ADA struggles to hold its place on the charts despite Cardano’s dominance over…

- Cardano outperformed its rival networks in terms of development activity.

- ADA could make a strong comeback, based on its metrics.

Cardano [ADA] might just secure the blockchain spotlight after the latest GitHub weekly development activity report. According to the report, Cardano had the highest development activity score from 10 – 17 December.

Read Cardano’s [ADA] Price Prediction for 2023-24

Cardano has had little going for it in the last few weeks, especially as far as development was concerned. However, that may change, now that it was the leading blockchain network at press time.

The GitHub weekly development activity report revealed that Cardano outperformed most of the top crypto networks in terms of development activity.

GitHub Weekly Development Activity:

#1: 542 Cardano

#2: 447 Polkadot / Kusama

#3: 344 Cosmos

#4: 334 Ethereum

#5: 315 Status

#6: 311 Decentraland

#7: 310 Filecoin

#8: 283 Internet Computer

#9: 277 Elrond

#10: 222 Optimism pic.twitter.com/5sG3y5klPa— ProofofGitHub (@ProofofGitHub) December 18, 2022

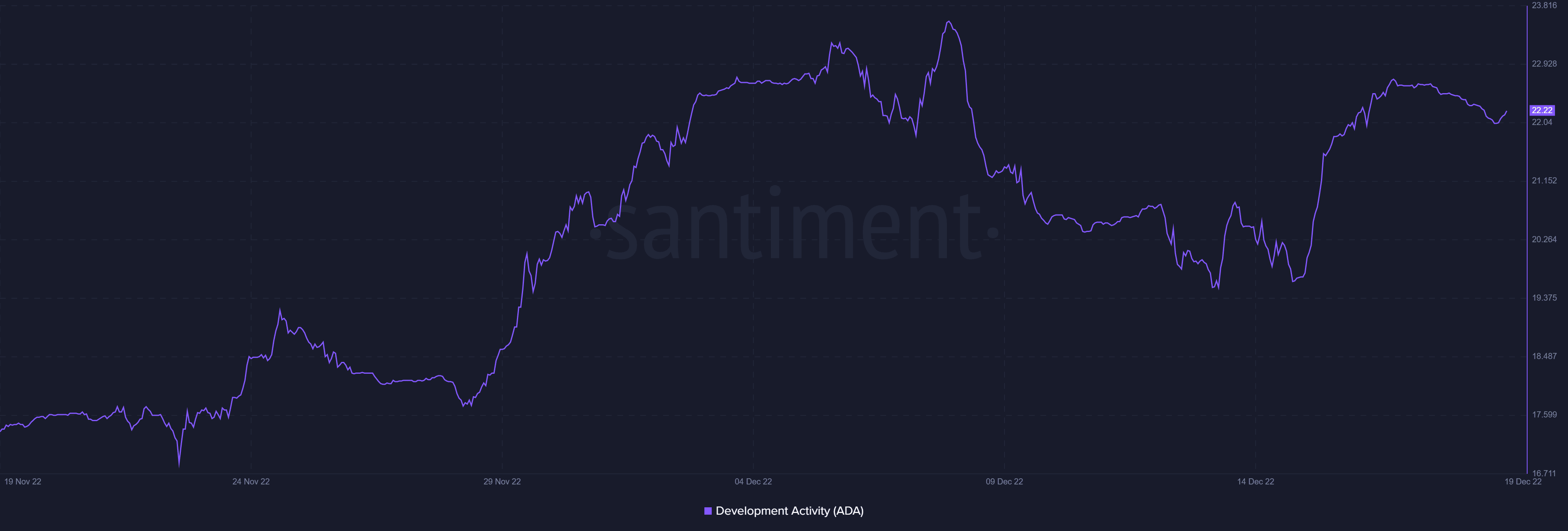

Cardano’s development activity metric registered a noteworthy upside in the last four weeks. This was consistent with the GitHub report. The network’s development activity registered a sharp uptick in the last five days.

What does the report mean for the Cardano network?

Strong development is often a sign that the network’s developers are still building. This promotes more confidence in the project’s future, and in most cases, sparks additional investor confidence in the native cryptocurrency. This is important, especially considering ADA’s current position.

ADA has been on a downward trajectory in the last seven days and was in oversold territory at press time. It traded at $0.26 at the time of writing, which was within its 12-month low.

ADA’s price action reflected strong outflows registered by the Money Flow Index (MFI). The same indicator looked to be pivoting, indicating that the sell pressure was declining. Can news of the strong development activity shift the market sentiment in favor of a bullish bounce?

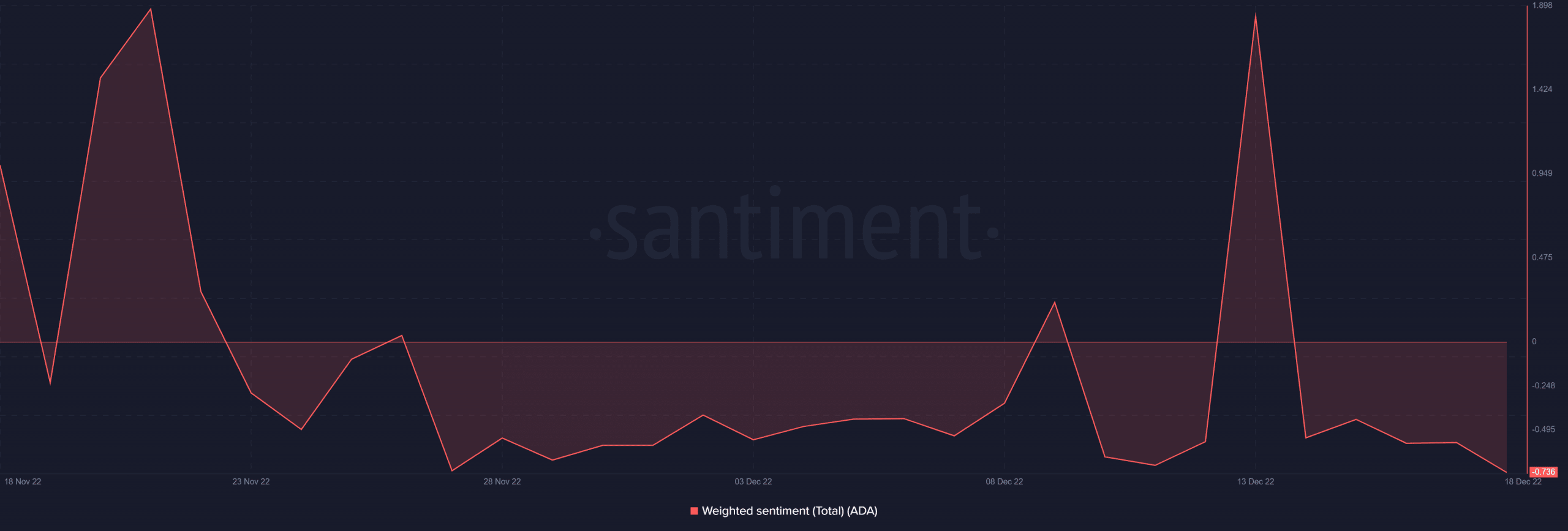

ADA’s weighted sentiment metric was still hovering within its lower monthly range. This meant that investors were yet to change their minds about ADA’s prospects. In other words, a sharp recovery might not be in the works.

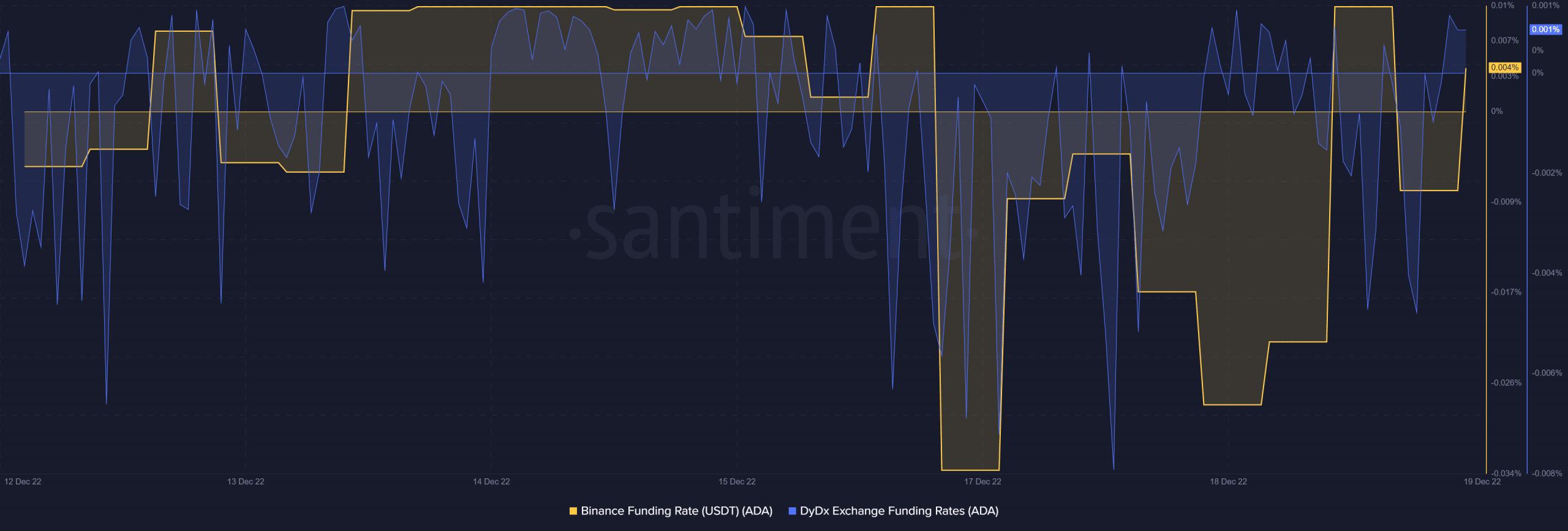

On the other hand, the demand for ADA in the derivatives market was recovering. Perhaps this was an indication that demand was recovering, in which case the cryptocurrency might deliver some upside in the coming days.

ADA’s supply distribution further indicated that ADA’s top addresses were accumulating. Addresses holding between 100 – one million ADA increased their balances in the last few days. Meanwhile, addresses holding over one million coins were contributing to sell pressure in the last three days.

The supply distribution observation explained why ADA bears were dominating the market at press time, even though there was ongoing accumulation. However, positive development, a discounted price, and oversold conditions may soon yield in favor of the bulls.