Algorand [ALGO] investors could profit more if this resistance level flips to support

![ALGORAND [ALGO]: Investors could profit more if this resistance level is flipped to support](https://ambcrypto.com/wp-content/uploads/2022/12/bn-fi-4.jpg)

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Algorand has been in a slight upward momentum

- ALGO could retest the immediate support level at $0.2186

Algorand [ALGO] found brief support at $0.1809 after a sustained downtrend since early November. At press time, ALGO was trading at $0.1924 and could move higher if the bulls maintained their momentum.

Such an upward move could see ALGO either retest or break through previous support at $0.2186, which served as immediate resistance at the time of publication.

Read Algorand’s [ALGO] price prediction 2023-2024

Algorand at $0.1809: A new support or a flip into resistance?

At press time, ALGO’s Relative Strength Index (RSI) pulled back from the oversold area. This indicated that sellers were exhausted, and buyers gained influence due to the increasing demand for ALGO at its lowest price.

Should the bulls gain a larger advantage, ALGO could be pulled higher to break through immediate resistance at $0.2186 or the Exponential Moving Average (EMA) ribbon at $0.2257.

However, ALGO bulls only have a clear advantage if they break the 23.5% Fibonacci retracement level at $0.2452.

However, an intraday candlestick below $0.1809 would nullify the bullish bias. Such a downtrend will force ALGO to look for new support at $0.1682, $0.1442, or $0.1200.

ALGO saw an increase in development activity, but …

Source: Santiment

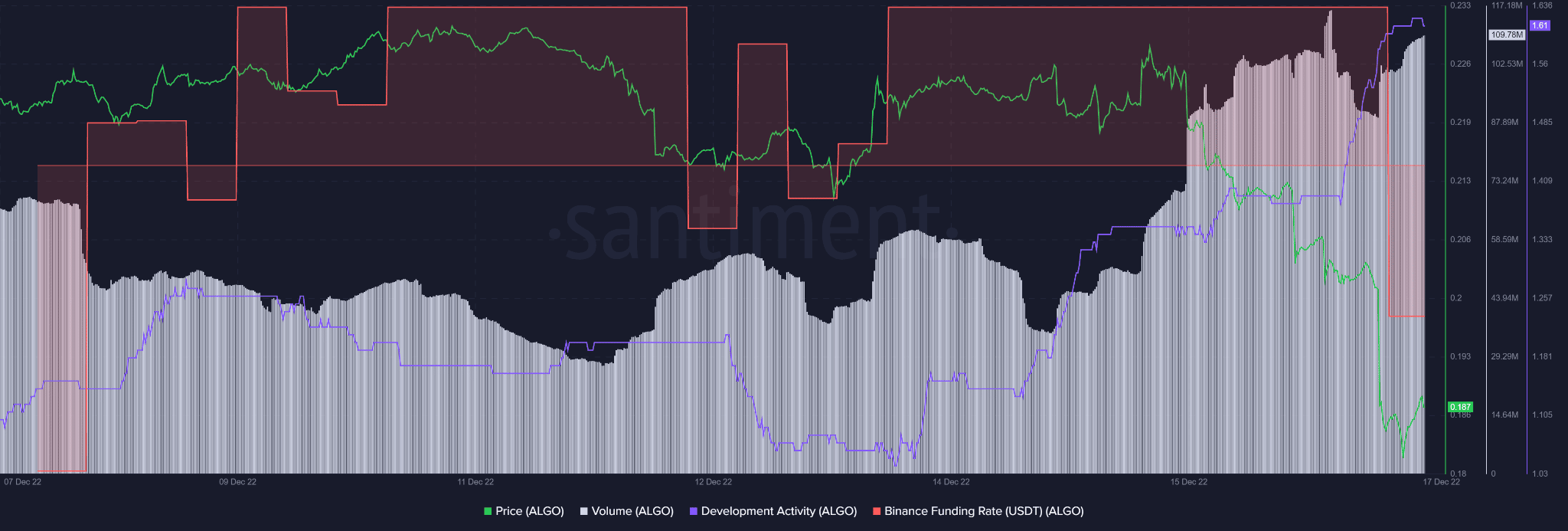

According to Santiment, ALGO saw a sharp increase in development activity since 14 December.

At press time, development activity continued to climb, coinciding with a recent partnership with Italy to support banks and insurance guarantees. Therefore, increased development activity could increase ALGO prices in the coming days or weeks.

In addition, ALGO’s volume jumped after the recent price decline, indicating increased selling pressure. However, by press time, volume increased further as the price rose, suggesting that buying pressure continued to build.

Such buying pressure could reinforce the uptrend and push ALGO to retest or break the immediate resistance level of $0.2186.

However, the Binance Funding Rate for the ALGO/USDT pair had fallen into negative territory after being quite positive for almost a week. This could indicate a bearish outlook for the pair in the derivatives market and could derail the bulls if it slipped deeper into negative territory.

A bearish Bitcoin [BTC] price could complicate the situation for ALGO bulls. Any downtrend in BTC will drag ALGO lower and invalidate the bullish bias described above.