Arbitrum’s organic activity v. Optimism’s incentivized usage – The winner is…

Ethereum layer 2 blockchain solutions, Arbitrum and Optimism, have both played a huge role in solving ETH’s scalability issues. However, the war between the networks is waging on, one showcasing some interesting insights. Have a look here –

The battle of the Gods

Fair to say, both the networks are breathing down each other’s necks as the race for the throne intensifies. Just recently, Messari’s analyst shared some insights to discuss the same.

Herein, Arbitrum used a permissionless bridge for all tokens, whereas Optimism deployed dedicated bridges based on market demands. Well, looks like the demand for the latter witnessed a massive uptick as both protocol’s network usage and TVL stood identical.

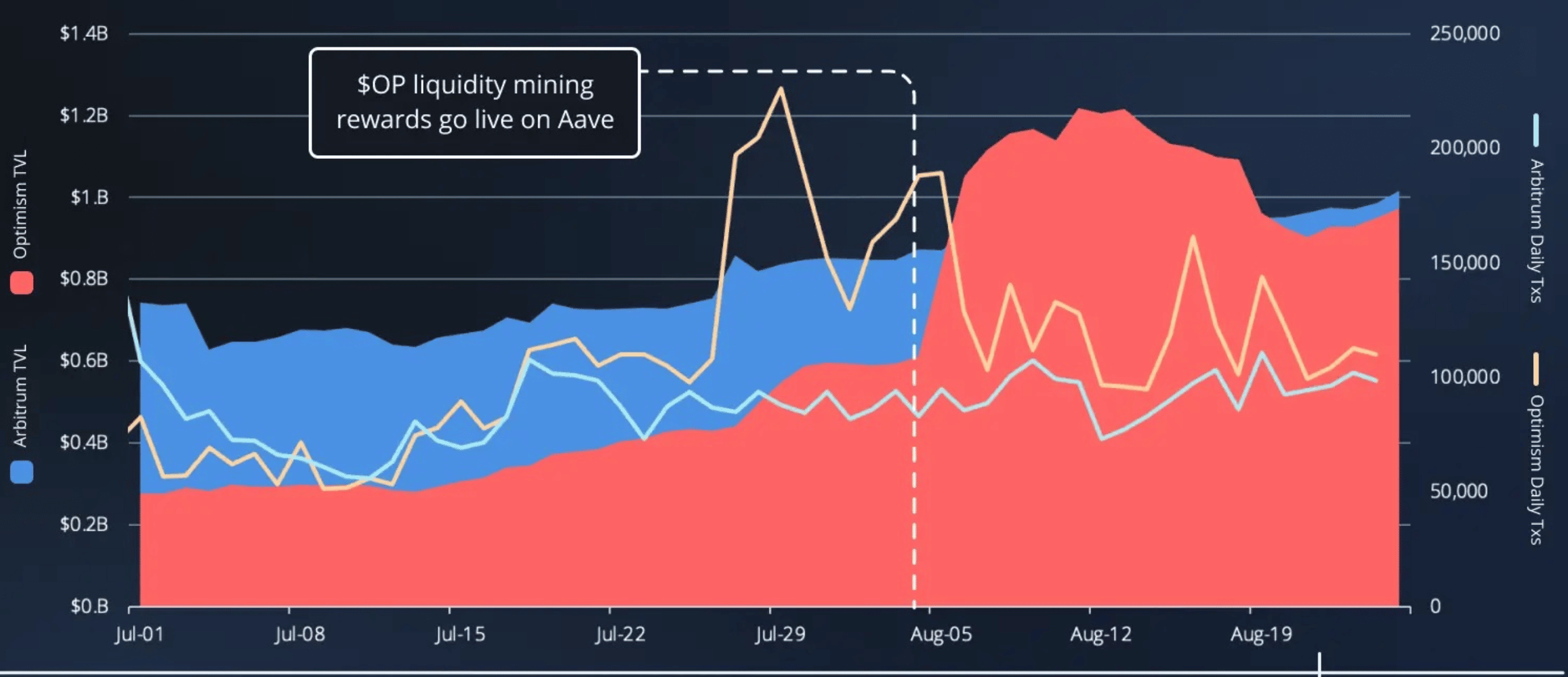

Optimism’s launch of the liquidity mining program ( OP rewards) for Aave users aided the said demand. Since the arrival of the OP rewards, users in early August managed to double Optimism’s TVL from $600M to almost $1.2B, as per Messari’s analysis.

Optimism’s daily transactions and TVL had briefly spiked, even at press time, but soon corrected as metrics flattened. Worth pointing out, however, that the past did see fireworks following the said release.

At the time of release (~Aug 5), Aave deposits on the Layer 2 network had increased by 493%, as per data from Defi Llama. Presently, Aave V3 on Optimism has just under $415 million worth of assets locked in its smart contracts. Meanwhile, according to L2Beat data, the network’s total value locked, excluding its native OP token, has appreciated by 63% since the OP token launched on 31 May.

However, Optimism’s network usage did see a massive correction, at the time of writing. The decline came as a result of a bunch of rumours that Optimism’s multi-signature wallet had been hacked. As of this writing, it was trading at $1.o6, dropping by 14% since the hacking scare of 12 August.

Natural v. Artificial

Yes, both protocol’s network usage and TVL stood at a similar base line, BUT Arbitrum chose the natural way out. The said analyst (@chasedevens) too shared the same narrative, one that highlighted the key difference ie. Arbitrum’s organic activity v. Optimism’s incentivized usage. The analyst stated,

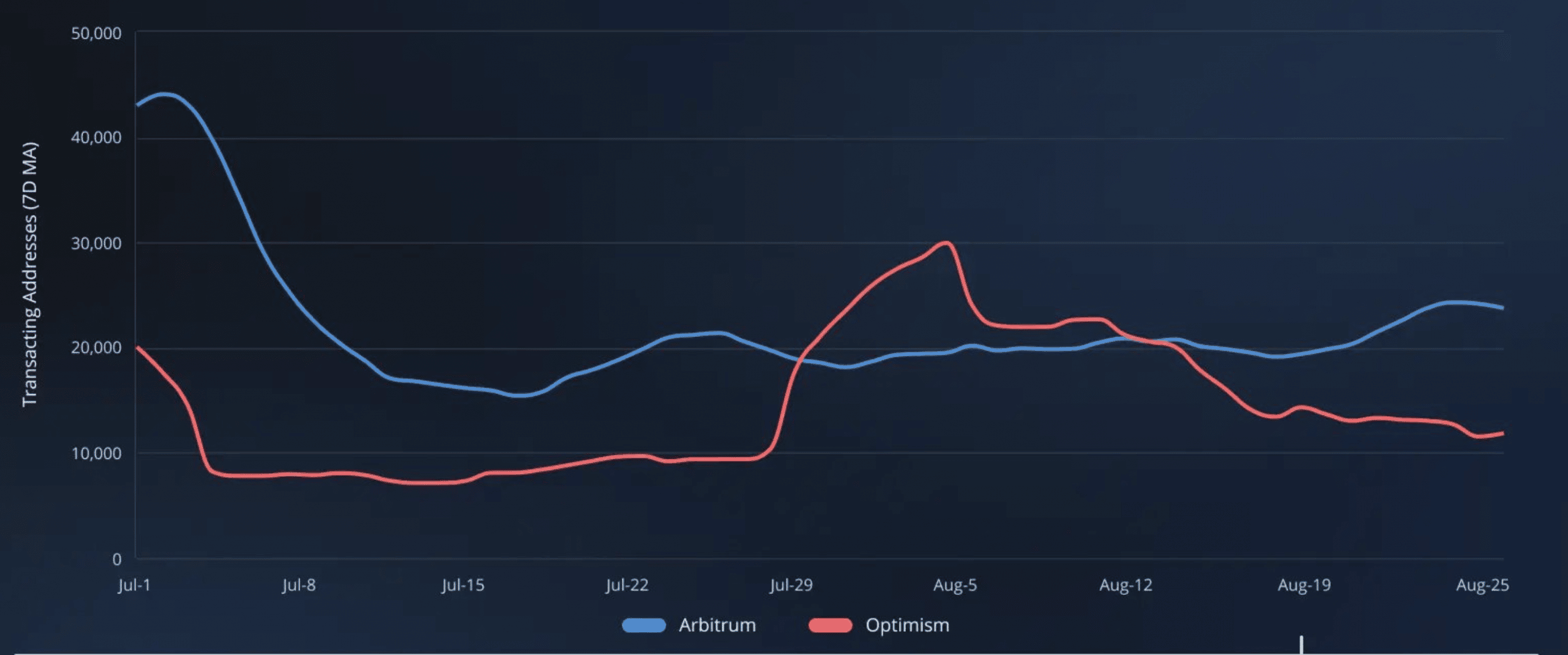

“OP rewards on Aave doubled Optimism TVL to get in line with Arbitrum, but Arbitrum still maintains double the number of transacting addresses with no incentives.”

Here’s the graph to support the stated narrative –

Herein, Arbitrum supported more active users than Optimism, despite the latter rolling out different ecosystem initiatives. However, the former isn’t far behind.

The Arbitrum network is slated to undergo a big upgrade. The transition to Nitro would solve a few key issues and incorporate innovative features. It is a prominent development for the popular network, although it may not necessarily yield a price increase.