Solana: Is this the only reason behind SOL’s bull rally? Unravelling…

- Solana ranked second on the list of blockchains in terms of NFT sales.

- Market indicators revealed the reasons behind SOL’s price surge.

Solana [SOL] outperformed every other blockchain except for Ethereum [ETH] in the NFT ecosystem. As per a 19 January tweet from Solana Daily, SOL ranked second on the list of the top 10 blockchains in terms of NFT sales volume in the last 30 days. ImmutableX, Cardano [ADA], and Polygon [MATIC] completed the top 5.

Top 10 Blockchains by NFT Sales Volume Last 30D

? $ETH @ethereum

? $SOL @solana

? $IMX @Immutable $ADA @Cardano$MATIC @polygon$FLOW @flow_blockchain$BNB @binance@PaniniAmerica$XTZ @tezos$RON @Ronin_Network@cryptoslamio #Solana $SOL pic.twitter.com/YlIW8JcEA1— Solana Daily (@solana_daily) January 18, 2023

How much are 1,10,100 SOLs worth today?

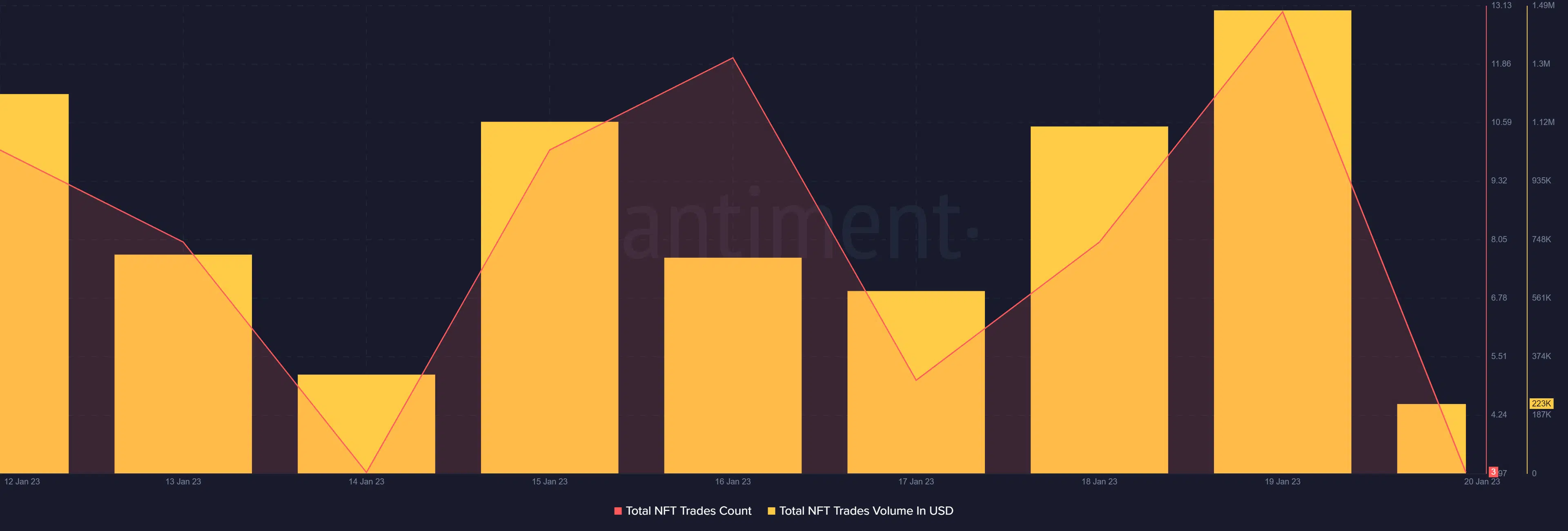

Over the last month, DeGod remained the most popular collection by volume, followed by y00t and Monkey Kingdom. Santiment’s chart revealed that, during the last week, Solana’s total NFT trade count and trade volume in USD also registered upticks, further proving the popularity of Solana’s NFT ecosystem.

Interestingly, a recent report also pointed out that Solana was the fastest growing developer ecosystem, surpassing 2,000 total developers in 2022.

The investors are happy too!

While the NFT space grew, Solana also made the investors happy by registering promising growth during the last few weeks. CoinMarketCap’s data revealed that SOL’s price increased by 26% last week, which was higher than all the other cryptos with a larger market capitalization. At press time, SOL was trading at $21.17 with a market cap of over $7.8 billion.

A look at Solana’s daily chart shed some light on what went in SOL’s favor. The Exponential Moving Average (EMA) Ribbon displayed a bullish crossover as the 20-day EMA flipped the 55-day EMA. The Relative Strength Index (RSI) and Money Flow Index (MFI) increased over the last few weeks, which might have helped Solana push its price upwards.

Is your portfolio green? Check the Solana Profit Calculator

Not everything was perfect

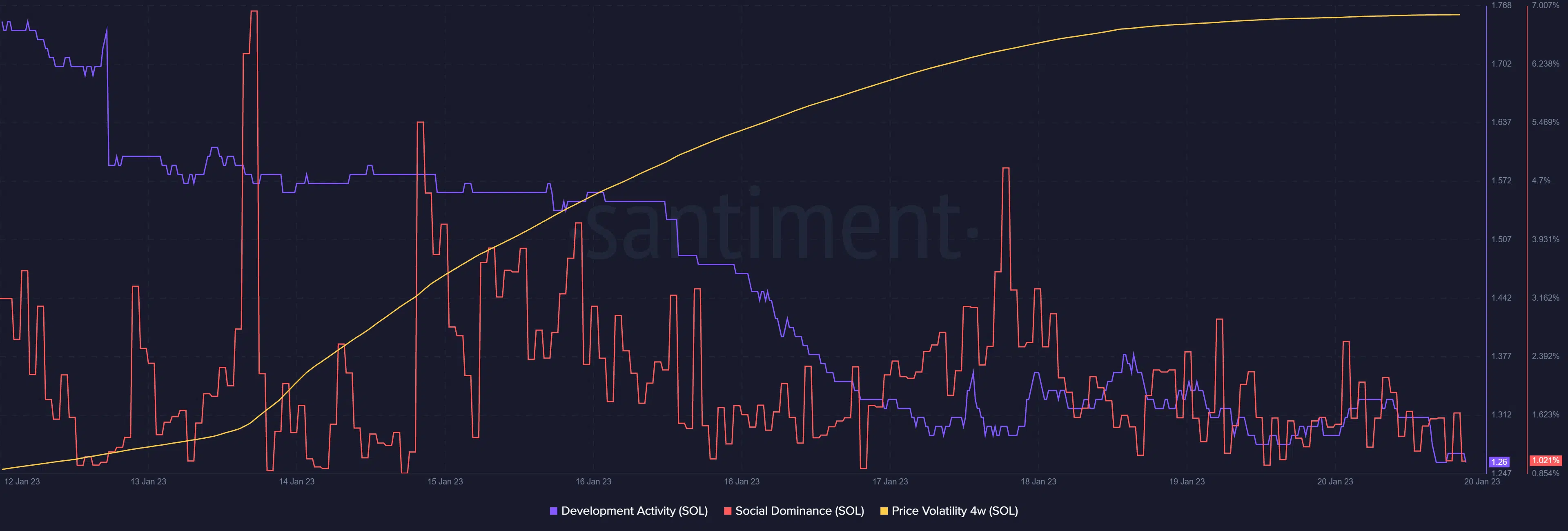

Solana’s on-chain metrics, however, told a different story, as most of them remained negative during the last week. For instance, SOL’s development activity decreased sharply, reflecting fewer efforts by the developers to improve the network.

Moreover, SOL’s social dominance registered a decline, which indicated less popularity of the token in the community. However, SOL’s four-week price volatility increased drastically, as the token’s value skyrocketed.