AVAX plunges by 4%, but short sellers could benefit from this silver lining

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- At the time of writing, AVAX stood in a position hounded by the bears

- A break above $11.93 could invalidate the above-mentioned forecast

Avalance [AVAX] has been in a downtrend since late-August, exposing long-term holders to losses. At press time, it was trading at $11.44 and threatened to break below its recent trading range of $11.16 – $11.93.

AVAX fell below $11.78 when Bitcoin [BTC] dropped below $16.88K. The above sensitivity to BTC’s performance could complicate AVAX’s uptrend if BTC is bearish, thus worth investors’ watchlist.

Given AVAX’s bearish structure at the time of publication, bears could push its price beyond these key levels.

Read Avalanche’s [AVAX] price prediction 2023-24

Will a breach of this trading range happen?

AVAX traded in the $$11.16 – $11.93 range since 19 December. Furthermore, AVAX also faced several price rejections at $11.93, blocking any recent rally attempts. There was a price pullback at the time of publication, which could break below $11.38 and settle at $11.16 or go lower.

The Relative Strength Index (RSI) has been rejected several times on the 40-mark, which explains the price rejections at the $11.93 level. The RSI showed a downtick, showing a drop in buying pressure as selling pressure increased.

In addition, the On Balance Volume (OBV) failed to break above the 136M trading volume mark. Thus, buying pressure and AVAX’s uptrend have been limited by volume fluctuations.

Therefore, AVAX could likely drop lower to $11.16, offering short-selling opportunities. An extremely bearish BTC could even have AVAX dropping to $10.40.

However, a break above the current obstacle and price rejection level at $11.93 will invalidate the above bearish forecast. In such a case, investors would want to watch if RSI breaks above the 40 mark and the OBV goes beyond 136M to close their short positions.

How many AVAXs can I get for 1$?

AVAX’s risk profile: Monthly Sharpe ratio hits below 1

According to Messari, AVAX’s Sharpe ratio was -1.63. This indicated that it was not a good investment compared to other risk-free or low-risk investments. For closure, the Sharpe ratio tracks how well an asset performs compared to the rate of return of risk-free assets like US treasury bonds.

A ratio above 1 can be considered as good, while 3 or above is deemed excellent. On the contrary, anything below 1 is considered as “not a good” investment. In this case, AVAX’s -1.63 shows its rate of return is way lower than other non-risk or risk-free investment options.

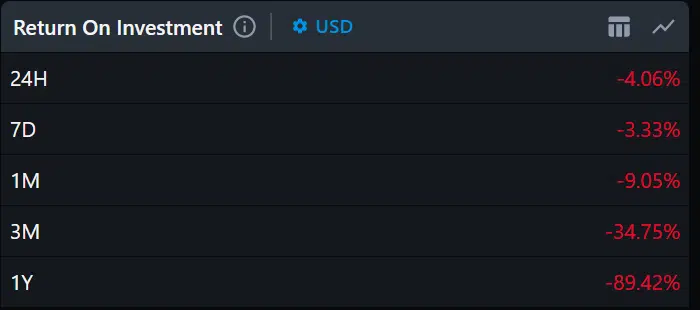

A look further into return on investment (ROI) was all red, reinforcing the extent to which long-term and short-term holders of AVAX were incurring losses.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)