Bitcoin: Was the Chinese mining crackdown really about the environment

The recent miner exodus from China has been one of the biggest bumps the Bitcoin ecosystem has faced since its inception. Initially marketed as a response to rising ESG concerns due to energy usage by miners, the Chinese crackdown entails much more. Its implications have been far-reaching as well, affecting both the market and network immensely.

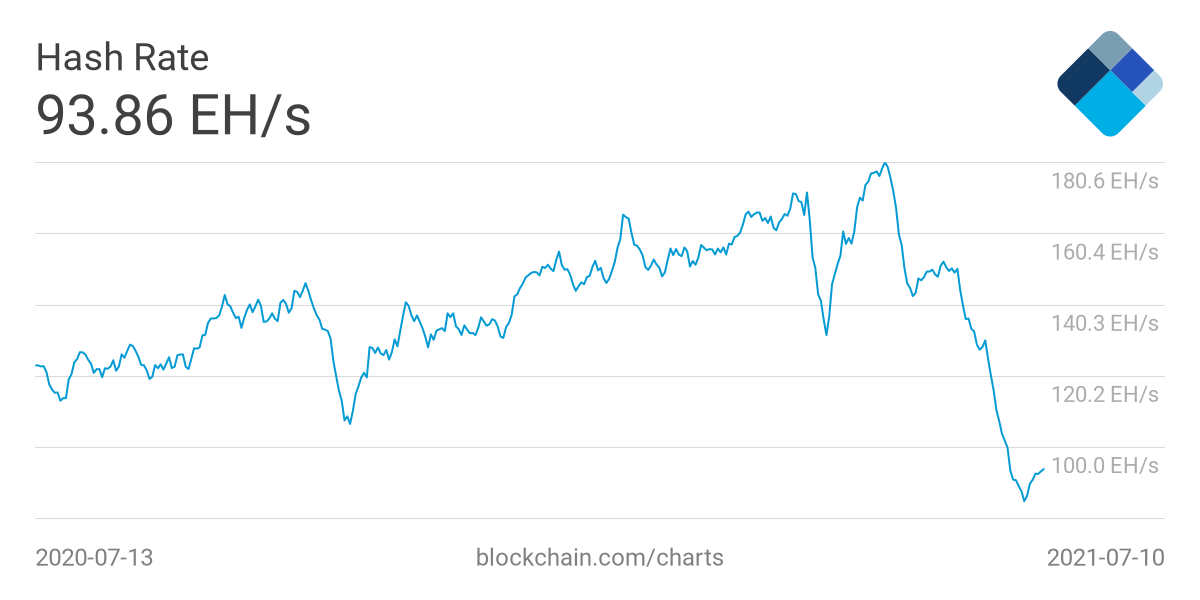

The biggest impact on the network has been a loss of hash rate. Since reaching an ATH on 13 May, around 50% of the hash rate, which is almost 90 exahash, has been plugged out of the network. A mid-range estimate of energy powering that is around 5-6 gigawatts, and going back to the ATH is going to be a long road.

In a recent podcast, The Block’s Asian region editor Wolfie Zhao also pointed toward the effects this has had on the market. Most of it has been from the side of miners, who have had to sell off their holdings and exit the space. He said:

“A lot of the miners in 2020, when they were expanding their mining equipment or infrastructure, they borrowed a lot of money, taking leverage using their bitcoin. I think right after the crackdown came, there was a lot of pressure on them from their loan providers or LPs in terms of liquidating the collaterals.”

He also alluded to the crackdown being motivated more politically and financially than environmentally. Sichuan province, which was initially hoped to be a safe haven for fleeing miners due to its abundance of hydropower, also imposed a blanket ban in June, pointing to the crackdown’s broad base.

Authorities have also been worried about cryptocurrencies disrupting the economic order and facilitating money laundering. Analysts have even concluded that Beijing suspects that Bitcoin could prove to be a strict competition to the digital yuan under development. On the issue, Zhao said:

“After 2017, when they issued the ICO ban, and the market has been pretty much going down in the following years. Retail investor interest picked up in China after the ATH at the end of last year. It’s getting a lot more financial risk.”

Moreover, while the exchanges are still functional, the banks have been barred from funding OTC trades threatening serious repercussions. Hence, new money hasn’t been entering the Chinese market as an OTC trade is required at some point by any new investor to convert their fiat currency into tether. Although leverages and futures have not been affected, Zhao added.

Nevertheless, a silver lining has emerged for the United States amidst all this chaos. While many miners have exited the business, many others are looking to flee to other regions where regulatory environments are more inclusive. Zhao stated that:

“So far the US has a better regulatory environment to do business, there is a public appeal legal system, there’s like a process. I guess people consider that as a big factor… The miners want to move out but they can’t find enough facilities and capacity.”

Additionally, the U.S. comes second only to China in terms of energy generation capacity. While Kazakhstan and Russia are also being considered as new mining hotspots, North American countries can also provide the miners with a familiar environment and language.

Stressing on the implications of the ban, the editor concluded:

“When people say China FUD, they tend to fudge it off thinking this is just another ban… But I think people probably underestimated the seriousness of the whole thing at the very beginning this time.”