Assessing AXS’ latest route and how it differs from investor expectations

- AXS registered a promising price uptick, and most metrics looked optimistic

- Market indicators, on the other hand, turned in the bears’ favor

Most cryptocurrencies, no matter how large the market capitalization, managed to list their values up last week. Axie Infinity [AXS] was also not left out, as its price surged by more than 9% over the last seven days. However, while the token’s price increased, most investors took their money out, which can cause trouble for the coin’s price action.

Realistic or not, here’s AXS market cap in BTC‘s terms

Is Axie Infinity under pressure?

Thanks to the bullish market, AXS managed to move its price up by more than 9% in the last seven days, giving hope for a further hike in its price. While the token’s price rose, investors’ confidence in AXS seemed to have dropped. Ali, a popular crypto analyst, recently posted a tweet highlighting the fact that 98.67% of AXS holders were “out of money.”

With 98.67% of $AXS holders "Out of the Money," #AxieInfinity is one of those altcoins that looks ready to pop! ?#AXS investors are in disbelief, selling pressure has gotten exhausted, and an important support floor was created around $4. pic.twitter.com/Ift5k2o5kH

— Ali (@ali_charts) October 23, 2023

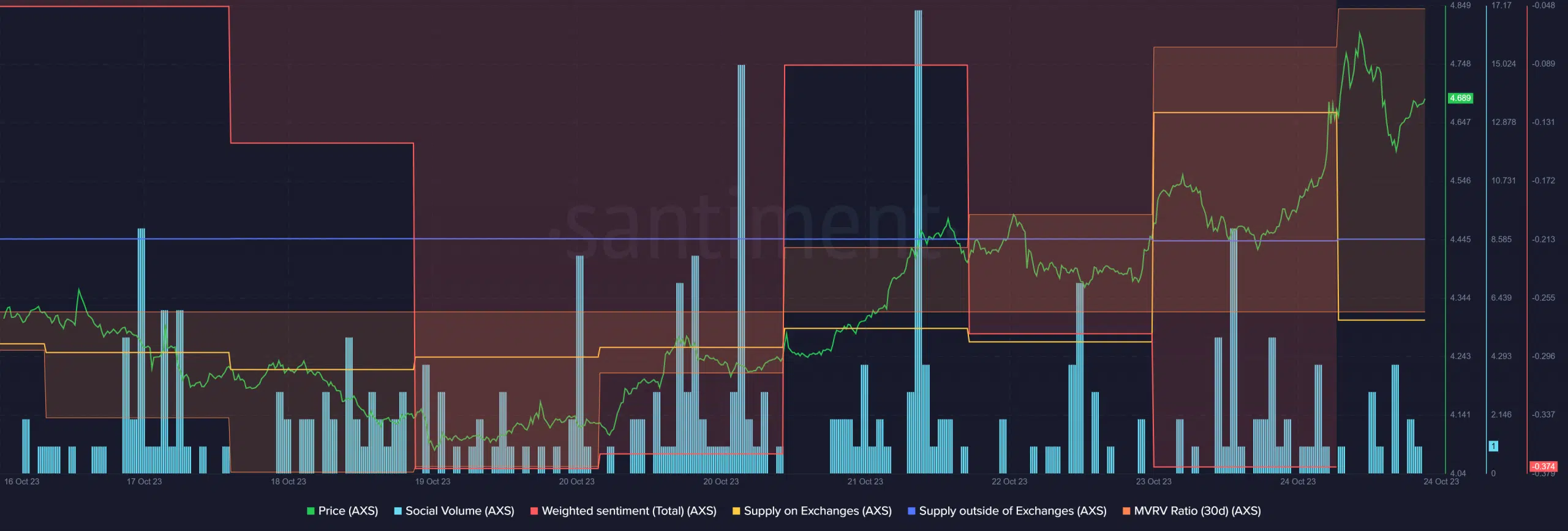

This created a possible support level of $4. A similar trend of disbelief was also noted considering AXS’ action on the social front. As per Santiment, Axie Infinity’s social volume fell despite a price hike. Not only that, but negative sentiment around the token was also high, as evident from the drop in its Weighted Sentiment.

Though the aforementioned metrics looked bearish, AXS acted differently as its price continued to rise. As per CoinMarketCap, AXS was up by over 4% in just the last 24 hours. At press time, it was trading at $4.68 with a market capitalization of over $661 million.

It was interesting to know that after a short sell-off, AXS’ supply on exchanges went under its supply outside of exchanges. This meant that buying sentiment was dominant in the market. Not only that, but another bullish signal was its Market Value to Realized Value (MVRV) ratio, which went up in the last seven days.

This can be expected of AXS

While most metrics were bullish, a look at Axie Infinity’s daily chart told a different story, as most indicators were bearish. For example, the Relative Strength Index (RSI) took a sideways path after a sharp uptick.

How much are 1,10,100 AXSs worth today

The Chaikin Money Flow (CMF) also followed a similar trend of decline. In fact, AXS’ Money Flow Index (MFI) was about to enter the overbought zone, which can increase selling pressure. Nonetheless, the Moving Average Convergence Divergence (MACD) remained in the bulls’ favor in the recent past. Thus, increasing the chances of a continued uptrend.