Aggressive buyers can take profit at this level before ATOM goes further down

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

Bitcoin has been treading water in the past couple of days, as it floated around the $39k area. Heading into the weekend, forming a bias toward either direction for Cosmos was a daunting task. The indicators and price action did not point toward a single direction. However, the token of Cosmos was trading at an area that bulls would be interested in bidding at. In the scenario that BTC can see a weekend pump past $39.2k, ATOM might post some gains in the next day or two.

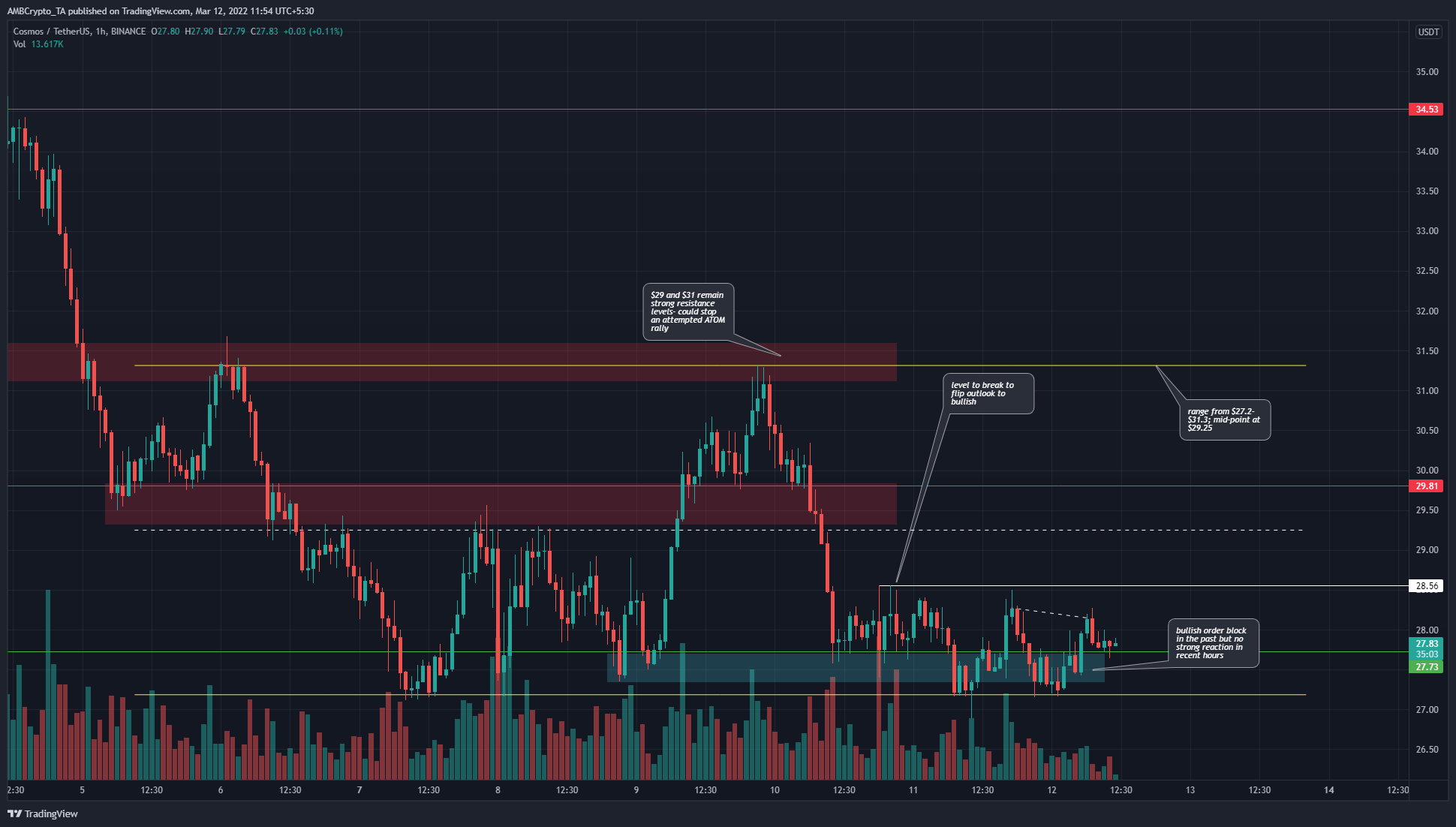

ATOM- 1H

In the past couple of days, ATOM has traded within a tight price range from $27.2 to $28.56. In the next few hours, these are the two levels that would act as support and resistance to the price respectively.

The past week has seen a larger range (yellow) for ATOM, from $31.3 highs to the $27.2 lows. The mid-point of this range lay at $29.25. Apart from this, longer-term support and resistance levels lay at $27.73 and $29.81.

That highlights the near-term important levels for ATOM. The coin was trading at $27.83 and was quite close to the range lows at $27.2. Therefore, aggressive buyers could try to bid ATOM. Their plan of action would be to take profits at the $29.5 and $31.2 resistance bands.

Rationale

The RSI made a higher high even as the price made a lower high (dashed white), a hidden bearish divergence. Generally, in a downtrend, a bullish divergence sees a pullback, and a hidden bearish divergence after it would indicate a continuation of the downtrend.

The CMF was in neutral territory, while the CVD showed some buying pressure in recent hours. Hence, it seemed like the indicators could not come to a consensus. Bearish, neutral, or bullish?

Conclusion

The price action was range-bound in the past week. In the past two days, the price has compressed further and $28.56 is a level the bulls would have to beat, to flip the near-term bias to bullish. The $27.2-$27.7 area should see demand arrive for ATOM- but if this area is lost to the bears, a further downside would be made quite likely.