Will Cardano’s development activity help ADA sail through crypto winter

- Cardano ranked number one in terms of development activity.

- However, its dApp activity declined, along with its TVL and revenue.

Santiment, a leading crypto analytics firm, announced on 30 December that Cardano [ADA] outperformed other major cryptocurrencies in terms of development activity.

?? Top 2022 #blockchain protocols by development activity:

1) #Cardano $ADA

2) #Polkadot $DOT

3) #Cosmos $ATOM

4) #Ethereum $ETH

5) #InternetComputer $ICP

6) #Elrond $EGLD

7) #Flow $FLOW

8) #Optimism $OP

9) #Aptos $APT

10) #Polygon $MATICRead our take: https://t.co/fYiOz86GWK

— Santiment (@santimentfeed) December 29, 2022

Read Cardano’s [ADA] Price Prediction 2023-24

Domination in development

Cryptocurrencies such as Polkadot [DOT] and ATOM, known for their growing ecosystem and development activity could not compete with Cardano this time. It simply meant that the developers on the Cardano team made more significant contributions to the network’s GitHub.

Upgrades such as the Vasil Hardfork and developments made on the daedalus wallet could be one reason behind the increase in development activity metric.

Well, despite the growing development activity on Cardano’s network, its ecosystem failed to register growth.

Cardano witnesses declining activity

According to data provided by DappRadar, multiple dApps on the Cardano network were unable to invite users to their platforms. Popular dApps such as Miniswap and SundaeSwap observed a decline of 10.03% and 16.42% respectively, in terms of unique active wallets.

In fact, Miniswap’s volume and the number of transactions also fell. Over the last month, the volume for Miniswap decreased by 27.06% and the number of transactions fell by 12.32%.

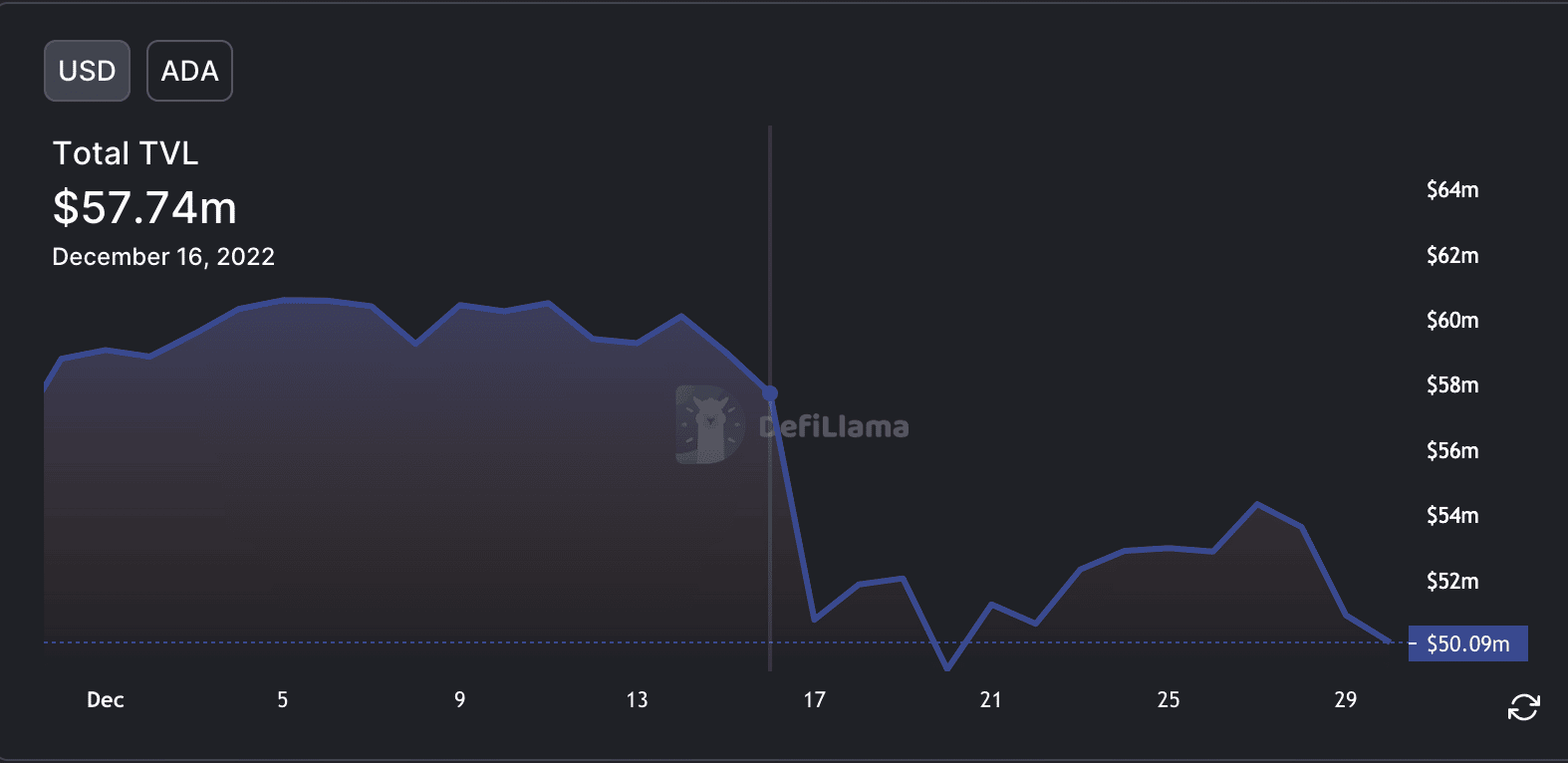

The decline in dApp activity impacted Cardano’s TVL. Based on data gathered by DefiLlama, Cardano’s TVL declined significantly. In the last few months, the overall TVL generated by Cardano fell from $58 million to $50 million.

This ended up affecting the fees generated by Cardano, which fell by 24.4% over the last week. According to Token Terminal, the overall fees collected by Cardano amounted to $189,300.

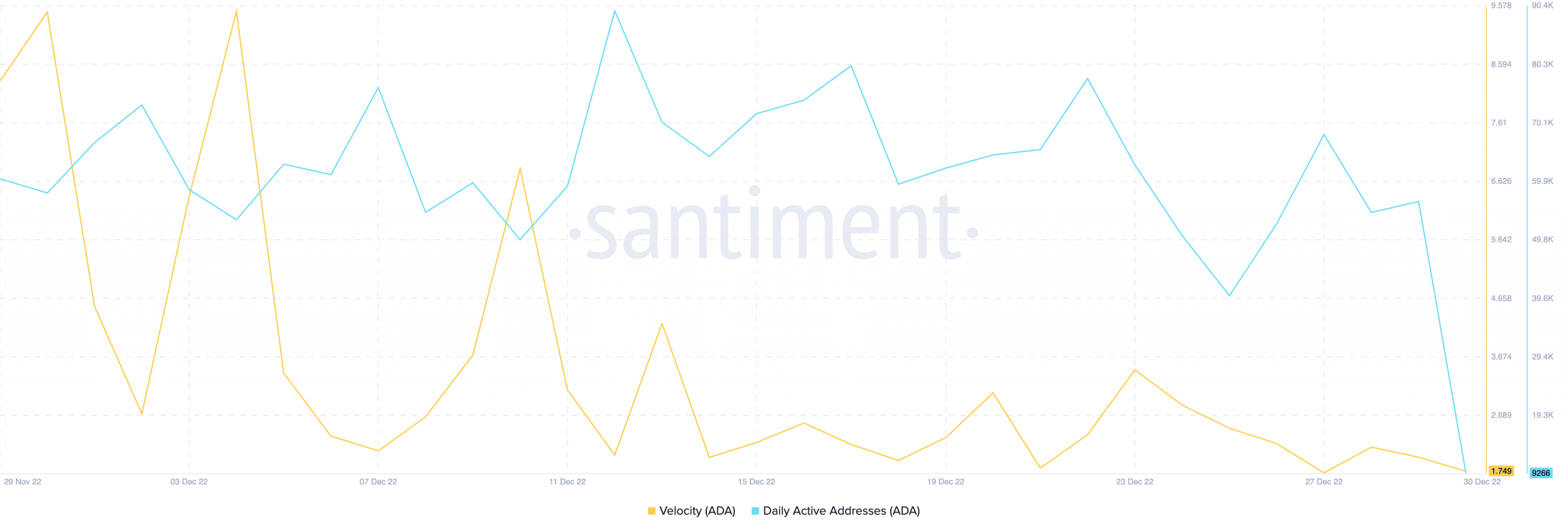

These developments impacted Cardano’s token, ADA, negatively. Based on data gathered by Santiment, the number of daily active addresses on the network had declined.

It decreased from 60,000 to 17,000 over the course of the last month. Even Cardano’s velocity declined during the same period. Thus, suggesting that the frequency with which ADA was being traded had declined.

It is yet to be determined whether Cardano’s increased development activities will help it confront the challenges ahead. However, at the time of writing, ADA was trading at $0.240, and its price fell by 1.45% in the last 24 hours.