Ethereum bulls awaken from years of slumber; can ETH avoid a bearish pivot

- Ethereum addresses lying dormant for years recently got active.

- The total number of ETH moved was over 22,000, which sparked a lot of speculation.

While Ethereum [ETH] investors have been watching the token’s sluggish growth, some bulls have started to stir, sparking rumors about what will happen next. The rally came at a time when the broader market and the price of ETH have both been quite underwhelming. What can investors anticipate?

Read Ethereum’s [ETH] price prediction 2023-2024

Ethereum bulls awaken

On 19 December, PeckShieldAlert published an intriguing post on its page describing how two addresses that were inactive since October 2018 suddenly came to life. The addresses sent 22,982 ETH in total, which at press time, was worth over $27 million, to new addresses.

Given how long these addresses had been inactive, there were questions about what these transfers might indicate.

#PeckShieldAlert 2 Dormant addresses transferred 22,982 $ETH (~27.2M) to 2 fresh addresses, their last movement was October 2018 (1,535 days ago).

These $ETH originated from Genesis and Poloniex pic.twitter.com/MXKpLnypif— PeckShieldAlert (@PeckShieldAlert) December 19, 2022

Transfers of 13,103.99 ETH and 9,878 ETH allegedly originated from the Genesis and Poloniex exchanges, respectively. The PeckShield flowchart made it possible to track ETH’s history in real-time.

ETH’s price fluctuated between roughly $190 and $230 when the wallets were last active.

The current state of ETH

The support range seen on the ETH daily timeframe chart between 1 December and 13 December was roughly $1,200. A lower support had developed following the almost 7% decline seen on 16 December, and the asset was trading at $1,180 at press time.

Since September, ETH was yet to maintain a break above the short Moving Average (yellow line). This meant that the yellow line had actually acted as a resistance at certain points during its movement.

No sell-off in the short-term, but possible in the long-term

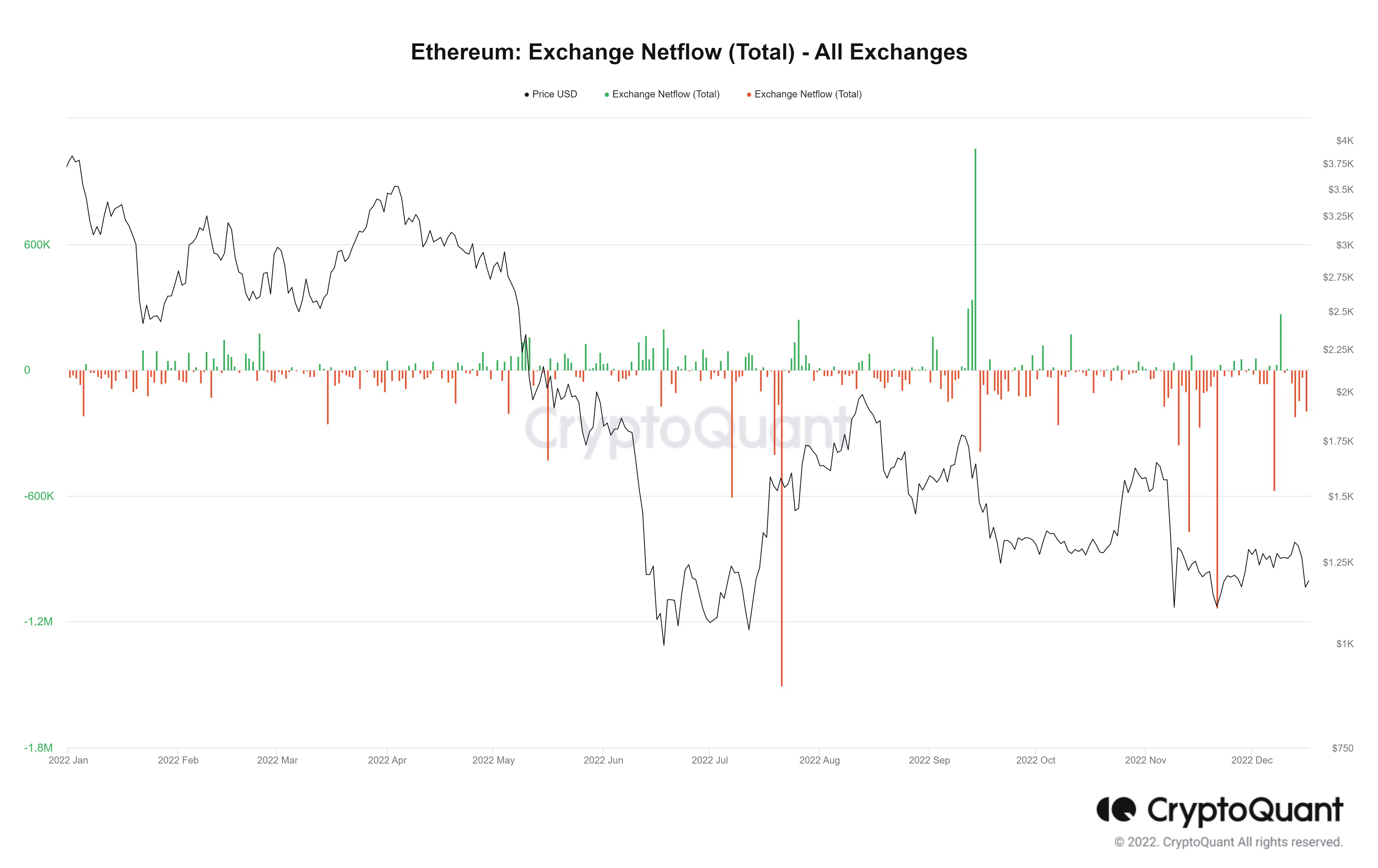

According to CryptoQuant’s Exchange Netflow statistic, there were more ETH transactions leaving exchanges than entering them. This could indicate that holders were hesitant to sell at the price, meaning that a potential sell-off in the near term is not happening. CryptoQuant, however, forecasted a potential sell-off in 2023.

? $ETH Mass-Selling Event Is Coming?

1/ The #ETH2 Deposit has amassed, holding 12% of the total supply.

As the $ETH exchange reserve drops down to 15% of the total supply and continues to decrease,

What will happen on $ETH after the Shanghai Hard Fork??https://t.co/RrFQrLPeda pic.twitter.com/CrWhqSbxPn— CryptoQuant.com (@cryptoquant_com) December 16, 2022

Due to the impending Shanghai upgrade, there may be a sell-off since investors will be allowed to remove their stakes once it is finished, which might impact ETH’s price.

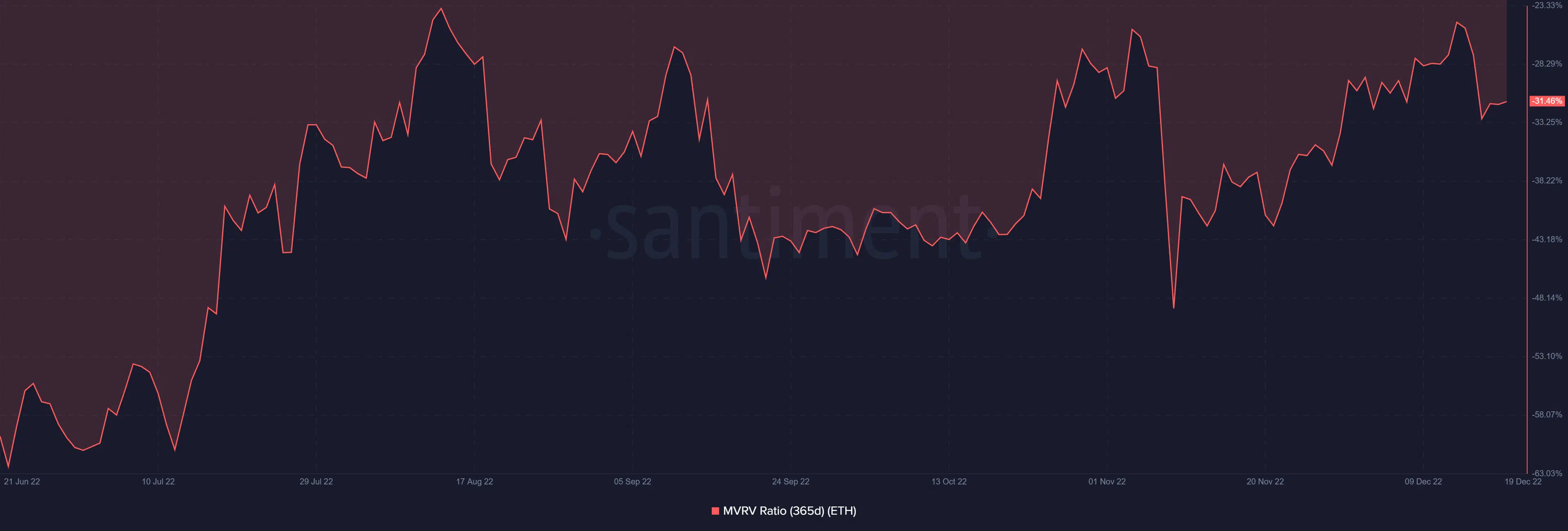

Investors at an improved loss

In recent months, the price of ETH fell short of the spectacular run it experienced in 2021. The Market Value to Realized Value (MVRV) Ratio revealed that investors were holding at a loss over the previous 365 days. Owners of ETH suffered a loss of more than 31% at the current price.

Even though it was holding at a loss, the present percentage was better than it had been around November.