Arbitrum rallies past Ethereum over here: What now?

- Arbitrum’s weekly derivatives transaction volume reached an all-time high in the last week.

- ARB’s value increased in the last month, but investors’ profits continued to drop.

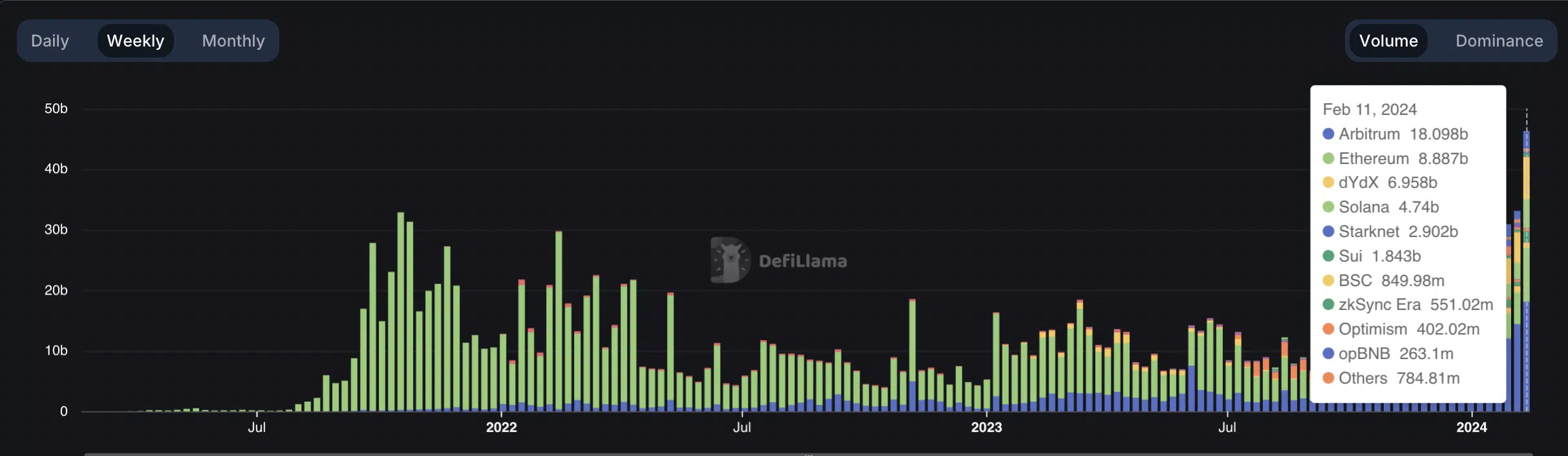

The weekly transaction volume of the derivatives protocols housed within leading Layer 2 network (L2) Arbitrum [ARB] climbed to an all-time high of $18 billion in the last week, data from DefiLlama showed.

According to the data provider, this marked a 17% uptick in derivatives volume on Arbitrum within a seven-day period, surpassing the $9 billion that Ethereum [ETH] recorded during the same window period.

Arbitrum dethrones Ethereum

On-chain data revealed that Ethereum had long held the spot as the number chain with the highest weekly transaction volume of its derivatives protocols.

However, Arbitrum’s weekly volume surpassed Ethereum’s for the first time on the 26th of November, and has since continued to do so.

Assessed monthly, the volume of transactions completed on the derivatives protocol on Arbitrum has consistently dwarfed Ethereum’s since December 2023.

For context, during those 31 days, derivatives volume on Arbitrum totaled $45 billion. Ethereum trailed behind with a monthly volume of $38 billion.

The trend continued in January, when Arbitrum closed the month with a derivatives volume of $55 billion, representing a 22% rise in month-over-month (MoM) transaction volume.

Ethereum’s monthly derivatives volume fell by 18% during the same period.

The steady rise in Arbitrum’s MoM derivatives volume has led to a significant surge in its share of the monthly transaction volume of multi-chain derivatives protocols, data from DefiLlama showed.

In December, the L2 network accounted for 39.25% of all transactions executed across all derivatives platforms. At the end of January, this had risen to 42.44%.

In comparison, Ethereum’s market share plummeted by 38% during the same period.

So far this month, Arbitrum’s derivatives volume has amounted to $18 billion. On the other hand, Ethereum has seen only $16 billion in transaction volume from its derivatives protocols.

ARB gains as market sees traction

At press time, the L2’s governance token ARB exchanged hands at $2.04. Per CoinMarketCap’s data, the altcoin’s value has risen by almost 10% in the last month.

An assessment of a key momentum indicator, the Money Flow Index (MFI), explained the price uptick. With a value of 84.25 at press time, readings from ARB’s MFI confirmed the growth in demand for the altcoin.

However, despite the price growth in the last month, the profitability of holding ARB during the same period has dwindled.

Read Arbitrum’s [ARB] Price Prediction 2024-25

AMBCrypto assessed the alt’s 30-day Market Value to Realized Value (MVRV) ratio and found that it has trended downward since the 2nd of January.

Sitting at 4.18% at press time, this metric has since dropped by 90%, according to data from Santiment.