Axie Infinity: $4B in NFT sales may not mean what you think in the short-term

Blockchain-based games have taken the world by storm. According to a report from DappRadar, these games got around $1 billion in funding last month, clearly showcasing increasing interest in the space.

Milestone unlocked

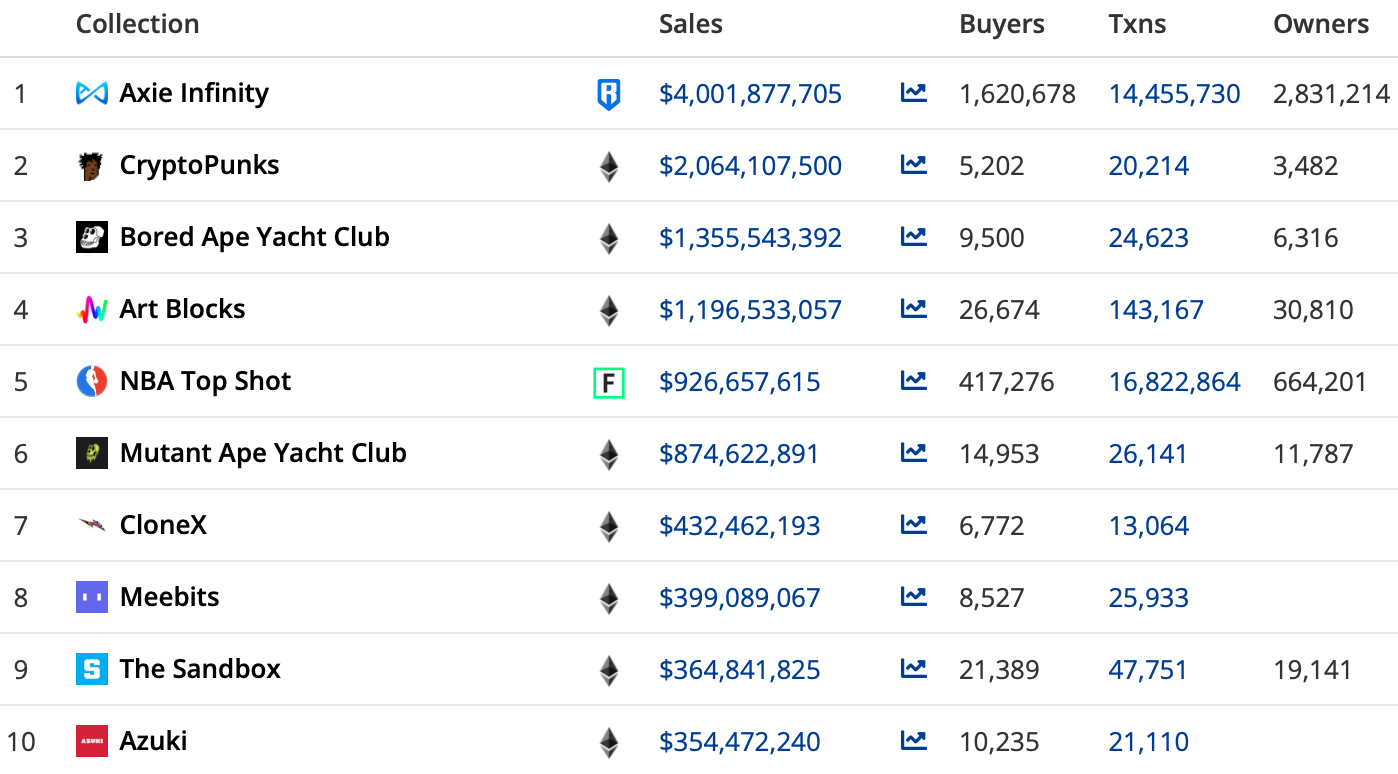

Axie Infinity, the Ethereum-based video game crafted by the Vietnamese software studio Sky Mavis, has been trending a lot of late. The Play-to-earn platform crossed the $4 billion mark in historic sales (all time). Ergo, becoming the third-largest NFT platform in terms of all-time sales.

This is monumental, despite the fact that the game’s NFT sales were below Opensea’s $21.85 billion and Looksrare’s $16.85 billion.

According to CryptoSlam, Axie Infinity’s sales’ figure stood at $4,001,877,705. In fact, Axie Infinity’s total sales volume was almost double the value of the second-place NFT collection, CryptoPunks.

Source: CryptoSlam

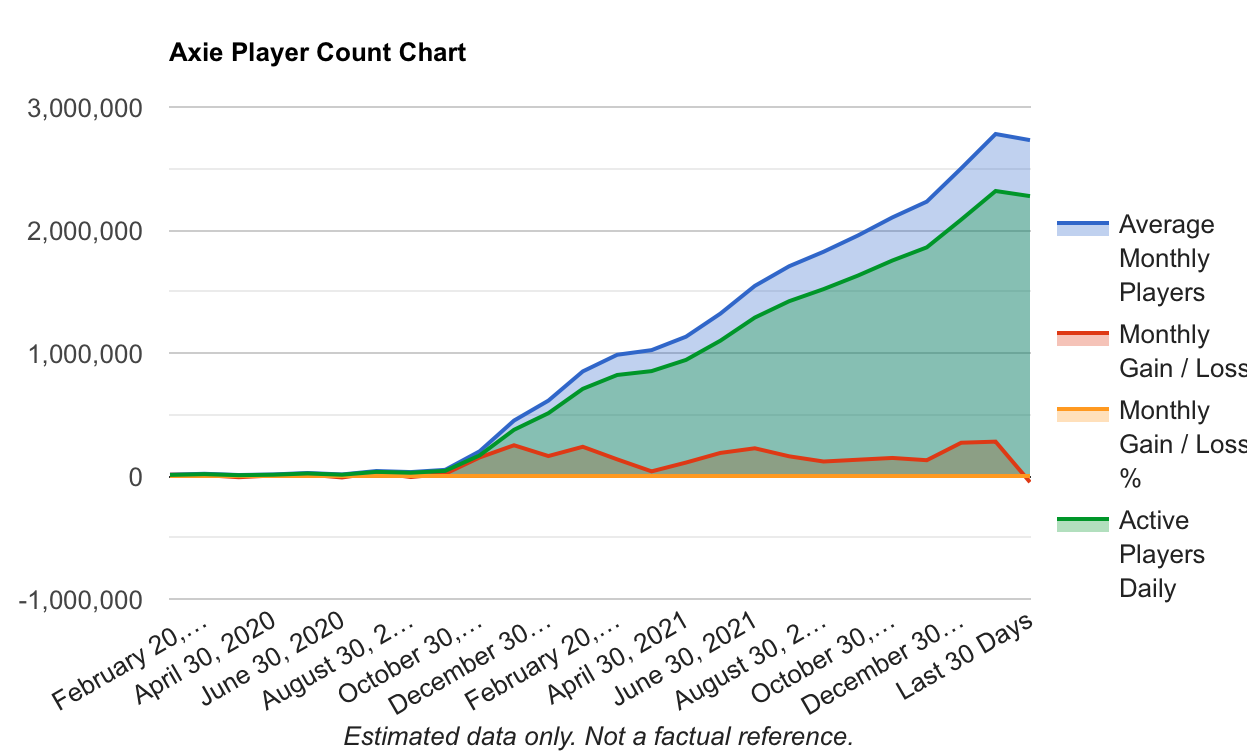

According to 24-hour Axie NFT sales numbers, the project received $2.4 million in transactions from over 38,000 buyers. It pictured consistent growth of players with nearly 3 million players worldwide in January.

Source: Active players.io

Talking about holders, there were 53,734 AXS token holders at the time of writing, as per Dune Analytics. The average Axie Infinity sale price was around the $110-mark.

And then there were hiccups

The game’s native digital currency Axie (AXS) appreciated by 2,544% against the U.S dollar over the last year. However, this trend wasn’t being reciprocated at press time. In fact, AXS suffered a 12% price correction following which, it traded below the $49-mark.

According to the most recent market figures, the average selling price of Axie Infinity was $32.93. That’s a 54% fall, as per the data from DappRadar. Weekly sales, at press time, were down by more than 40% as it stood on the #5th spot. Over the last month, it was placed eighth in terms of 30-day NFT sales.

Overall, the average Axie Infinity sale price was $198.77 and the project saw 1,905,222 traders, according to lifetime statistics.

Can it recover then, despite a dwindling performance in 2022? That’s the question.