After witnessing a 390% rally, OMG needs this to keep up its performance

Right from Arbitrum to Optimism, a host of scaling solutions have been launched over the past few months and, yet, there’s no full stop. Individual networks have been able to reap benefits from the launches, OMG being the latest one to do so.

OMG is a non-custodial L2-scaling platform that makes use of optimistic rollups to improve the scalability of Ethereum. It recently partnered with Enya, the creator of the Boba network. Being an L2 solution itself, Boba intends to reduce the gas fee, improve the transaction throughput and extend smart contract capabilities.

In fact, the amount locked on this network has witnessed a 209.78% rise over the past 7-days, the highest amongst all prominent L2 solutions. Enya, notably, built the Boba Network as a core contributor to the OMG Foundation and that’s the main reason why the native OMG token has been able to benefit from Boba’s lively performance of late.

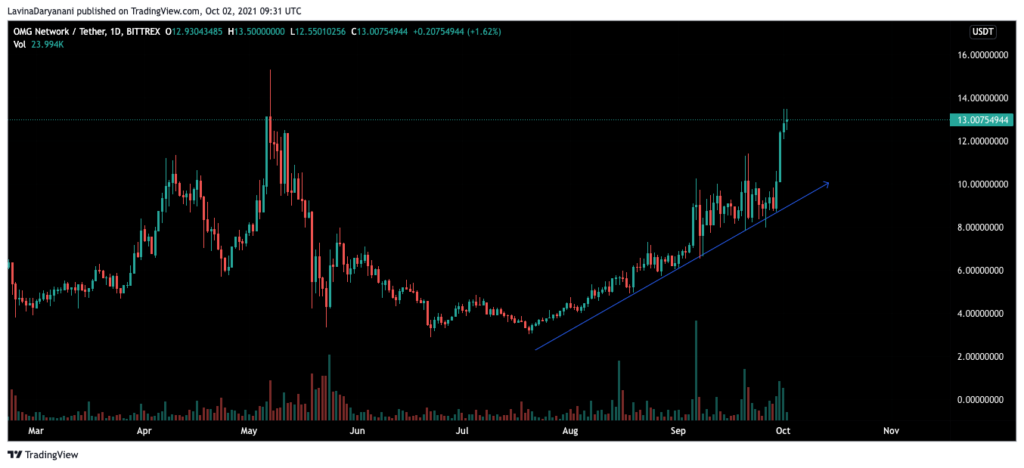

Just like all other coins, even OMG successfully pulled-off a rally in the April-May period, but fell victim to mid-May’s crash. After a brief halt during June-July, the alt re-commenced its broader uptrend and has rallied by over 390% since then. The northbound strides, however, became even more prominent only this week. In fact, the alt was trading quite close to its $15.3 ATH at press time.

No looking back?

The consistency maintained on the price chart does make this alt quite a compelling pick, right? Well, there’s unfortunately a flip-side that market participants need to be aware of. The state of the metrics have changed course of late, and the collective trend isn’t bullish.

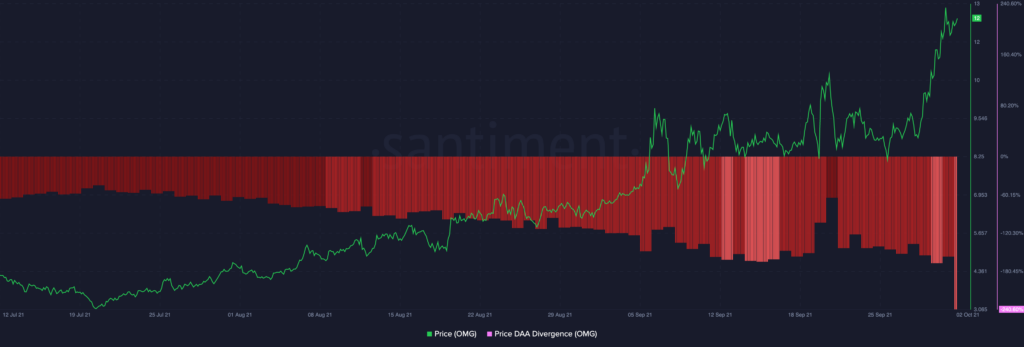

Consider the Price DAA Divergence, for instance. This model tracks the relationship between the coin’s price and the amount of daily addresses interacting with the coin. A buy signal is indicated when the DAA increases alongside the price. Conversely, when the active addresses decline during a price hike phase, selling pressure is induced.

Over the past few weeks, however, a bearish projection has been noted on the charts, indicating the not-so-healthy state of the active addresses.

Price DAA Divergence || Source: Santiment

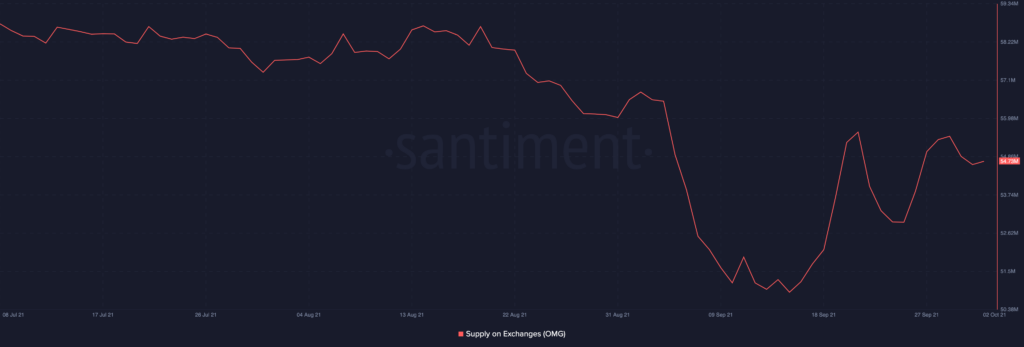

The supply on exchanges additionally saw an uptick lately indicating the lack of buying-momentum. Only when this metric drops, it means that coins are moving to private wallets from the exchanges. Thus, if the buyers continue exhibiting lack of interest, the alt’s rally would not be able to go on for long.

Supply on Exchanges || Source: Santiment

The dormant circulation has further been on the drop. Over the past 3-weeks, for instance, this metric dropped from its 5.21 million peak to 109k, indicating the movement of old tokens. Whenever coins are dormant, it essentially means the accumulation trend is going on. However, the current trend indicates that strong hands are selling at strength.

Thus, keeping the state of the aforementioned metrics in mind, it can be claimed that OMG might witness a pullback in the coming days. However, if just the buying pressure box is alone ticked, a ripple would end up improving the state of most of the metrics. In effect, the broader environment would then be able to foster the alt’s long-term rally.