Navigating through Bitcoin’s fluctuating price-action

Seems like this pattern of short-term rises and falls is not coming to an end for Bitcoin or any other altcoin. In this month alone we witnessed two stark rises and two equally steep falls.

This has put many investors in jeopardy since the cycle of random movements has put them into losses. So for them going ahead, knowing this could prove to be very helpful.

Bitcoin losses at their worst

Yesterday the market witnessed the second-biggest price fall this month when Bitcoin fell by almost 11%. Since then there have been some rather interesting developments.

Firstly the realized losses touched $650 million today owing to the price fall. This was the highest recorded loss in almost 2 months.

Bitcoin realized profit/loss | Source: Glassnode – AMBCrypto

Accordingly, the realized profit/loss ratio dropped as well to the farthest it has in the same 2 months duration.

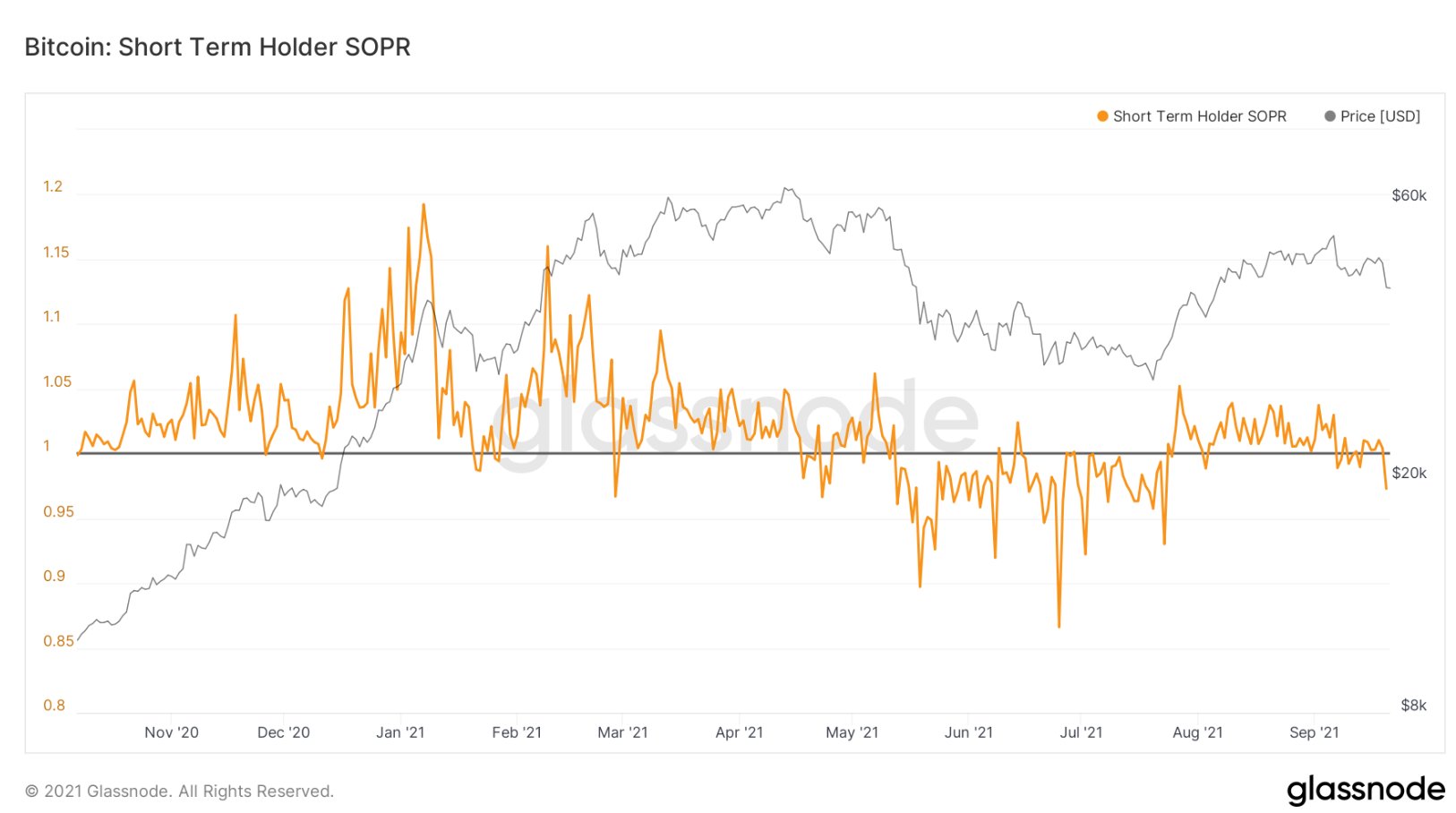

Consequently, the Spent Output Profit Ratio (SOPR) fell under 1 as well coinciding with the losses. However, the most losses since the drop were witnessed by short-term holders (STH) or traders as visible on the STH – SOPR.

Bitcoin STH – SOPR | Source: Glassnode – AMBCrypto

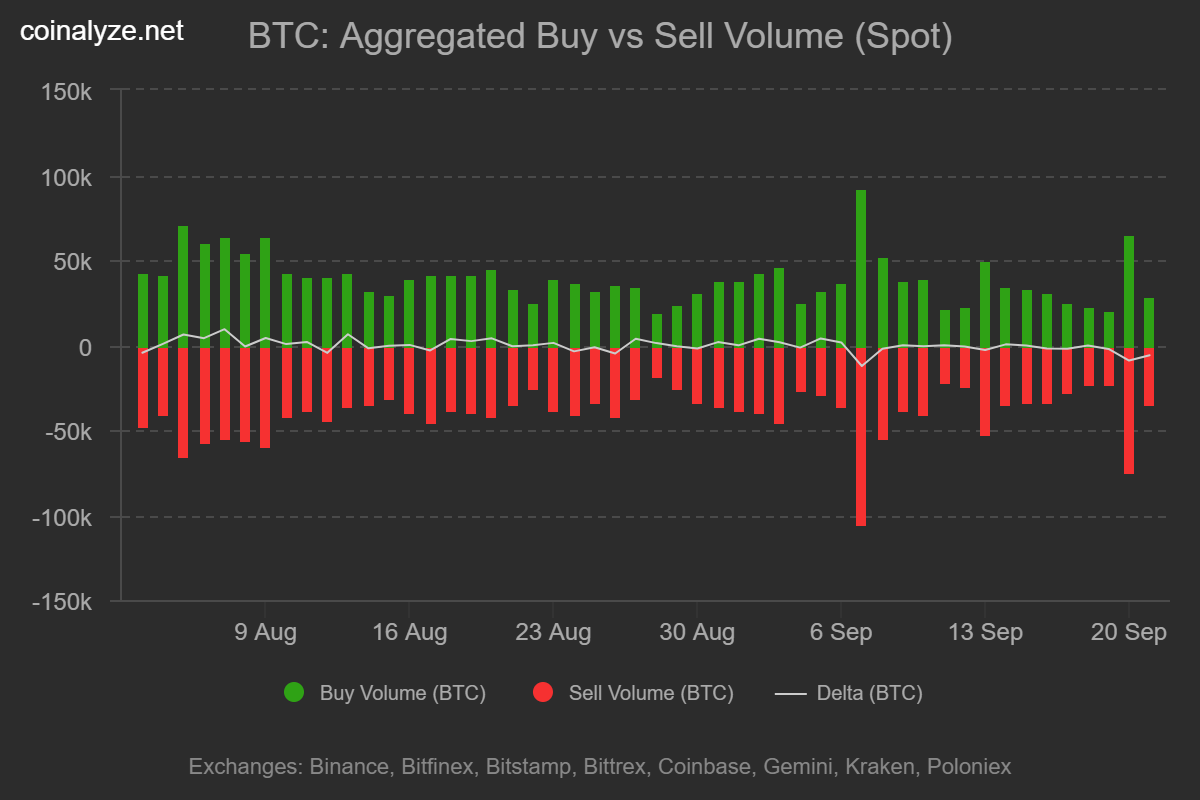

Yesterday 74k BTC were sold off, of which 65k were bought back as well. Now, this took a significant toll on Bitcoin’s growing participation as well.

Addresses with non-zero balance fell to a monthly low after growing constantly for almost 1 month. This means that the holders either sold off their holdings or exited completely which either way, is not a good sign.

Bitcoin buy/sell volume | Source: Coinalyze – AMBCrypto

So when would holders be back in profits?

Right now that is hard to answer. This is because as of now, looking at the market’s movement, there are two possibilities of where the price could reach going forward.

- Since SOPR is under 1, the price could bounce back and this would then turn into a short-term blip. Entry points thereafter can be seen around $44k or $42.4k if the price falls further.

- SOPR’s such a deep fall could be the beginning of a long-term price fall as we witnessed back in May, which kept SOPR under 1 for almost 2 and a half months.

Bitcoin entry points | Source: TradingView – AMBCrypto

In any case, for now, investors should just sit tight and HODL.