Analyst sees ‘signs of maturation,’ resistance at $100,000, for Bitcoin in 2022

Bitcoin and the cryptocurrency market have been volatile from the beginning. But, the last few months have particularly been a wild ride. Compared to other assets, for instance, the traditional equity market, the volatility factor for BTC is pretty aggressive.

The question here is why is it so? Well, simply because it is still at a very nascent stage compared to other forms of investment tools and currency.

The result of this newness is high volatility in the industry. However, despite the fluctuations, crypto enthusiasts remain undeterred from their bullish narrative.

Bloomberg Intelligence chief commodity strategist Mike McGlone opined that BTC will carry its bullish momentum in the next year irrespective of temporary price correction(s). He opined that BTC would “likely face resistance at $100,000 with the $50,000 mark acting as the support.”

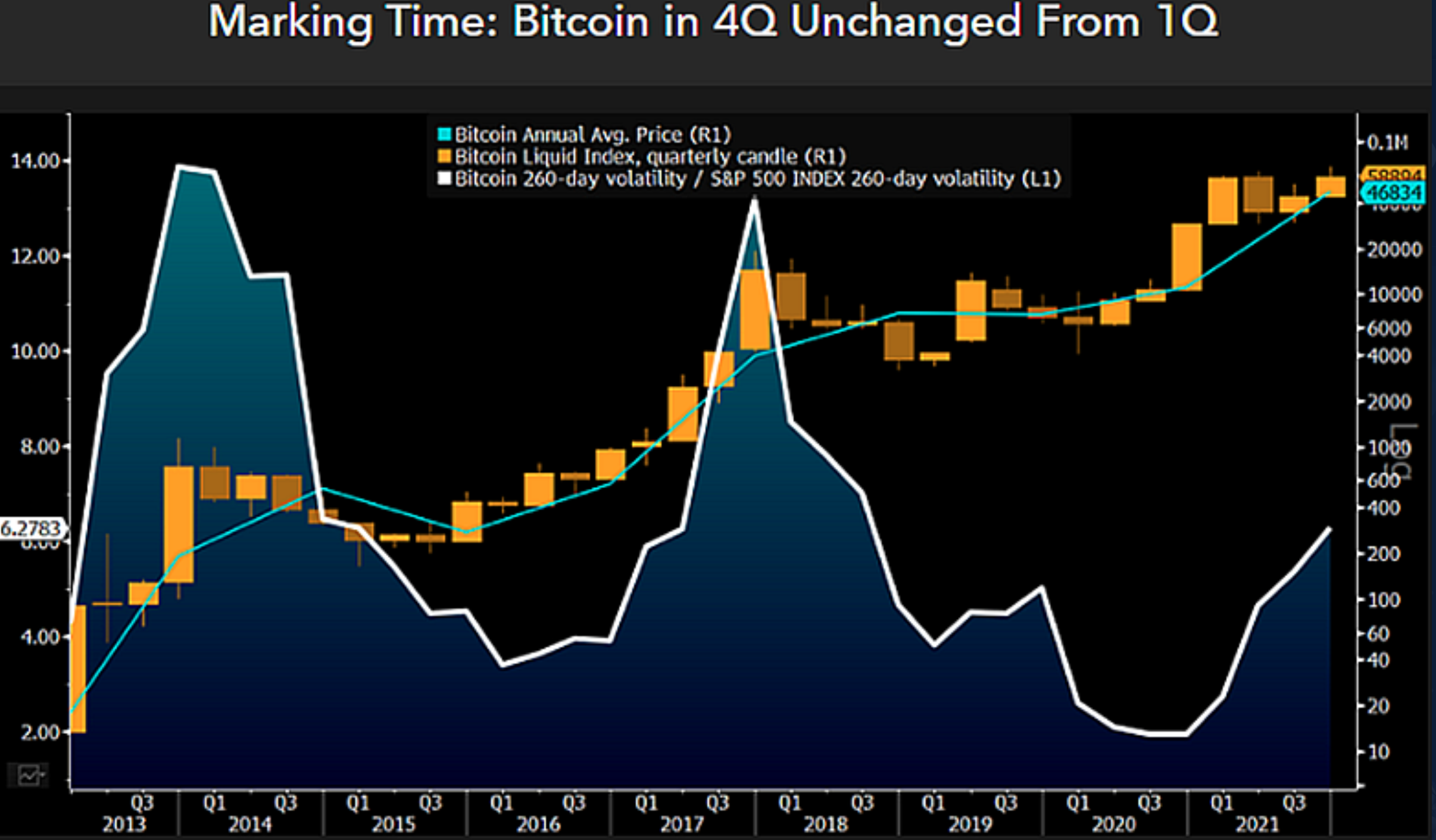

Consider the chart below.

Source: Bloomberg Intelligence

The said exec tweeted,

“Bitcoin Bull and $50,000 Support vs. $100,000 Resistance in 2022 –

Bitcoin is approaching 2022 in what we view as simply a bull market. The nascent technology/asset is experiencing increasing adoption vs. declining supply and showing signs of maturation.”

Ergo, increased adoption and reducing supply will be key factors for BTC’s promising success. The token, at press time, suffered a major fall below the $60k mark. Although, it did show some positive signs, in the past 24 hours (+2.6%). However, despite the setback, the analyst is bullish.

Earlier, McGlone placed Bitcoin’s long-term projection at $100,000 in coming years. He noted that any price correction is short-term which builds the base for a possible Bitcoin surge.

Volatility sustains

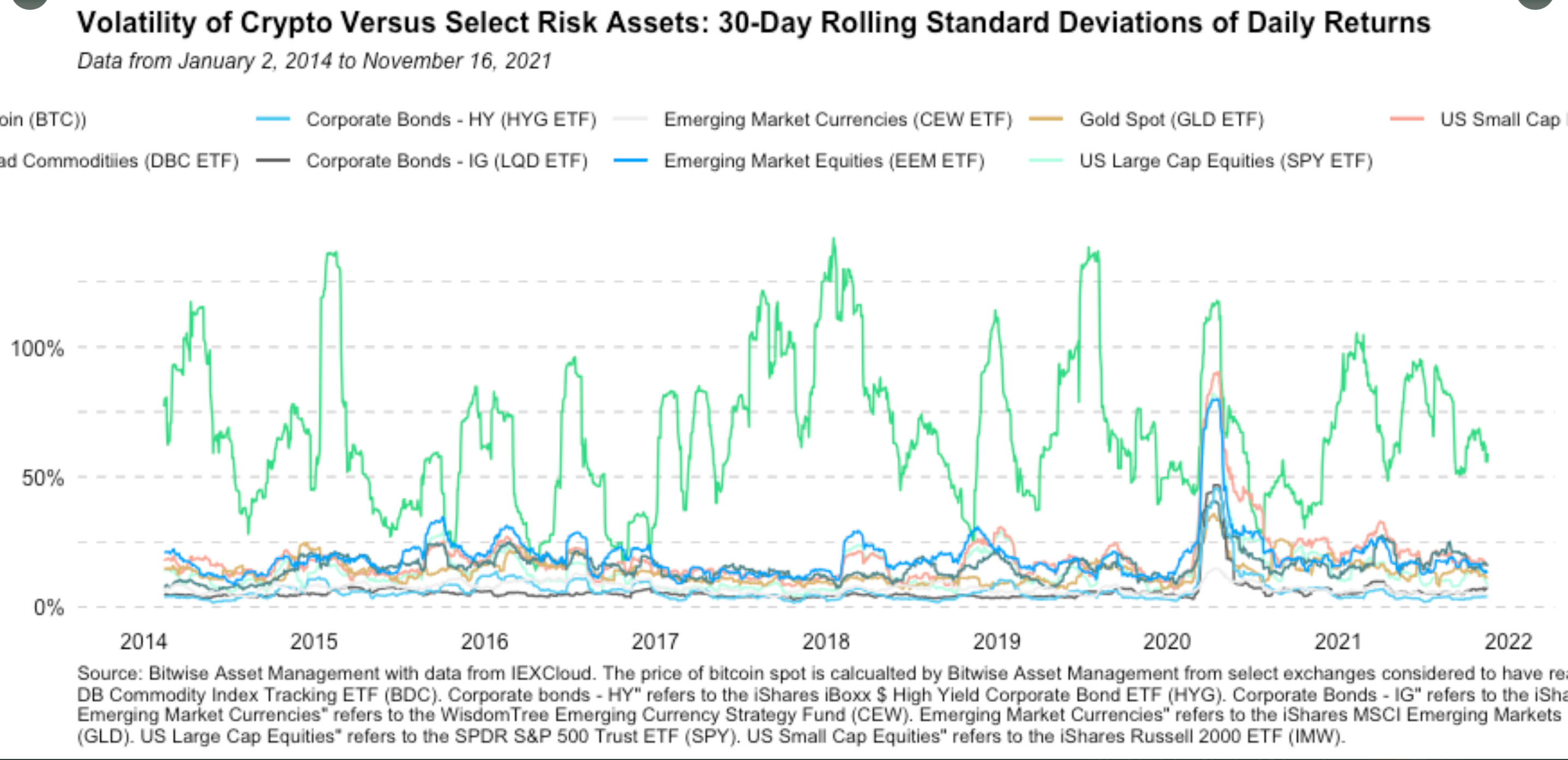

“During times of volatility, this comparison of magnitude is important to understand,” Anthony Pompliano, crypto commentator and analyst, tweeted.

Source: Twitter

Bitcoin’s volatility is about 7x higher than the S&P500’s. A 12% move in BTC would be equivalent to a 1.7% move in the SPY. David Lawant, a research analyst at Bitwise asserted

“These are not uncommon: since 2014, the SPY has moved more than 1.7% or less than -1.7% in 141 out of 1978 sessions (7.1% of total).”

Yet, these digital assets have an upper hand over equities. Lark Davis reiterated a similar optimism in a tweet.

I believe that the #crypto will continue to be very bullish well into 2022, with lots of volatility. After which we see a big bear market, but one that is shallower and much shorter than the 2018 bear.

— Lark Davis (@TheCryptoLark) November 20, 2021

Overall, volatility and crypto go hand-in-hand. Despite that, the crypto ecosystem has continued its growth.