AAVE to reclaim ATH amid DeFi renaissance, says crypto VC

- AAVE broke above a 2-year price range and could eye $200.

- AAVE has outperformed its lending sector rivals and top DeFi blue chip tokens.

Aave [AAVE] has been an outlier on the price charts, defying overall market headwinds that derailed most assets at the start of H2 2024. It slightly outperformed even Bitcoin [BTC] on a year-to-date (YTD) basis.

BTC was up 42%, while AAVE YTD returns stood at 46% at press time.

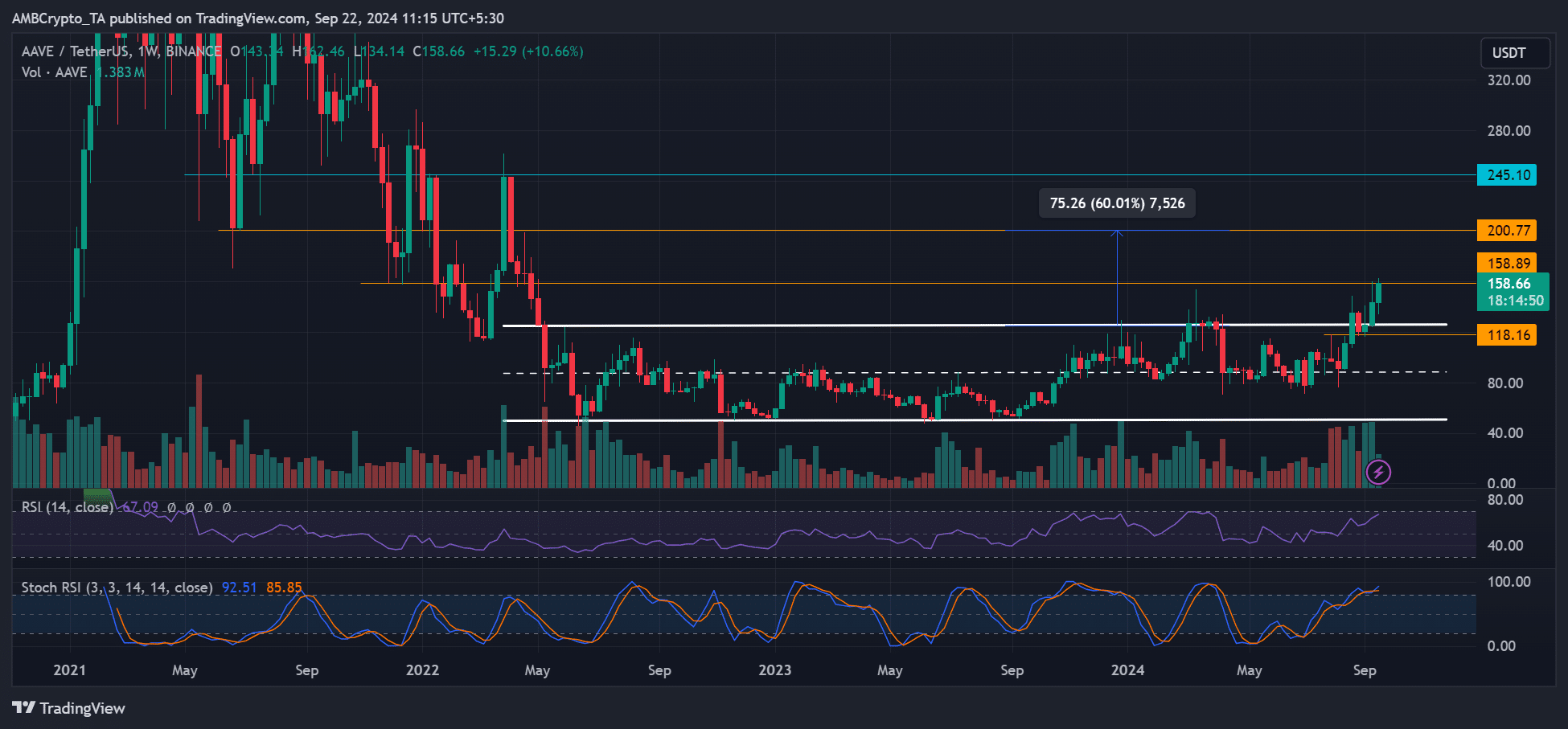

Arthur Cheong, founder of crypto VC DeFiance Capital, projected the DeFi token would reclaim its ATH (all-time high) after fronting a range breakout.

“$AAVE is trading at the highest level since May 2022 and seems to be breaking out from a 2 year consolidation pattern. Expect ATH reclaim to further solidify DeFi Renaissance.”

AAVE is bullish on the outlook

For context, AAVE debuted in 2020 and hit an ATH of $668 at the peak of last cycle’s bull run in 2021. The recent break-out from the 2-year-long price range could set the altcoin to $200 in the medium term.

At the time of writing, the alt was valued at $158, suggesting that a potential 26% gain was likely if AAVE recovery was extended to $200.

Despite the overbought conditions flashed by technical chart indicators, the DeFi renaissance mentioned by Cheong is picking pace.

A recent Bernstein report highlighted a resurgence of the DeFi space and declining US bank rates as a positive catalyst for DeFi yield demand.

The report singled out AAVE’s strong growth potential and solid fundamentals, indicating that it is primed to benefit from the likely demand.

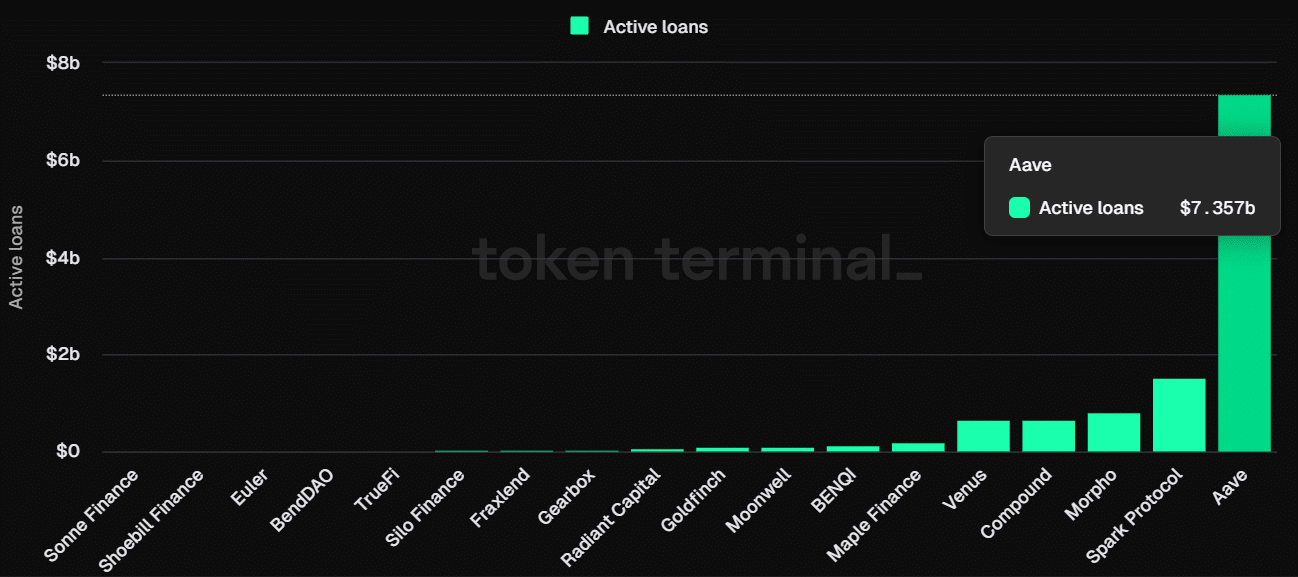

Among its peers in the lending sector, AAVE had the most active loans, at $7.35 billion, followed by Maker’s [MKR] Spark Protocol.

This was nearly 2X the borrowed amount of around $3.4 billion in early 2024. This underscored the protocol’s growth, but the remarkable performance was also evident on price charts.

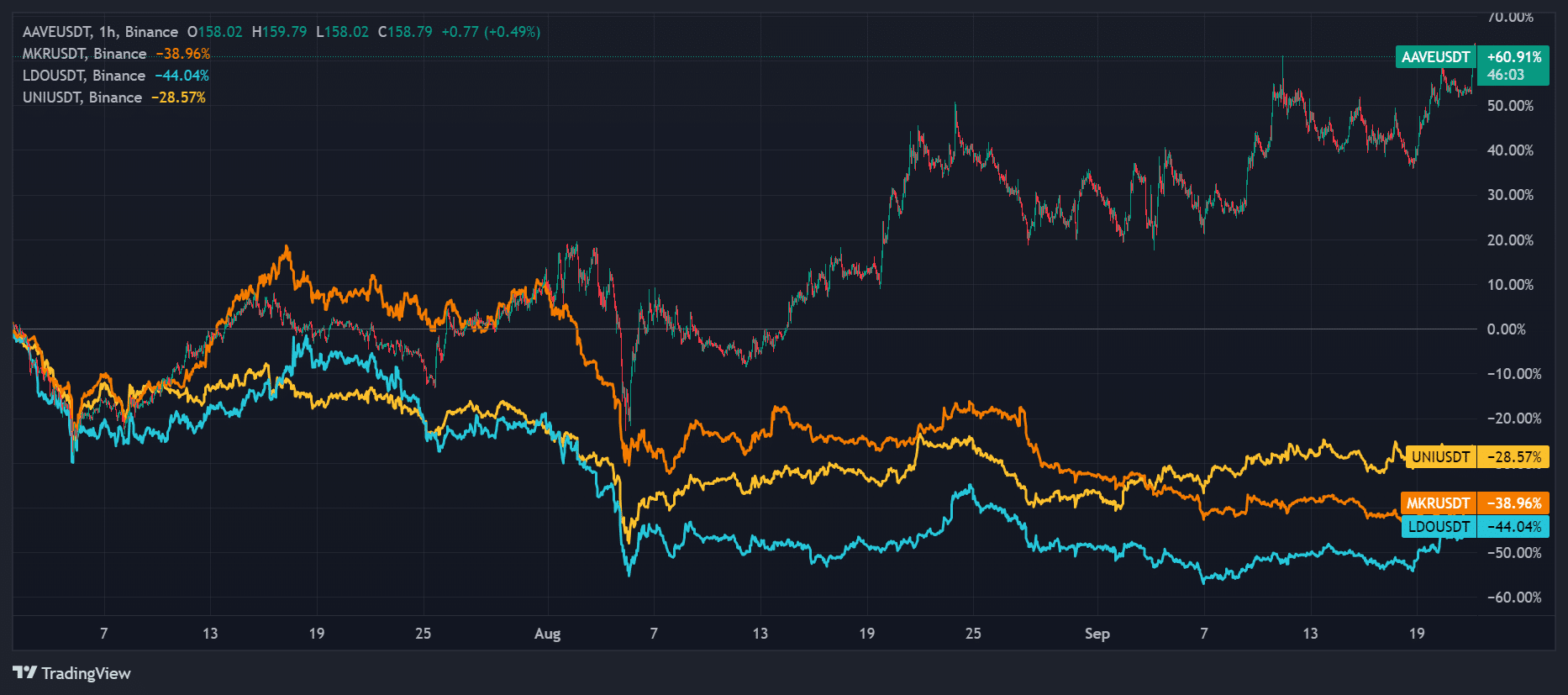

So far in Q3, AAVE has been up by 60%, while the rest of the lending sector and overall DeFi blue chip tokens have been in the red.

MKR and Uniswap [UNI] were down by 38% and 28%, respectively. Lido [LDO] slumped the hardest, with a 44% decline over the same period.

Interestingly, AAVE decoupled from the rest after the early August sell-off. Messari research analyst Kinji Steimetz linked AAVE’s outperformance to a recent protocol fee switch proposal and reduced supply overhang.