This is the only certainty in today’s Bitcoin market

Bitcoin, with every passing day, continues to stray away from any possibility of a bull market. As discussed previously, the price action already does not fit any previous bull run pattern and now, even on-chain metrics are denying any possible recovery. Adding to the already falling volumes of Bitcoin Futures, these developments can be considered to be the icing on the cake. However, this trend can be reversed only if things work out the way particular metrics dictate the market.

A bear market?

Without beating around the bush too much, let’s dive right into the numbers and observe how this market is definitely far from a bull market at the moment. The very first indication came from the NVT ratio.

24 hours ago, the indicator touched its 9-year ATH at 42.6. While it may sound positive, the NVT ratio often is an indication of a trend reversal going forward. Historically, such a high has resulted in an equally strong fall on the charts.

NVT ratio at a 9-year high | Source: Glassnode

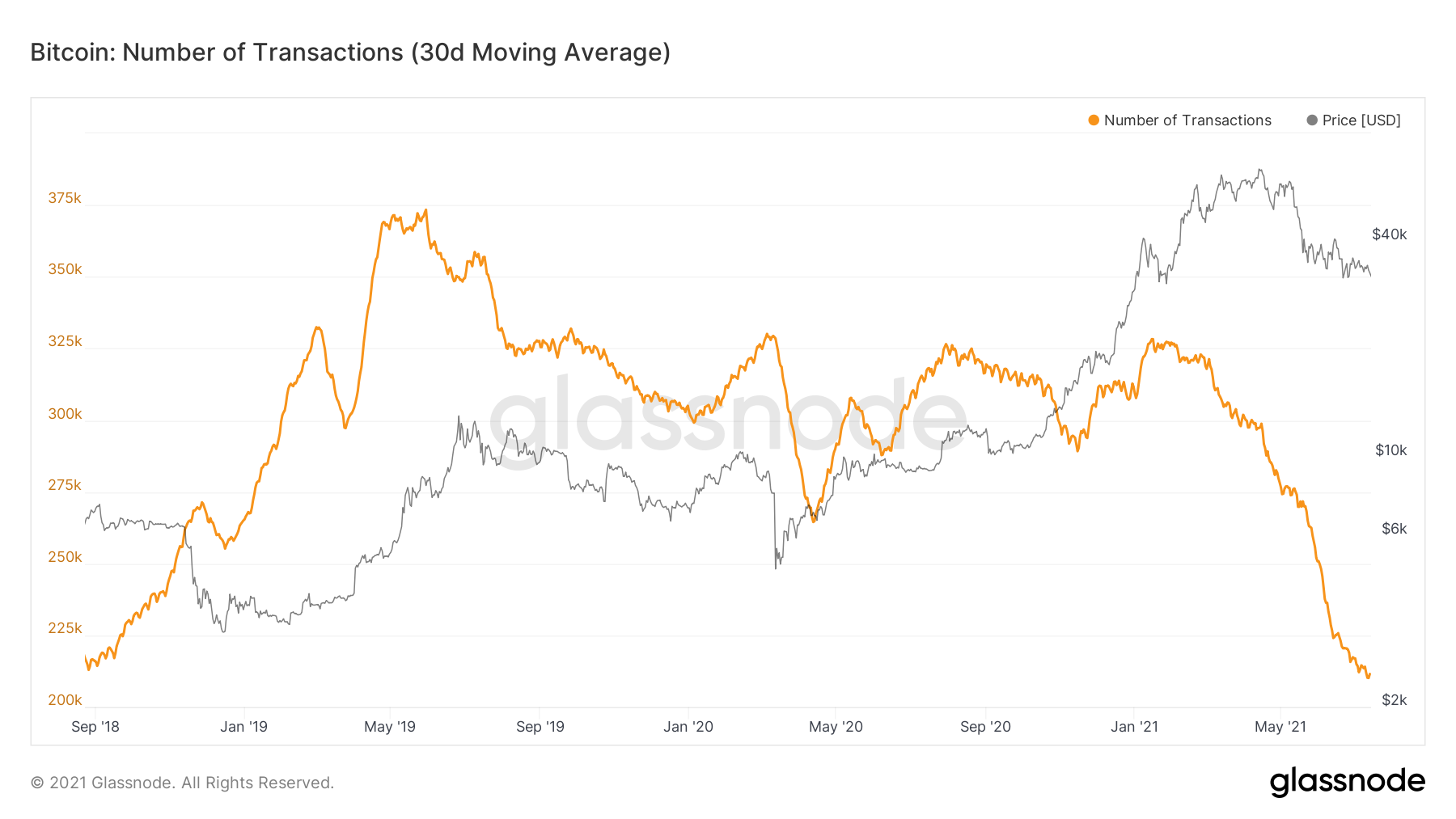

What’s more, the extreme drop in transaction count can be taken into account here as well. Since the beginning of February 2021, a gradual decline has led to the 30-day avg. transaction count falling to a 3-year low. The level this metric was at was last observed back in August 2018.

Bitcoin transaction count | Source: Glassnode

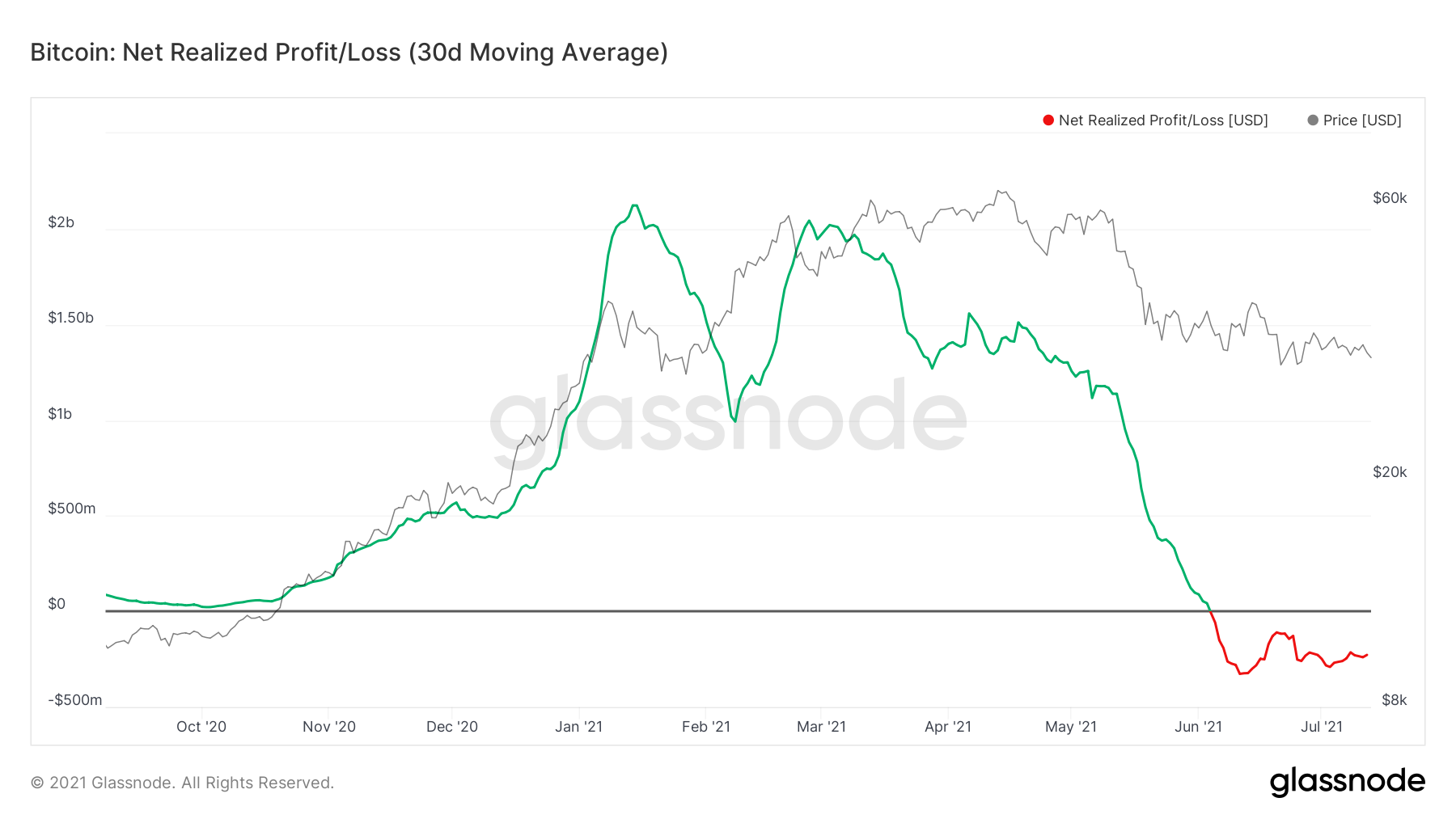

The Net realized profit/loss chart also pictured losses dominating the indicator. The indicator’s movement remains close to the all-time low of 12 June. This speaks plenty for the present market condition. Until this line turns green, profits might just be far, far away.

Net realized profit/loss – 30 DMA | Source: Glassnode

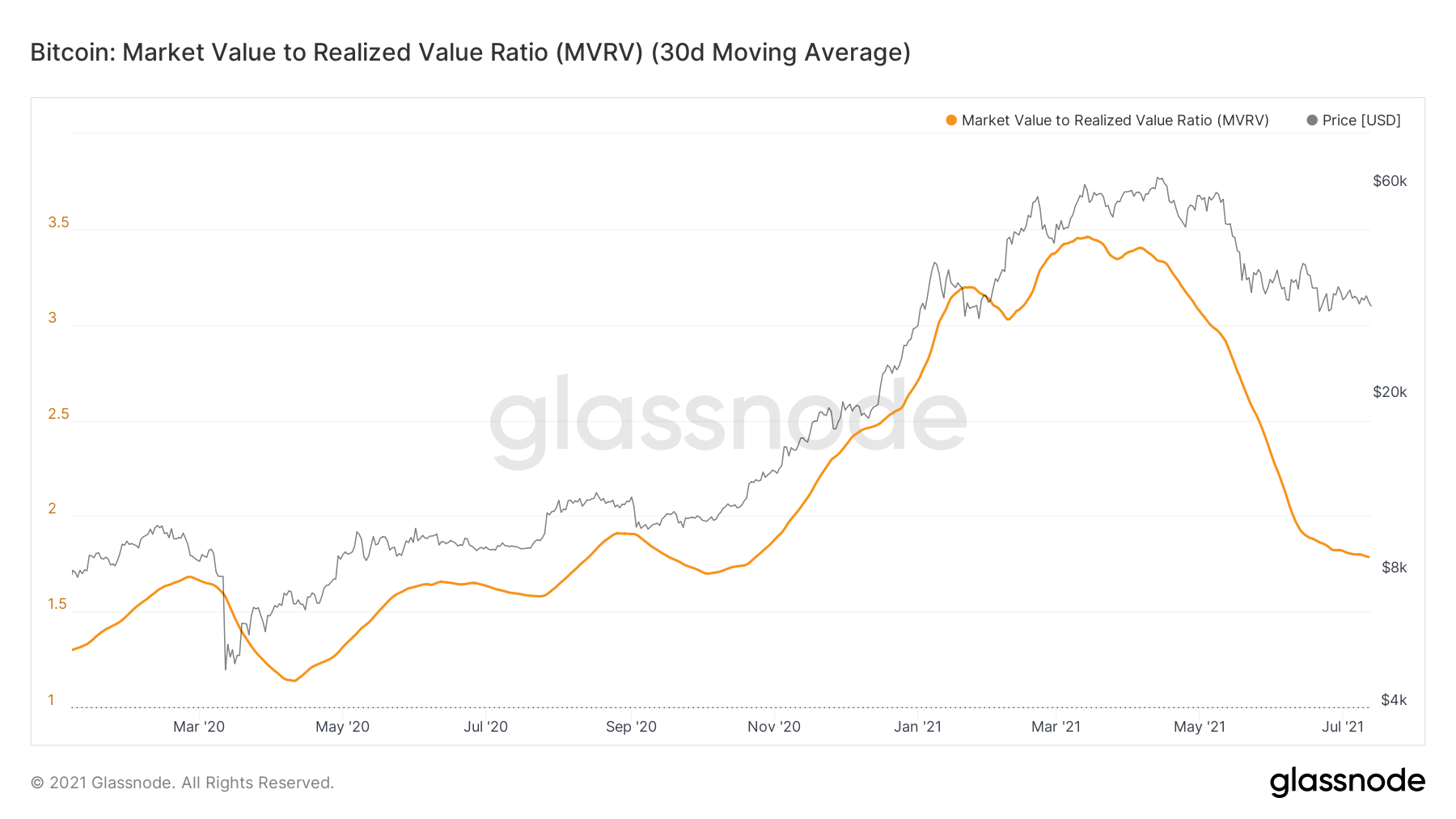

The MVRV ratio can be taken into consideration as well, especially since it too contributes to the aforementioned losses. The MVRV, in simple terms, shows the profits investors are making with respect to the value of BTC. At press time, this indicator was at 1.7, sharing the same value as the figures seen in October 2020. Needless to say, the Bitcoin market has seen better days.

MVRV ratio at October 2020 level | Source: Glassnode

All hope is not lost…

This is also true since a few important metrics were showing signs of a possible bullish reversal if their movements hold.

The first on this list is the Reserve Risk indicator. For a while now, this yellow line has been inching closer to the green zone. This buy zone is considered very positive for the market as it highlights the investors’ increasing confidence in the asset.

Reserve Risk reaching close to the buy zone | Source: Glassnode

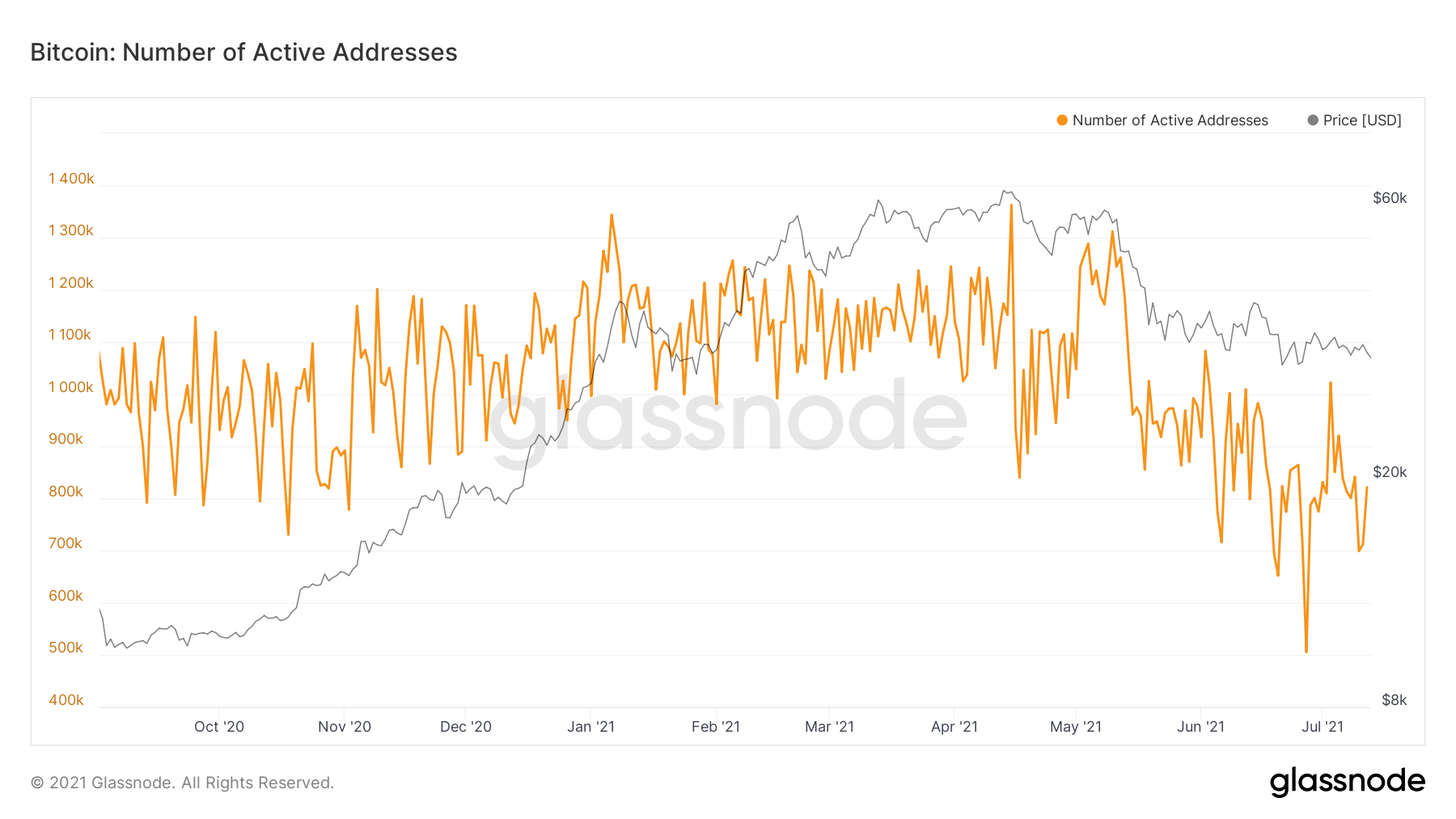

Contributing to the same are the rising active Addresses which have been increasing at a good rate after falling to a 2-year low on 27 June. In the last 24 hours, active addresses jumped by 100,000 to touch 821k.

Bitcoin Active Addresses | Source: Glassnode

Despite all these indications, Bitcoin and the market’s volatility can change the winds at any moment. That is perhaps the only certainty in this market. Thus, it is important to stay updated at all times if you are looking to make an investment.