Ethereum Classic [ETC] and its technical analysis you need to know this month

![Ethereum Classic [ETC] and its technical analysis you need to know this month](https://ambcrypto.com/wp-content/uploads/2022/12/1669904649224-e94c16a8-2f91-44d6-ad32-0432879156b1-e1669904754126.png)

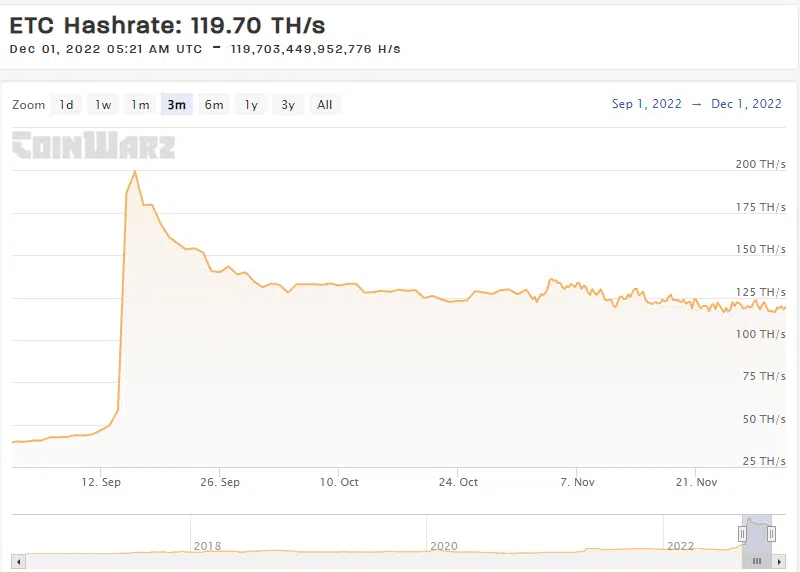

- Ethereum Classic’s hash rate is gradually declining after previously bringing excitement into the network

- ETC’s current short-term outlook looks bearish

Ethereum Classic [ETC] might be one of the best cryptocurrencies for short-term traders in the second half of 2022. Its price action has been moving within a support and resistance range since August, which may affect its performance in the first week of December.

Read Ethereum Classic’s [ETC] Price Prediction 2023-24

However, one of the most noteworthy developments in the ETC network has been its surging hash rate over the last few months, which may have had a hand in its price action.

The Ethereum merge resulted in a miner shift to ETC, which subsequently boosted the network’s capacity, investor expectations for the network, and demand for the cryptocurrency.

Additionally, ETC’s hash rate has been gradually declining since September, and recently dropped below 130 TH/S. Why is this an important observation? Well, the hash rate may have boosted investors’ confidence, but more downside might also have a negative impact on investors’ sentiment.

The hash rate decline aligned with a retest of Ethereum Classic’s short-term descending support. Thus, there is a higher probability of a bearish reversal near the $20 price level.

ETC could swing either way

ETC’s RSI was closing in on the 50% level at the time of writing, which has historically acted as a take-profit zone during a rally. If this outcome becomes a reality, it might present a short-term opportunity for short sellers. A retracement may potentially push the price back down to the $18.5 price range.

The above expectations are based on the assumption that Ethereum Classic’s price action will remain bound to the support and resistance range. A pattern breakout is also probable, especially if the market sentiment continues improving in favor of the bulls.

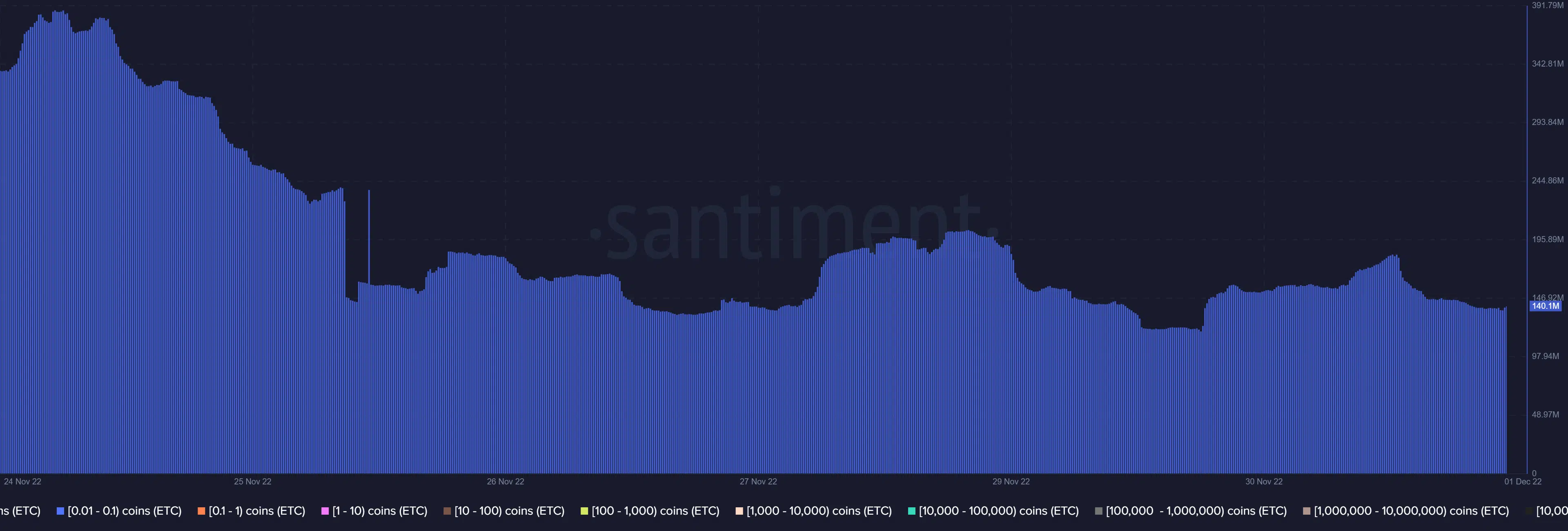

ETC’s volume kicked off in December with a slight decline. Thus, indicating that the upside might be losing its momentum.

A lack of substantial demand to sustain the bullish trajectory will inevitably give way to the bears. Ethereum Classic’s market cap already dropped by as much as $53 million in the last 24 hours. This net outflow was a confirmation that selling pressure was already building up.

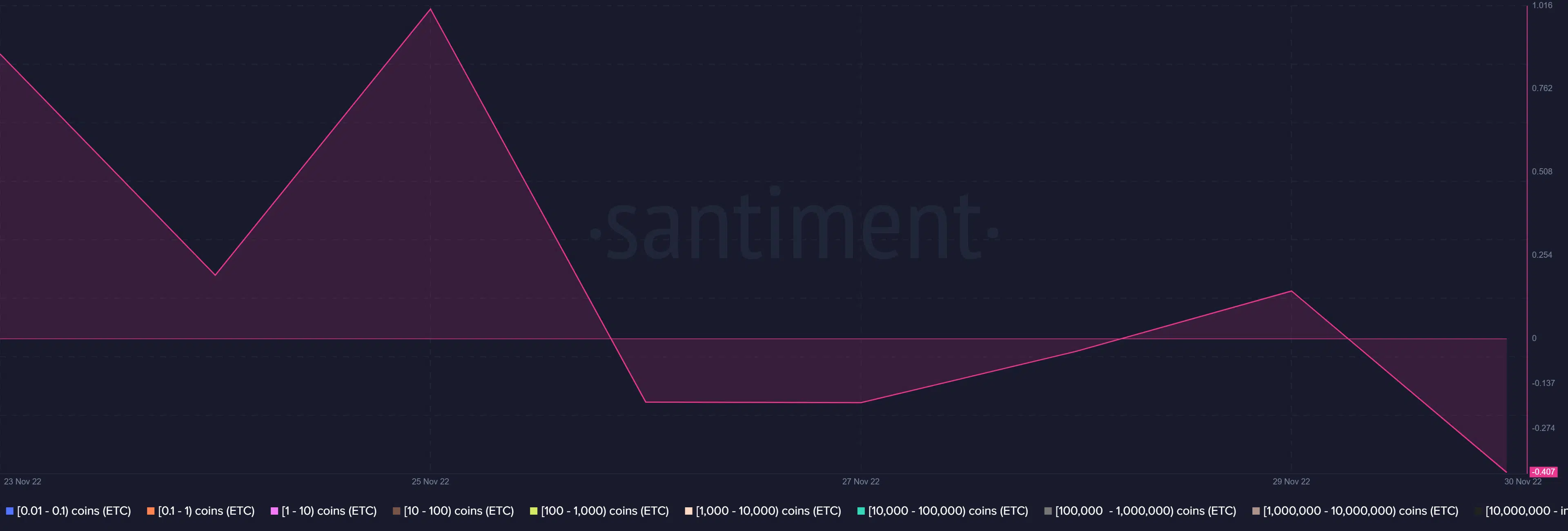

The market sentiment unsurprisingly favored the downside in the last five days as ETC’s weighted sentiment registered a sizable drop. This indicated that investors were gradually shifting towards a bearish expectation.

The odds of a bearish retracement are high, given that the above metrics and chart observations are leaning toward the bearish side. Nevertheless, investors should keep an eye out for factors that may alter the expected direction.