What you should know about ’15x more people paying Ethereum to….’

The cumulative altcoin market cap rose by 16% over the last week, with one of the market’s top gainers being Ethereum. Ahead of the London hard fork, the top alt has seen some decent weekly gains. Ergo, it is interesting to take a look at how the Ethereum network looks like ahead of the said event.

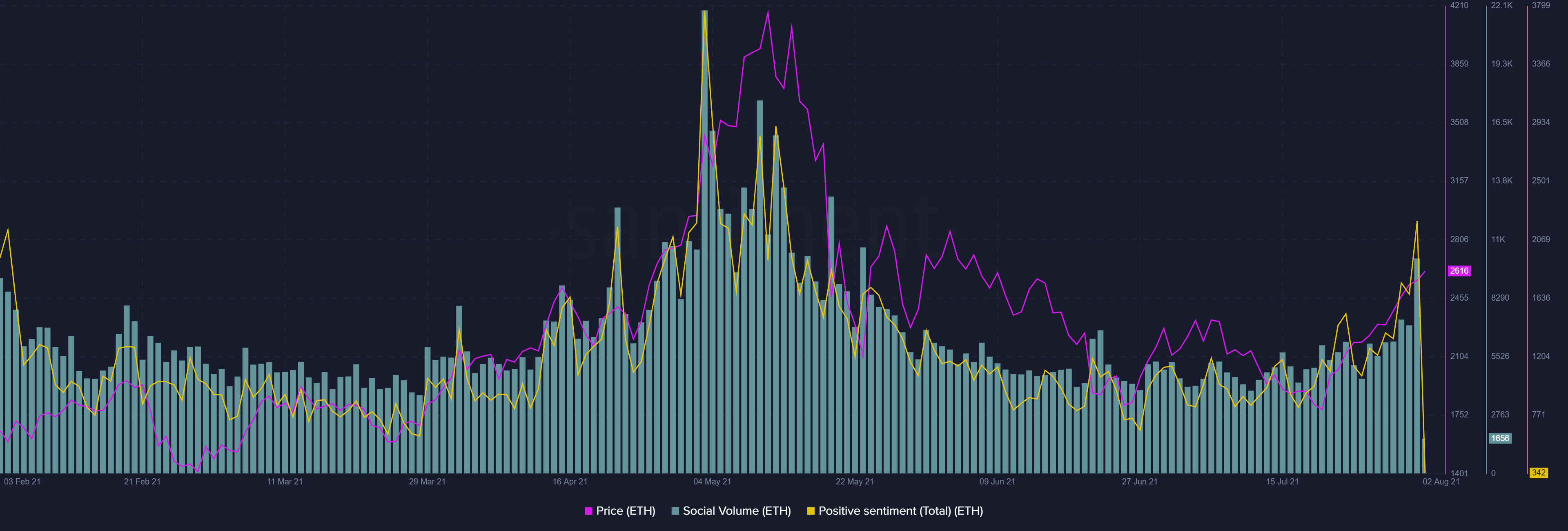

Gauging social interest

Amid claims of newer all-time highs for ETH post the London hard fork, one thing that is for certain is high social traction. Ethereum’s social volumes noted a sizeable uptick on 1 August, its highest since 23 May. In fact, the metric took off by 42% in one single day.

Total positive sentiment for Ethereum also recorded a hike, with the 1 August spike being the tallest since 12 May. Socially, ETH seemed to be in a comfortable spot, especially in light of the London hard fork two days later.

Source: Sanbase

How strong is Ethereum’s network?

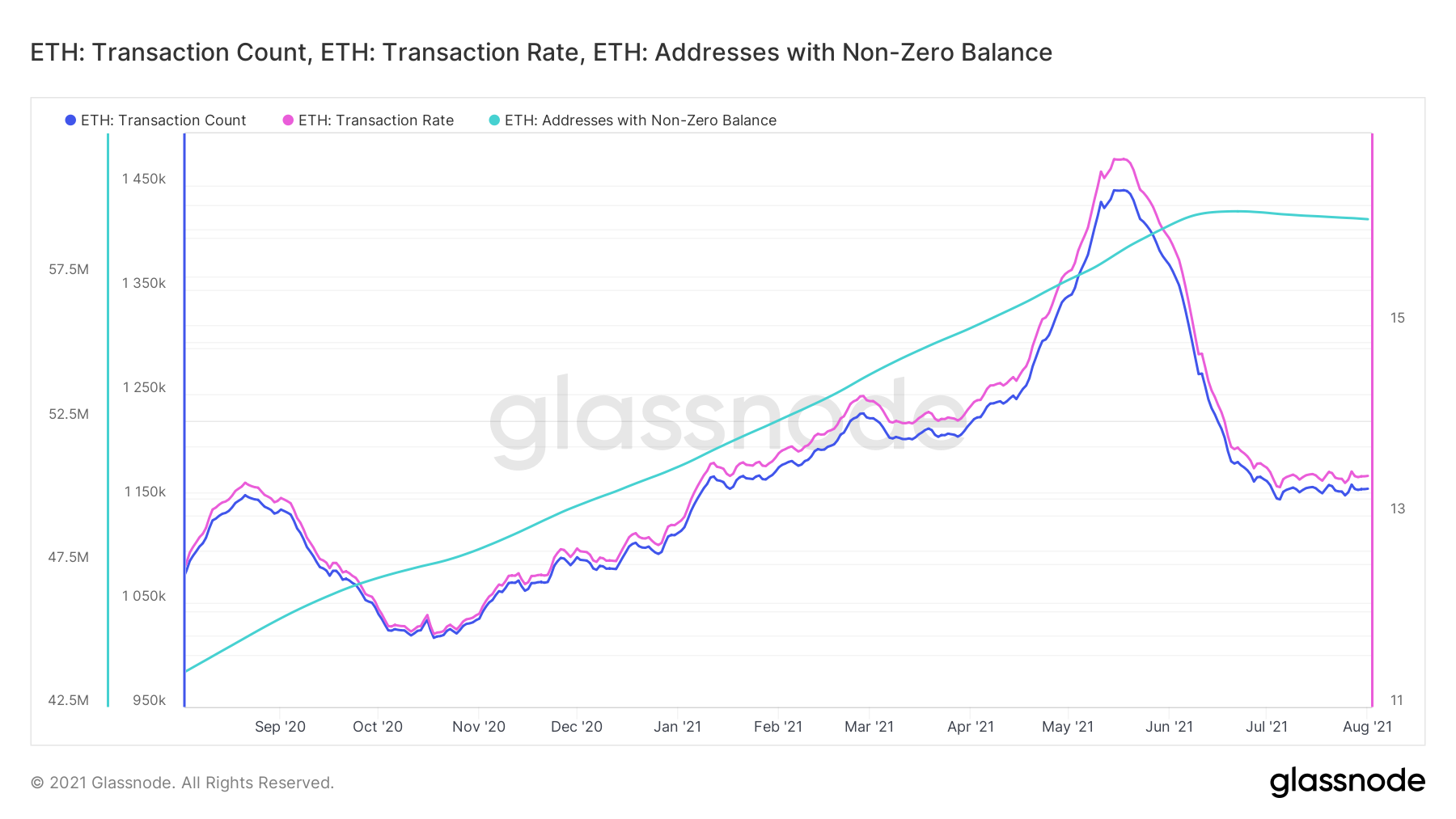

Ethereum’s network showed some solid signs of strengthening towards mid-May when its transaction count and transaction rate were at an all-time high. However, a notable decline in these metrics was seen soon after the alt’s price started falling on 15 May.

An inverse parabolic curve which was seen at the time highlighted the drastically reduced network transaction rate. With ETH’s price rising, a similar upward rise was expected along with the price this time too which didn’t show up.

Source: Glassnode

Transaction count and its rate were both seen largely consolidating in the same range. This highlighted a comparatively weakened state of the network, as opposed to May’s hike. However, ETH addresses with non-balances seemed to maintain themselves above its May levels.

That’s not all, however.

Ethereum seemed to maintain its fee dominance over Bitcoin by around 15 times as Bitcoin was ranked seventh by weekly fee generation. This is a positive sign for the Ethereum network, with the implication being that almost ’15x people are actually paying to use Ethereum as compared to Bitcoin.’

Source: CryptoFees

Finally, it is also notable that Ethereum’s network development activity was at the lowest on 26 July. While the metric did note an uptick later, it didn’t hike by much. In fact, it only pushed the number from 228 to 238 on 1 August.

![Dogecoin [DOGE] drops 16% – But is a $0.25 rally now loading?](https://ambcrypto.com/wp-content/uploads/2025/06/08519350-41B0-4D47-8530-DADB272A4AD3-400x240.webp)