of assets in the market are experiencing a significant drawdown.

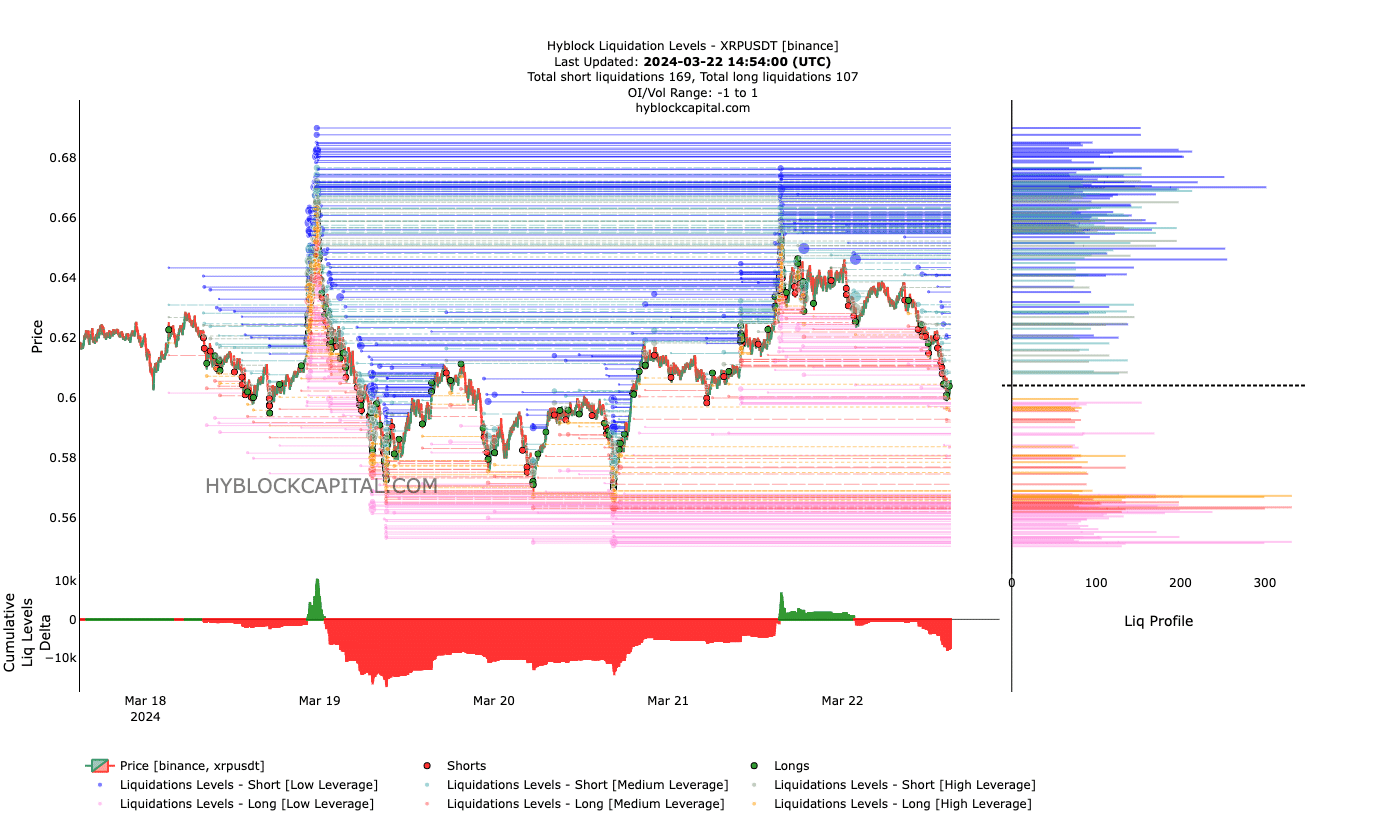

Despite the decrease, AMBCrypto’s analysis of the liquidation levels showed that the token might appreciate in the short term. At press time, we spotted a cluster of liquidity from $0.65 to $0.68.

This indicates that the XRP’s price might move in that direction. Should this be the case, a lot of short positions might be wiped out. However, the value of the token is likely to drop below $0.60 before it rebounds.

We also checked the Cumulative Liquidation Levels Delta (CCLD). The CLLD is the sum of the difference between the short liquidation levels and long liquidation levels.

When the CCLD value is positive, there are more long liquidations. On the other hand, a negative reading implies that short liquidations are more than longs.

XRP struggles to pick a side

At press time, the CLLD of XRP in the last seven days was negative. Price-wise, the reading gives a bullish bias. This is because as prices sharply decline, the dip might reverse, and late short positions could be liquidated.

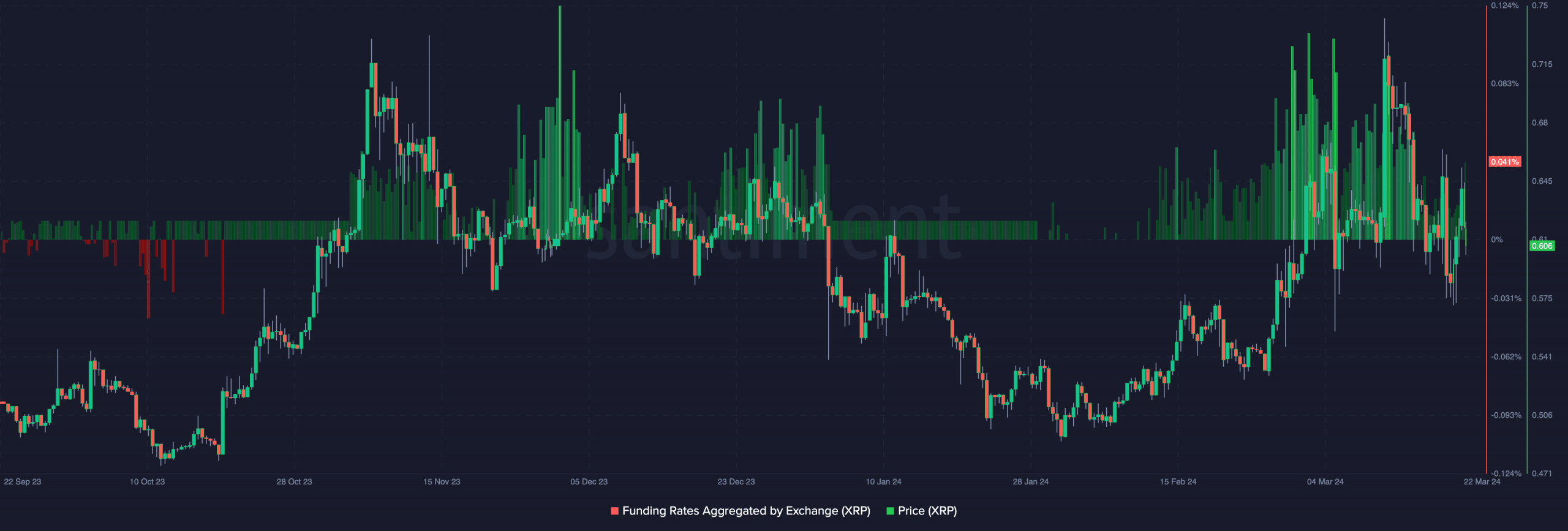

Another part AMBCrypto looked at was XRP’s Funding Rate. If the metric is positive, it means that longs are paying shorts a funding fee. Conversely, a negative value suggests that shorts are the ones making the payment.

As of this writing, on-chain data showed that the Funding Rate was positive. But there was one other thing we could take our eyes off. The Funding Rate was not only positive but had begun to rise higher.

How much are 1,10,100 XRPs worth today?

XRP’s price moving lower as funding rises means pero buyers are in disbelief. It also implies that most spot traders were sellers. Therefore, this is bearish for the token.

In this circumstance, the Ripple native token might need to bank on immediate support to prevent a harder plunge. Should bulls defend the price around $0.58, then XPR might bounce from there. If not, a slide to $0.55 might be possible.