You might not know this about the impact of Bitcoin’s short-term holders

Bitcoin, at press time, was recovering slowly and steadily on the back of a 12.74% uptrend from its lows of $29,583. In fact, it was trading within the same range as the one seen back in January 2021. However, while the crypto’s price may have taken a turn for the best, is there still something amiss about Bitcoin’s on-chain data?

January 2021 v. July 2021

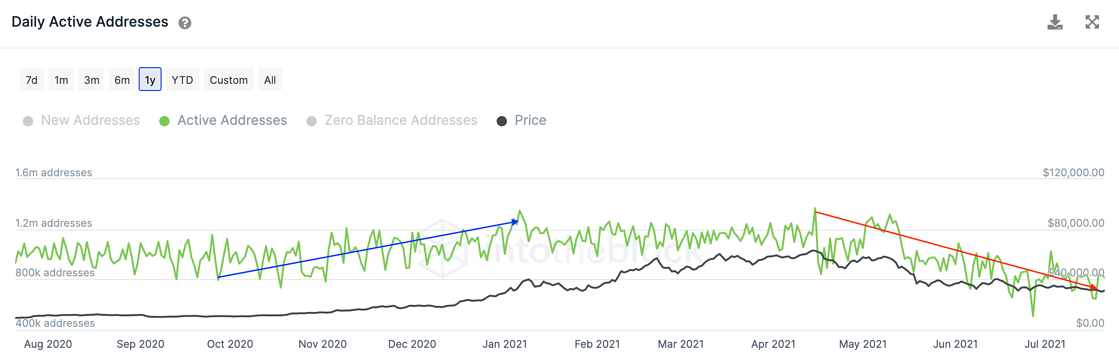

Bitcoin’s rallying price gained a lot of attention in Q4 of 2020. In fact, as per a research report, the 30-day average number of Daily Active Addresses [DAAs] transacting on the Bitcoin blockchain grew by 20% from 950,000 to 1.15 million.

While this trend did slow down a little in Q1 of 2021, it still set a new all-time high of 1.37 million addresses as the value of the world’s largest cryptocurrency surged past $60,000, albeit briefly.

Bitcoin hit an all-time high of close to $65,000 in May, following which, the crypto’s price began to decline and invited massive selling pressure in the market.

Daily Active Addresses

Now, although the price is currently at its early January 2021 levels, the DAAs hit a two-year low this June. This finding is indicative of on-chain activity falling significantly after the aforementioned crash. At the time of writing, the DAAs were at 800,000 active addresses, with the same continuing to trend lower.

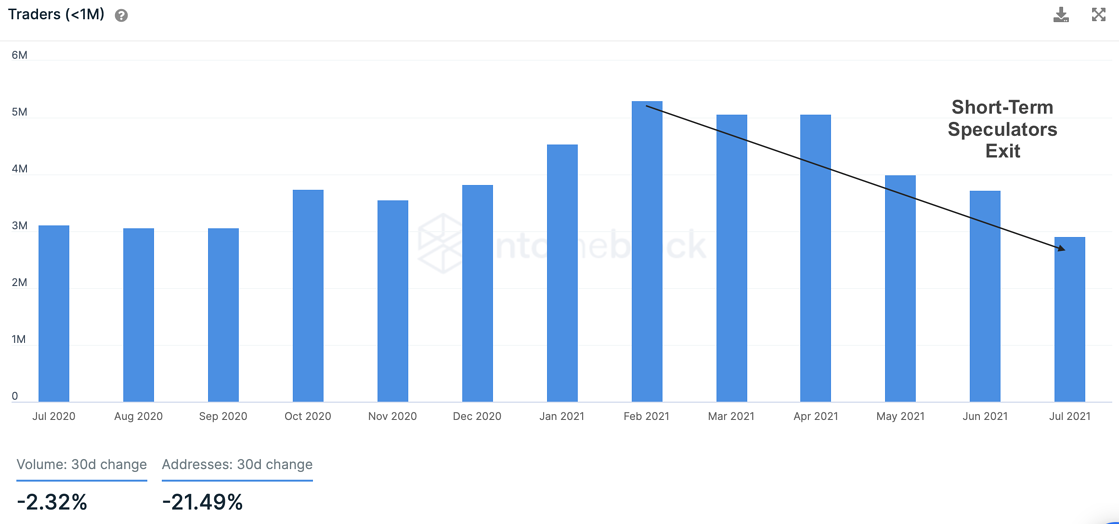

This fall in DAAs can be clubbed with short-term holders realizing their profits and exiting the market. Short-term traders, as the name suggests, are only in the market for a short time. As BTC slipped into a downtrend, many of these traders exited the market. This observation can be supported by the fact that the number of addresses holding Bitcoin for under one month set a new one-year low too.

How did the holders respond?

The number of addresses of STH dropped by over 20%, while volume decreased by only 2%. What this finding means is that retail traders managed only a small volume and left the market. However, not all of them exited the market with profits.

As per data, 70% of the addresses that bought Bitcoin within 14% of its press time price were at a loss. This suggested that many traders tried to either break even when the price slid lower, or panic sold.

On the contrary, Long Term Holders strapped on to their Bitcoin and did not sell despite the volatile market. The Global In/Out of the Money (GIOM) index which covers all addresses holding Bitcoin noted that 70% of all Bitcoin addresses are “in the money,” or holding positions with unrealized gains.

Source: IntoTheBlock

The prevailing market is thus seeing less selling pressure from recent buyers, while the LTHs are still in profit. Bitcoin’s price needs to carry this positive sentiment going forward if there is any chance of breaching its immediate resistance levels.