Up by 21%, MKR’s whale activity is having this effect

By now, any investor who follows crypto knows the market crashed and burned this week. Both Bitcoin and altcoins suffered immensely following headwinds (Rising inflation, interest rate hikes, and geopolitical instability).

That being said, a few altcoins did see significant surges in their on-chain activity and price analysis. To many, this represented some light at the end of this long, dark tunnel.

Who’s the Maker?

Maker (MKR) seemed to be the one bright spot to emerge in trading on 15 May. Crypto-traders now find themselves embracing Dai (DAI) as the “best” decentralized stablecoin option in the market. The #42 ranked crypto and the governance token of MakerDAO and Maker Protocol registered a major spark amidst the chaos. MKR rose by more than 8% in just 24 hours as it traded just shy of the $1600-mark.

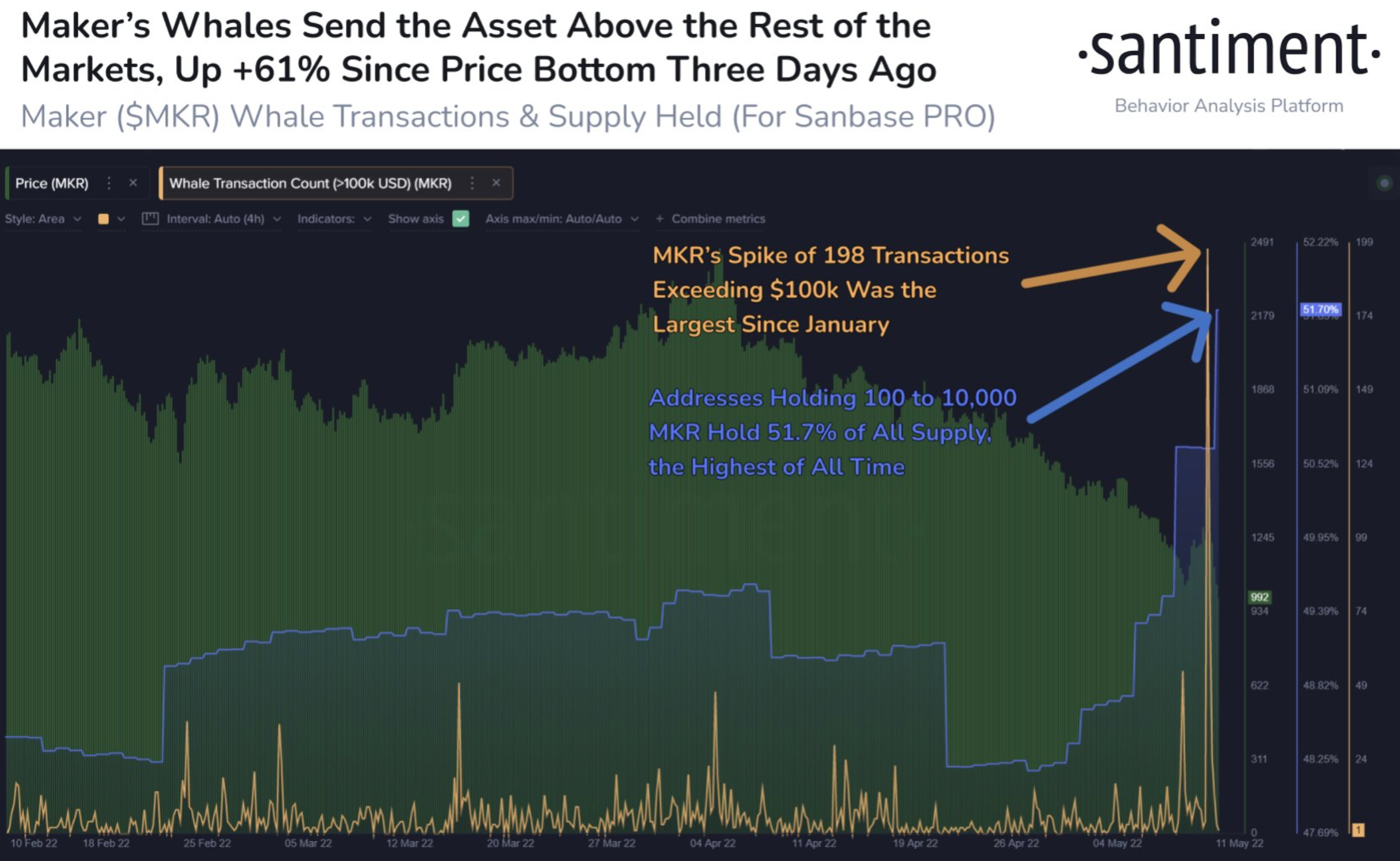

Well, dominant buyers indeed played a vital role in aiding this surge. Maker has seen major whale activity these past couple of days. Its most-significant spike in $100k+ transactions propelled the asset by +21% over the past week and another +18% in the last day alone.

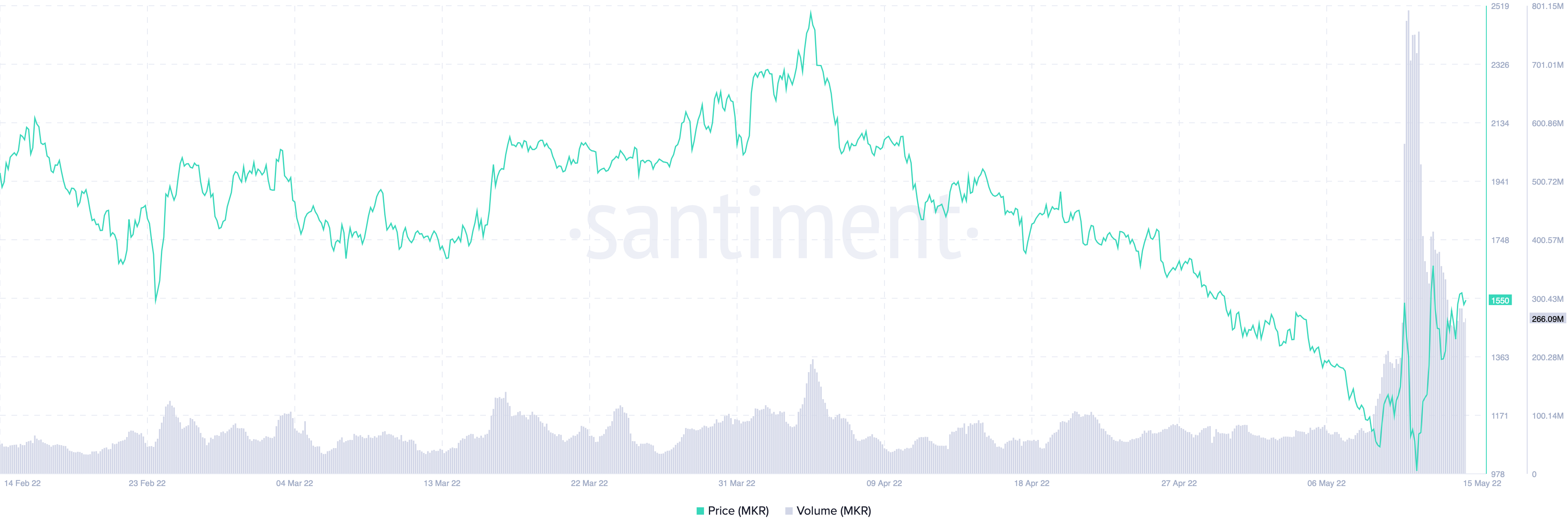

As per Santiment’s crypto-analytics, key stakeholders owned an ATH in MKR supply. To better understand how this whale spike made a mark, let’s take a look at volumes. While these were negligible when compared to spikes in late 2021 and early 2022, they were nevertheless rising at press time.

This just showcases that investors or traders have faith for the long run and would continue to hold it, despite market volatility. Here’s a glimpse of this volume hike within a 3-month period –

More than 300 transactions worth over $100,000 took place on 11 May. The last time MKR saw these numbers was before the December 2021 crashes.

The surge in interest made MKR the largest DeFi token, according to DeFi Llama. It accounted for 9.7% of the $146 billion total value locked in decentralized protocols, surpassing Curve, SushiSwap, and Lido in the process.

Who else wants IN?

Such a surge within a period of major uncertainty underlines different enthusiasts, dominant buyers incorporating the said smart contract.

For instance, MKR is one of the most used smart contracts among the top 5000 ETH whales, as per this 14 May tweet.

JUST IN: $MKR @MakerDAO one of the MOST USED smart contracts among top 5000 #ETH whales in the last 24hrs?

Peep the top 100 whales here: https://t.co/kOhHps8XBB

(and hodl $BBW to see data for the top 5000!)#MKR #whalestats #babywhale #BBW pic.twitter.com/VspdDBAq4T

— WhaleStats – BabyWhale ($BBW) (@WhaleStats) May 13, 2022