ApeCoin [APE] to swing high or stumble even lower? Metrics have the answer

The market’s latest stumble left Bitcoin trading at $31,456.23 while Ether was changing hands at $2,367.80. Naturally, altcoins are having a difficult time at the moment, but some tokens that usually suffer along with ETH are NFT-related assets. In particular, ApeCoin [APE] has been seeing a lot of fluctuation in the past few days, so it’s time to study what investors are up to.

Bear vs Monkey

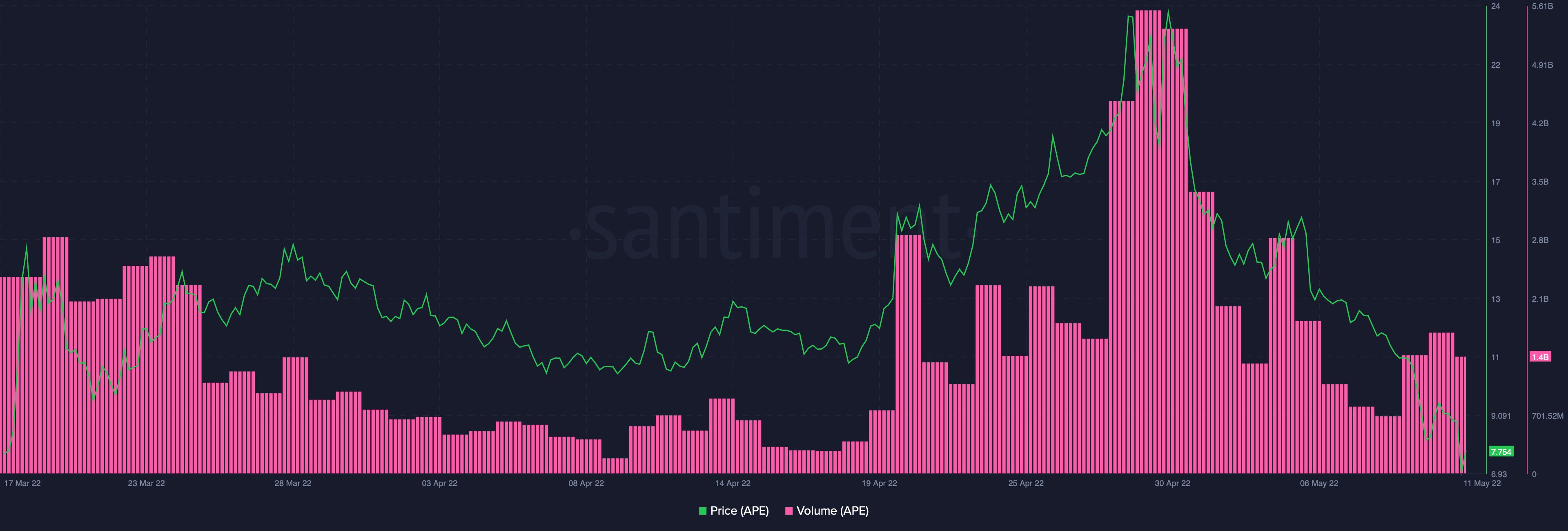

While APE saw a brief recovery earlier on 11 May, this quickly came to an end. At press time, the token was trading at $8.69 after falling by 5.31% in a day and losing 38.33% of its value in the past week.

In general, APE volumes have been falling along with the asset’s price since it touched all-time-highs of above $23. However, since 9 May, there has again been an increase in volumes, and APE’s price was moving upwards at press time.

Source: Santiment

So, can we point a finger at the usual suspects – whales – for this latest development? Santiment data revealed that whale transactions worth more than $100,000 had drastically fallen after APE touched its all-time highs. That being said, though, whale transactions did rise slightly as the asset’s price plunged on 9 May.

Now, the question is, are whales buying or selling?

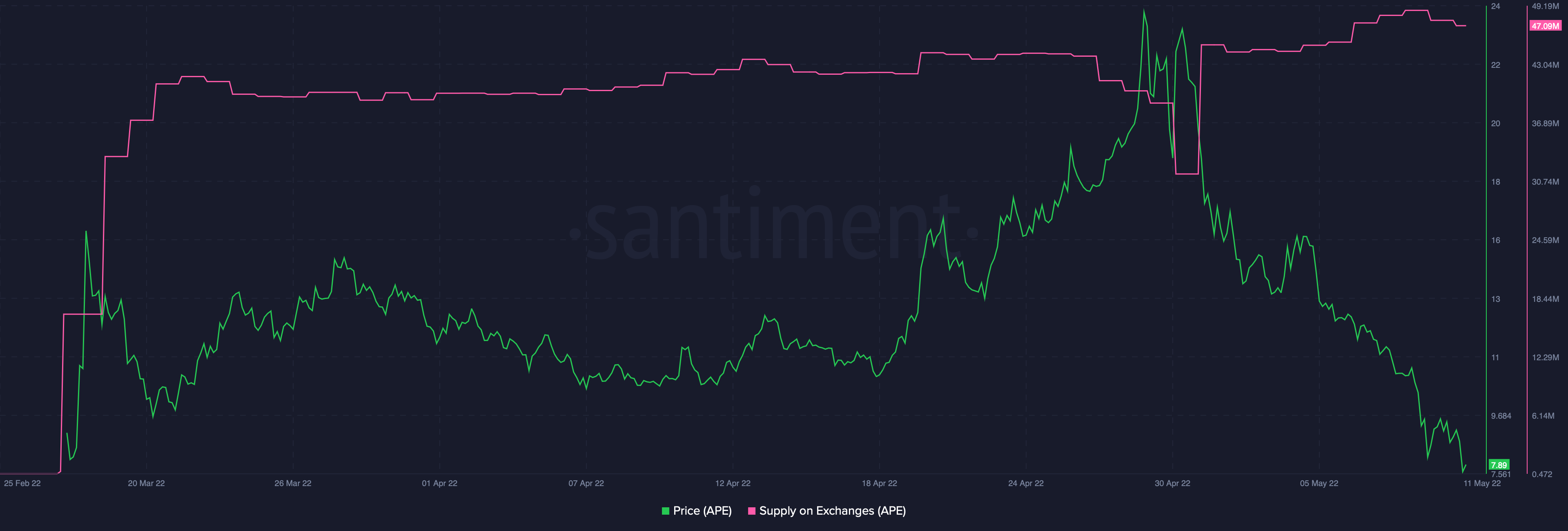

Source: Santiment

A quick look at APE supply on exchanges tells us that while there was interest in buying APE when ATH prices were reached, tokens began returning to the exchanges as soon as the price began to fall.

On 9 May, however, the number of APE tokens returning to exchanges reached an all-time high. The effect of this selling pressure on the price is clearly seen.

Source: Santiment

Adding to that, APE velocity also fell, as investors perhaps chose to be more cautious. However, APE velocity is one metric which has been rising with time. Average address change counts remained largely consistent, even as APE’s price fell. This means APE holders are actively moving their assets.

Source: Santiment

A token presence

Well, so ApeCoin might be dealing with a number of side effects due to the latest crash, but what about the Bored Ape Yacht Club itself? According to CryptoSlam, the 24-hour sales volume for the collection was up by 24.49%. However, BAYC’s seven-day sales volume was down by 48.61% at press time.