Aave: Why traders must overlook AAVE’s address activity this trading season

Data from on-chain analytics platform Santiment revealed that October was marked by a rally in AAVE’s network activity. This rally culminated in the altcoin registering a daily high of 495 new addresses on 30 October. This was the highest daily count of new addresses since 17 July.

In addition, the count of unique addresses that traded AAVE daily rose consistently over the course of October to record a daily high of 951 new addresses on 31 October. According to Santiment, the above-mentioned number represented the highest daily count of unique addresses that traded AAVE in the past three months.

? Address activity and & address creation rises are generally key components for an asset's price rise. #Aave has been seeing sharp spikes in both, hitting milestones not seen since mid-July. Check out our short take on $AAVE's key #onchain metrics! ? https://t.co/L6zP7cjZqI pic.twitter.com/0XCabzexDz

— Santiment (@santimentfeed) November 1, 2022

Before you make your next trade

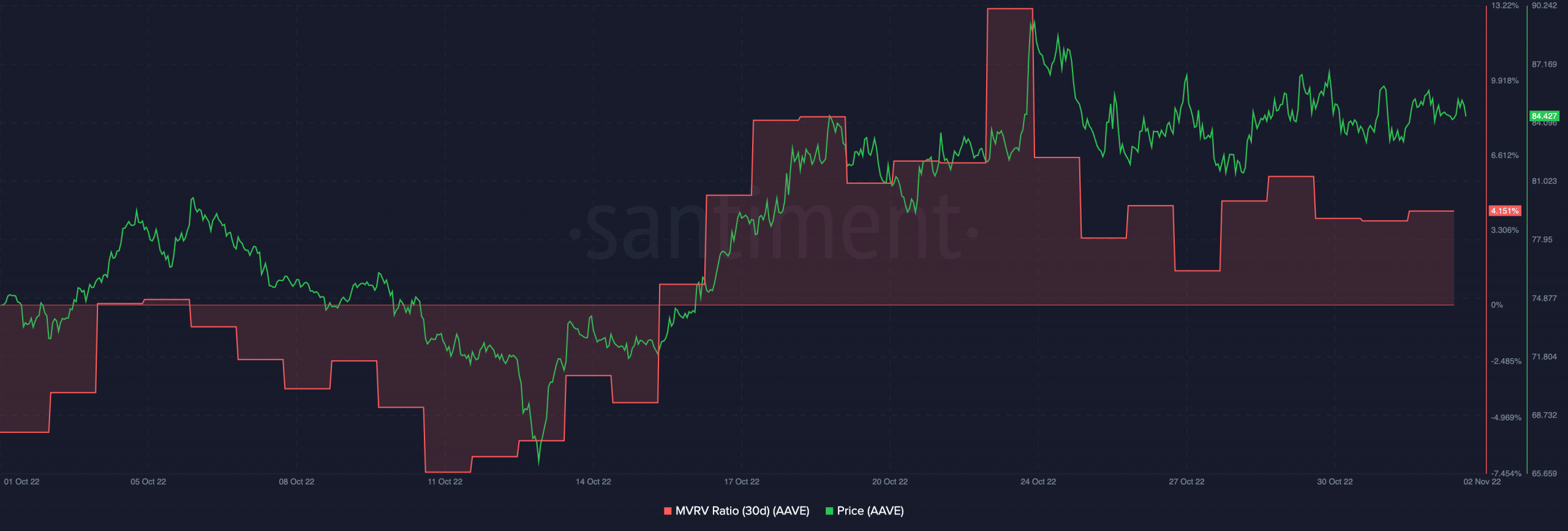

The last few weeks were marked by a bullish market correction, and AAVE was not left out. After trading at a low of $66 on 13 October, AAVE’s price embarked on an uptrend. This led AAVE to exchange hands at $84.41 at the time of writing. Furthermore, it represented a 27% growth in the price of the ghost token since 13 October, data from CoinMarketCap revealed.

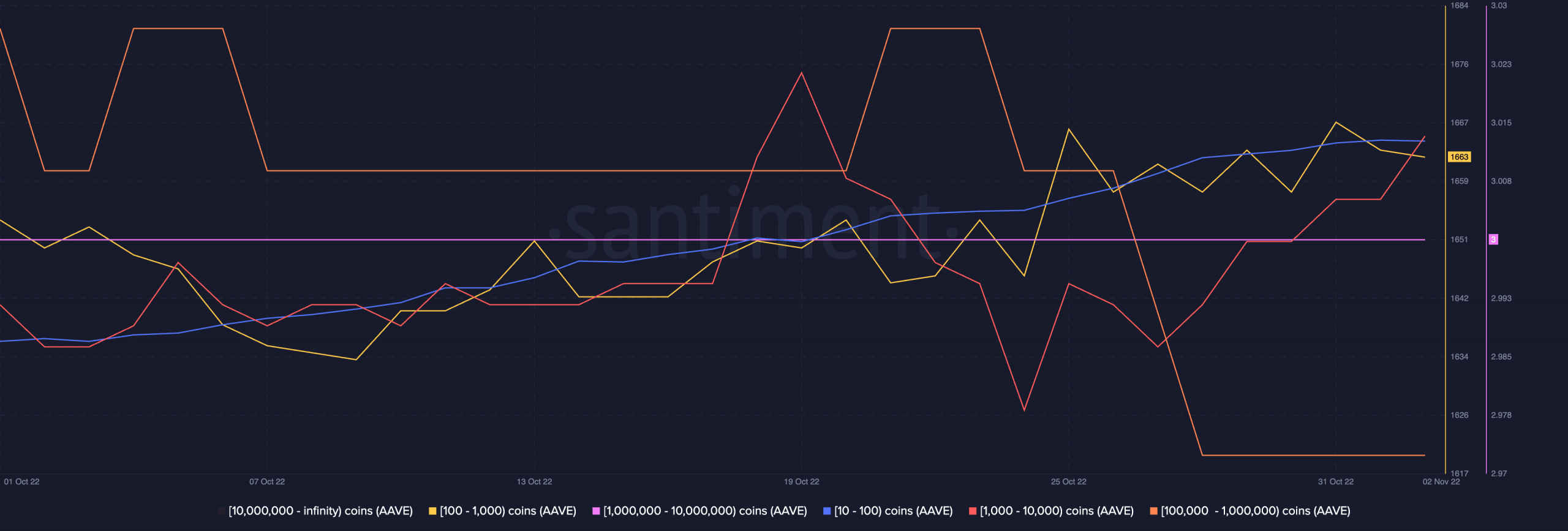

While the price of the token rallied last month, the count of whales that held between 10 to 10,000 AAVE tokens also grew as per data from Santiment. However, bigger whales were not impressed by the price rally as 100,000 to 1,000,000 AAVE token holders gradually let go of some of their holdings. Furthermore, the count of whales that held 1,000,000 to 10,000,000 AAVE tokens remained flat during the 30-day period.

Further, the positive correction in AAVE’s price on 13 October changed the course of the asset’s market-value-to-realized-value ratio (MVRV). Observed on a 30-day moving average, AAVE’s MVRV flipped into a positive value on 16 October. At press time, this figure was spotted at 4.151%.

This meant that if all AAVE holders sold their tokens at the current price, they would generate double the profit on their initial investments.

Heed the warning

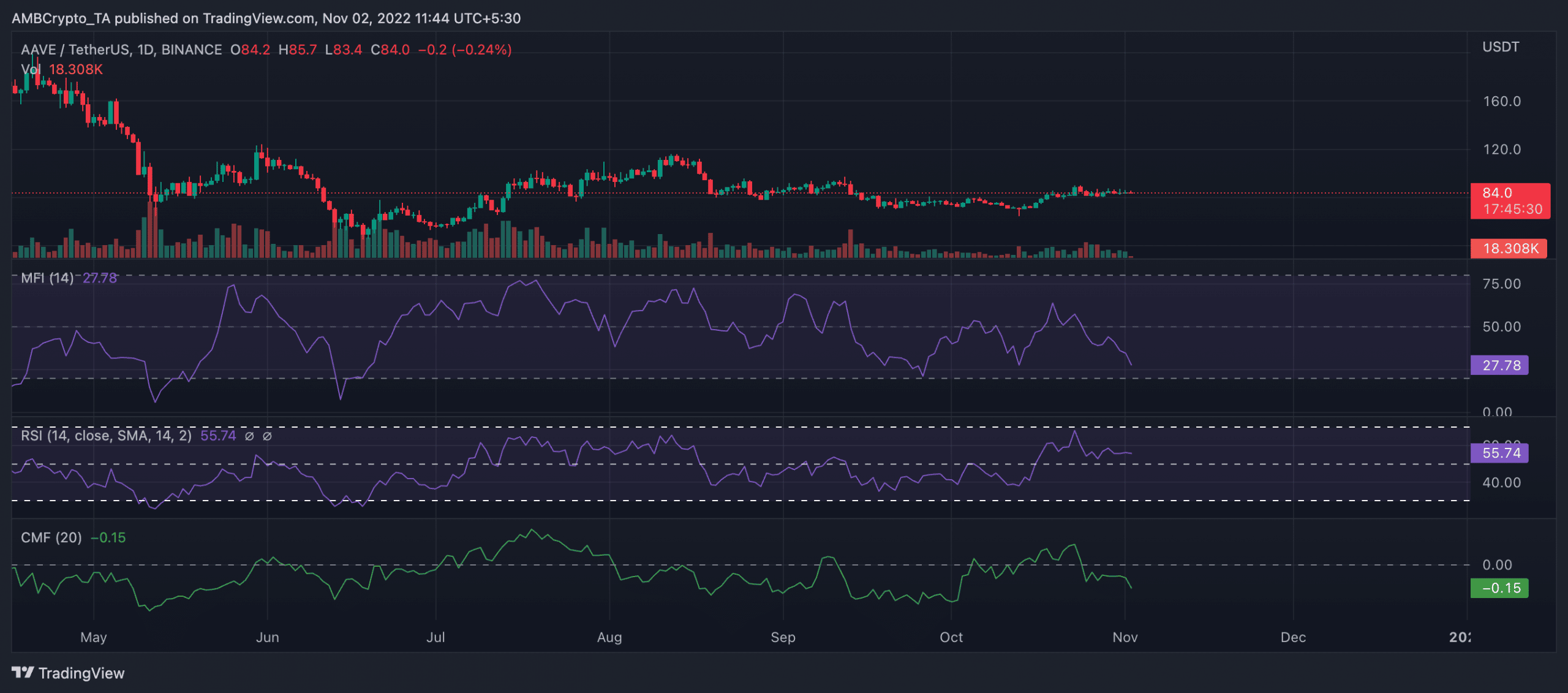

As of this writing, AAVE exchanged hands at $84.41. Per data from CoinMarketCap, the asset’s price dropped by 1% in the last 24 hours, and its trading volume was down by 8%.

Observed on a daily chart, buying pressure appeared to have dropped significantly. As of this writing, indicating that AAVE would soon be oversold, its Money Flow Index (MFI) stood at 27. Also approaching the 50-neutral zone, the Relative Strength Index (RSI) was spotted at 55.

The dynamic line (green) of the asset’s Chaikin Money Flow (CMF) rested below the center line at -0.15. This showed increased AAVE distribution in the last few days as the sellers took over the market.