Bitcoin outshines others to see $97.8M in inflows while others…

In the past 24 hours, the total transaction volume of cryptocurrency had exceeded $100 billion. This marked an increase of 63.07% over the previous day. The total market value, at press time, is $2.12 trillion, a month-on-month increase of 4.75%.

Such a bullish trigger incorporated an impressive institutional inflow across different digital assets.

What a rise

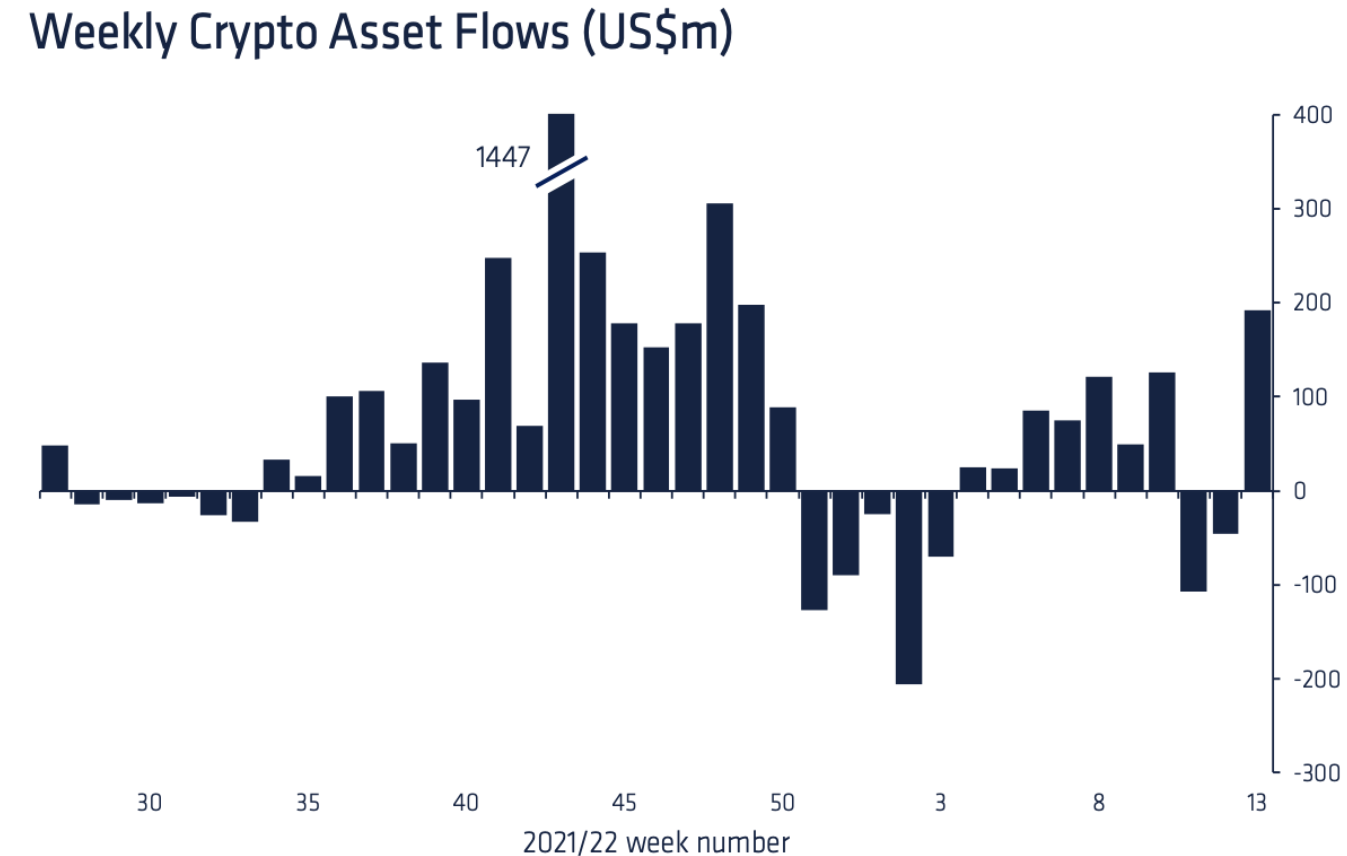

Institutional investments into cryptocurrencies were at the highest levels in three months. A sharp rise from the previous week which saw outflows of $47 million. Thus, marking a recovering from the bloodshed.

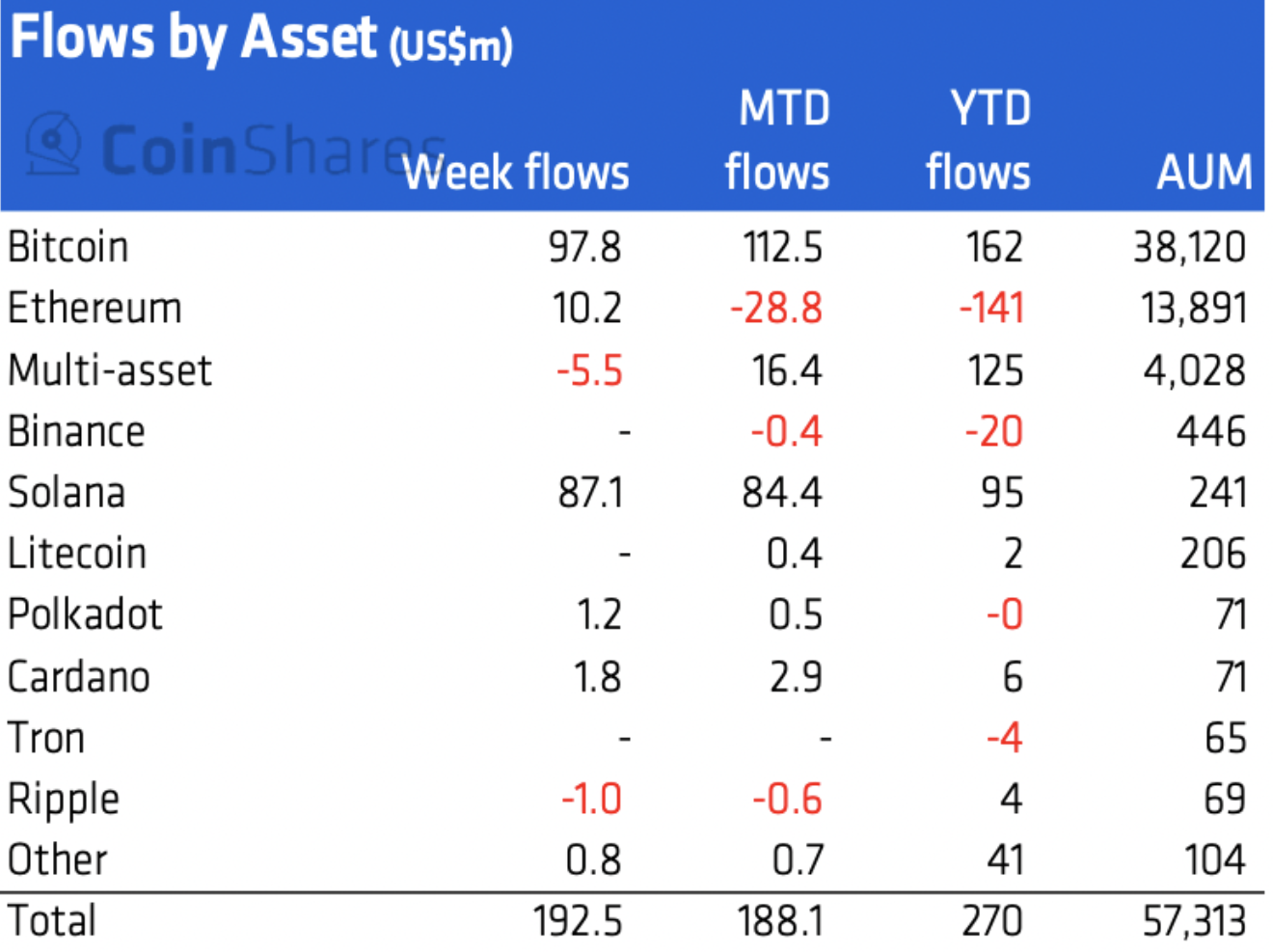

According to the latest CoinShares Digital Asset Fund Flows Weekly report, investment products for digital assets saw total inflows of $193 million last week. This marked the highest inflows since a late last year as evident in the plot below.

Source: CoinShares

Such impressive investment levels came into effect somewhere in December, seeing $184 million worth of inflows. Geographically speaking, the majority (76%) of inflows came from Europe at $147 million. While the Americas “lagged at $45 million, with some providers continuing to see minor outflows,” the report noted.

Leading from the front

Bitcoin, the largest cryptocurrency led the charge as it enjoyed $98 million in inflows last week.

The study added:

“Investors focused on Bitcoin which saw inflows totaling US$98m last week, bringing year-to-date inflows to US$162m.”

Ethereum, the 2nd largest cryptocurrency saw a decent rise as it recorded $10.2 million in investor inflows last week. However, smart contract platform dubbed ‘Ethereum-killer’ Solana (SOL) far outperformed ETH. Solana saw the most significant single week of inflows on record totaling $87 million, representing 36% of AuM.

“Solana saw the largest single week of inflows on record totaling US$87m, representing 36% of AuM [assets under management]. AuM now sits at US$241m, making it the 5th largest investment product and the largest single altcoin other than Ethereum.”

In the previous report on March 23, SOL registered negligible net flows (around $0.7m) as compared to other tokens. Ergo, SOL recovered from its battle scars in the previous week.

Digital asset investment products focused on altcoins Cardano (ADA), Polkadot (DOT) and Cosmos (ATOM) enjoyed small inflows last week. The statistics totalled $1.8 million, $1.2 million, and $0.8 million.