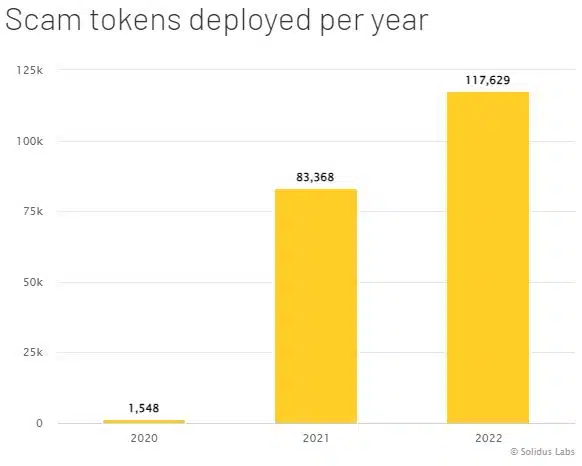

All there is to know about the 41% rise in crypto ‘scam tokens’ in 2022

- The year 2022 saw the formation of more than 350 crypto scam tokens created per day

- BNB Chain witnessed the largest number of scam tokens

According to a 2022 Rug Pull report published by Solidus Labs, a blockchain risk monitoring firm, 2022 saw an average of 350 crypto scam tokens created per day, defrauding millions of investors.

From the beginning of the year until 1 December, 2022, 117,629 scam tokens were deployed. On the other hand, barely 83,400 scam tokens were deployed in 2021. Thus, there was a 41% rise in such tokens this year.

The BNB Chain had the greatest number of scam tokens, with 12% of its native BEP-20 tokens being fraudulent. The Ethereum network was next on the list, with 8% of its native ERC-20 tokens being fraudulent.

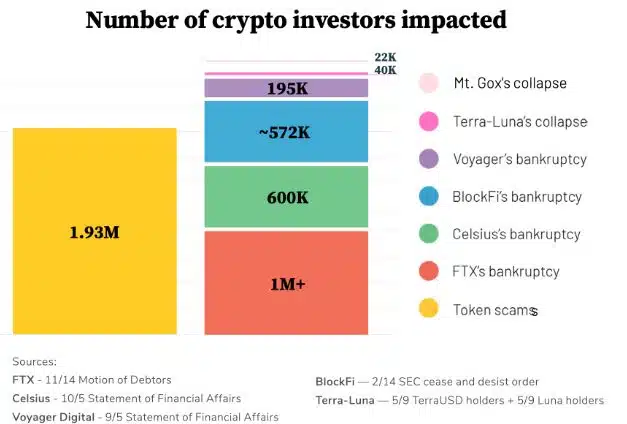

Over two million investors fell victim to one crypto scam or another

Since September 2020, these scams defrauded approximately two million investors. This was way more than the 1.8 million users affected by bankrupt crypto exchanges and lending platforms, like FTX, Celsius, or Voyager.

A honeypot is the most common type of scam token. It involves a token smart contract that does not allow buyers to resell. According to the report, the most common honeypot in 2022 was the $3.3 million Squid Game [SQUID] token scam.

In the SQUID scam, investors bought tokens due to the rising hype but were unable to sell. Thus, resulting in the anonymous founders apparently fleeing with investor funds. This type of scam is also known as a rug pull.

Rug pulls affect centralized exchanges as well, as many developers behind these malicious tokens use the latter to fund their fraudulent projects and cash out the ill-gotten gains.

According to the report, approximately $11 billion worth of Ether [ETH] stolen from scam tokens flowed through 153 CEXes since September 2020. Furthermore, most exchanges were supervised by the US regulators.

In the analyzed time frame, nearly $4 billion dollars flowed to US CEXes, which was nearly double that of the second-most exposed CEX jurisdiction, the Bahamas.