Can Aave Protocol’s latest “stablecoin” bring some stability in the performance of AAVE?

One of the leading liquidity protocols, Aave Protocol [AAVE], proposed the creation of its stablecoin “GHO”. This proposal by the Aave Protocol comes amidst an increased uncertainty related to the stability of the so-called “stablecoins”. According to the proposal, the “GHO” coin will be a decentralized multi-collateral stablecoin fully backed and native to the Aave Protocol.

Following the announcement, the network’s native token, AAVE, was spotted posting intraday gains. With the AAVE token currently trading at its December 2020 level, can a bull run be anchored on the proposal of the launch of the ‘GHO’ stable coin? Let’s take a look.

‘GHO’-ing to the moon

Exchanging hands at $71.33 per AAVE token at the time of writing, the last 24 hours have been marked with a 14% uptick in price. As of 7 July, the token’s opening index price stood at $62.8. Furthermore, upon the proposal’s announcement, the price rose to a high of $72.01. Still maintaining gains 24 hours later, investors took to filling their bags with Aave tokens as data from CoinMarketCap showed a 113.52% growth in trading volume. Within the last 24 hours, the token’s market capitalization also grew from $874 million to $1.02 billion.

With an increase in buying pressure spotted in the last 24 hours, the token’s Relative Strength Index (RSI) was 52.82 at press time. Similarly, the Money Flow Index (MFI) was in an uptrend at 60.65 at the time of writing.

While the going gets good…

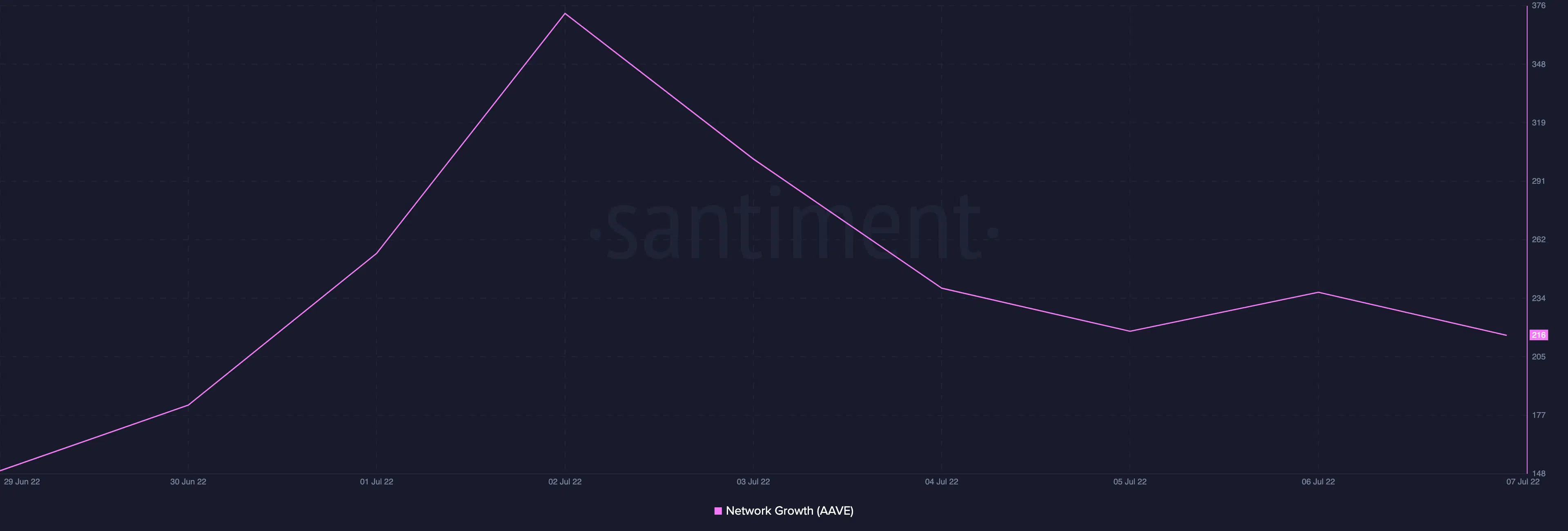

Interestingly, as per data from Santiment, the AAVE token did not record an impressive on-chain performance in the last 24 hours. For example, the number of new addresses created on the network declined within the period under review. An 8% decline in the network growth was lodged in the last 24 hours.

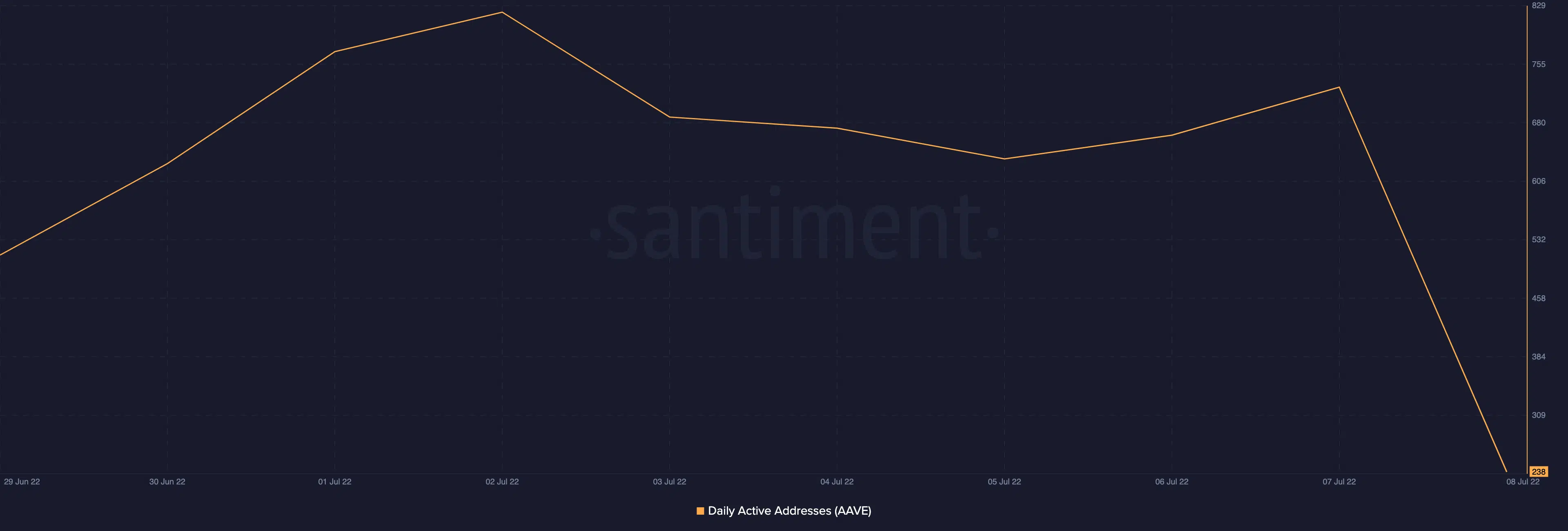

Further, the number of unique addresses involved in AAVE transactions fell in the last 24 hours. At 238 unique addresses at the time of press, a 67% decline was posted within the period under review.

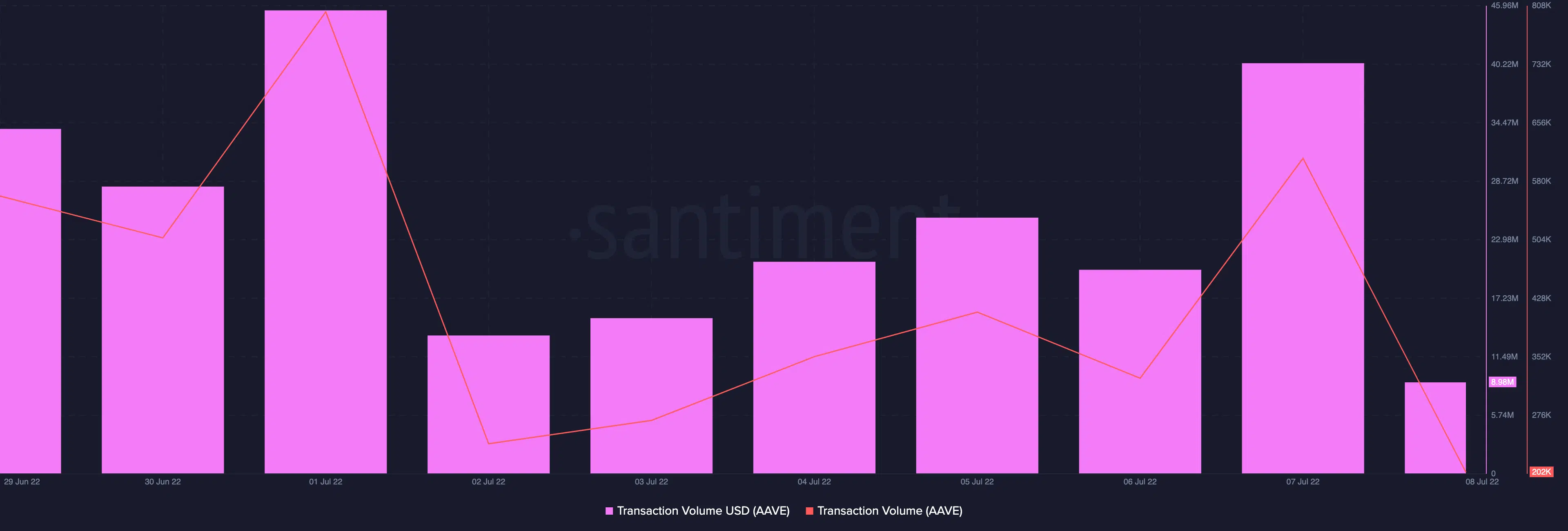

In addition, the aggregate amount of AAVE tokens across all transactions that happened in the last 24 hours registered a 66% drawdown in the last 24 hours. This represents a decline from $40.32 million to $8.98 million in the transaction volume for the AAVE token in the last 24 hours.

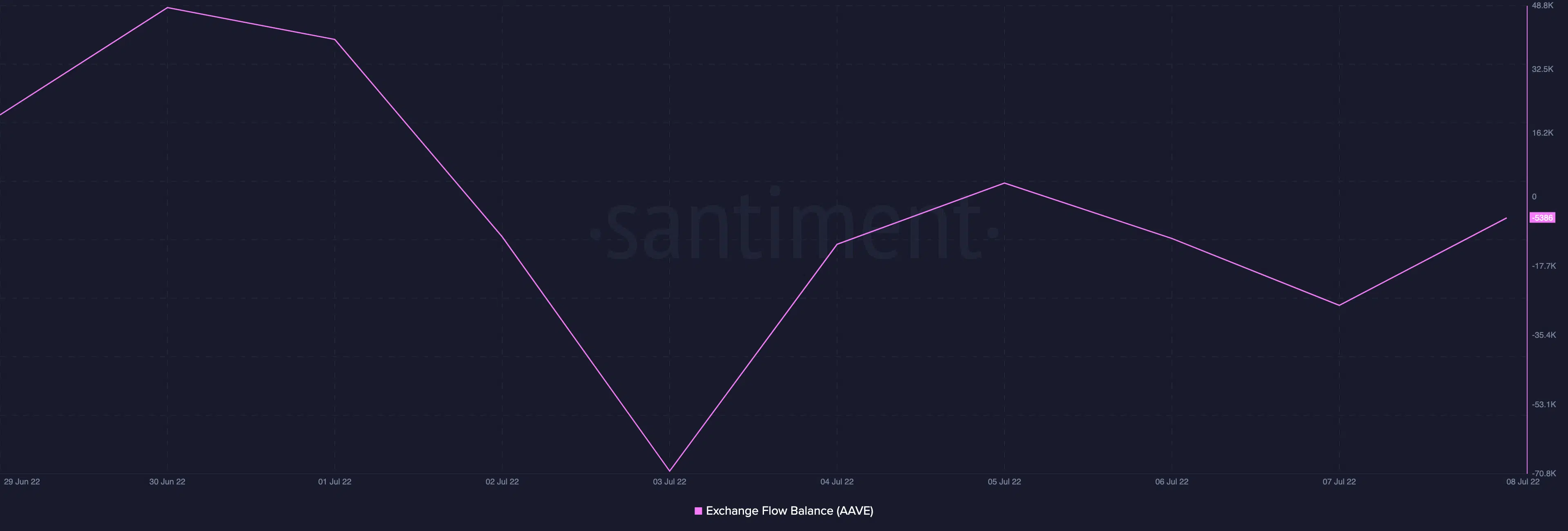

Despite the price rally observed in the last 24 hours, investors should exercise caution as the exchange flow balance tells a tale of an impending price retracement. On a seven-day average, this was spotted at a negative 33.1k position. In the last 24 hours, this index stood at a negative 5386, indicating that more AAVE tokens have left exchanges than entered in the last week.