Between inflows and outflows, is Bitcoin awaiting a sell-off?

- Bitcoin saw a significant inflow recently that reached a monthly high.

- Despite this, BTC outflow still dominated the exchange flow.

Bitcoin [BTC] has recently gained significant attention, primarily because of its ongoing downward price trend. In light of this downtrend, recent data indicates that the amount of Bitcoin deposited into exchanges reached a monthly peak. But how does this influx compare to the outflow of Bitcoin from exchanges?

Read Bitcoin (BTC) Price Prediction 2023-24

Between Bitcoin inflow and outflow

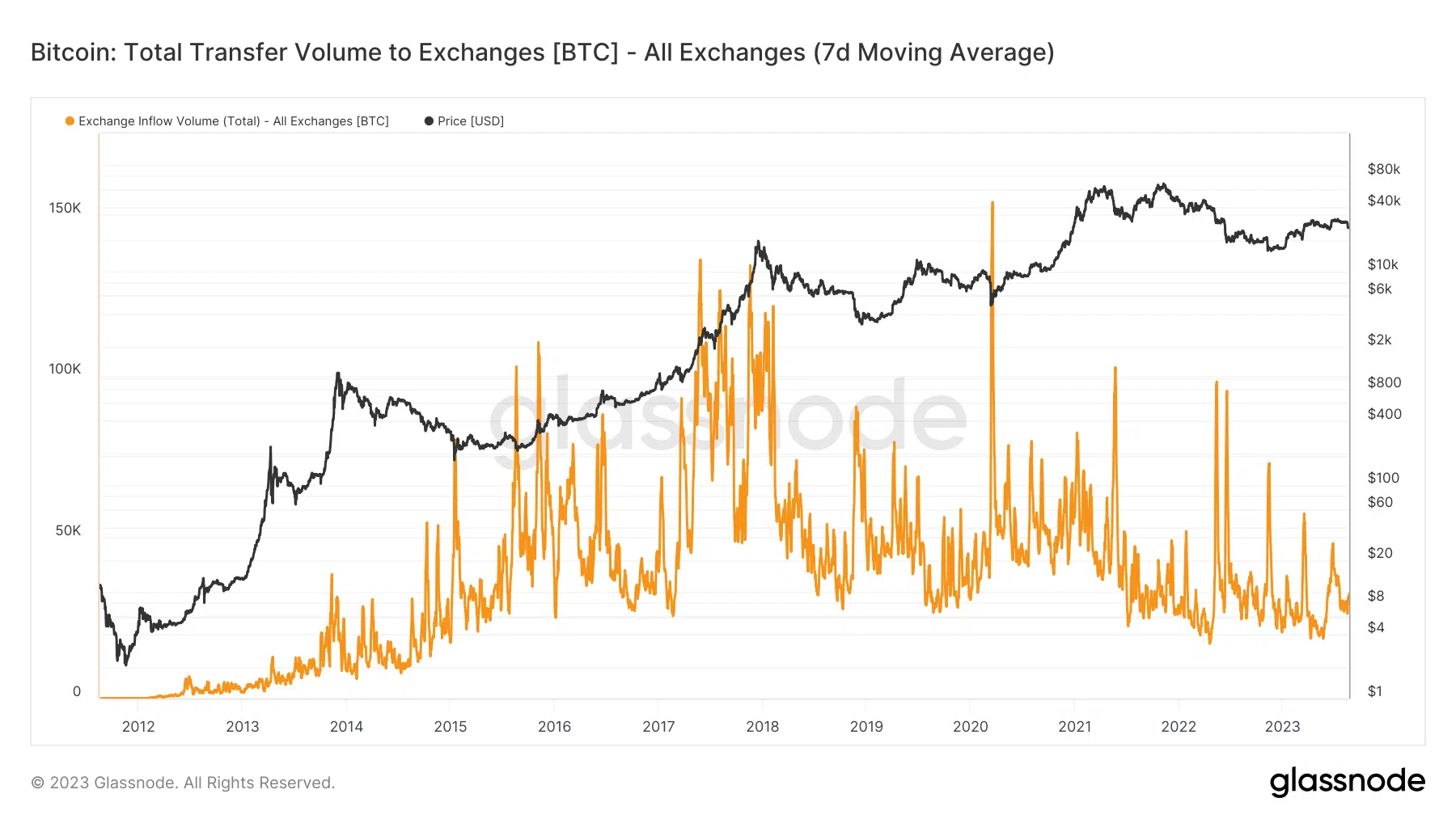

A recent update from Glassnode Alerts highlighted that the inflow of Bitcoin into all exchanges reached a new monthly peak on 22 August. Then, the recorded inflow surpassed 1,300.

Expanding the analysis, a comprehensive overview of the cumulative inflow volume, according to Glassnode, revealed that the overall inflow exceeded 32,000. These figures would naturally imply a substantial influx of BTC into exchanges, indicating a potential sell-off.

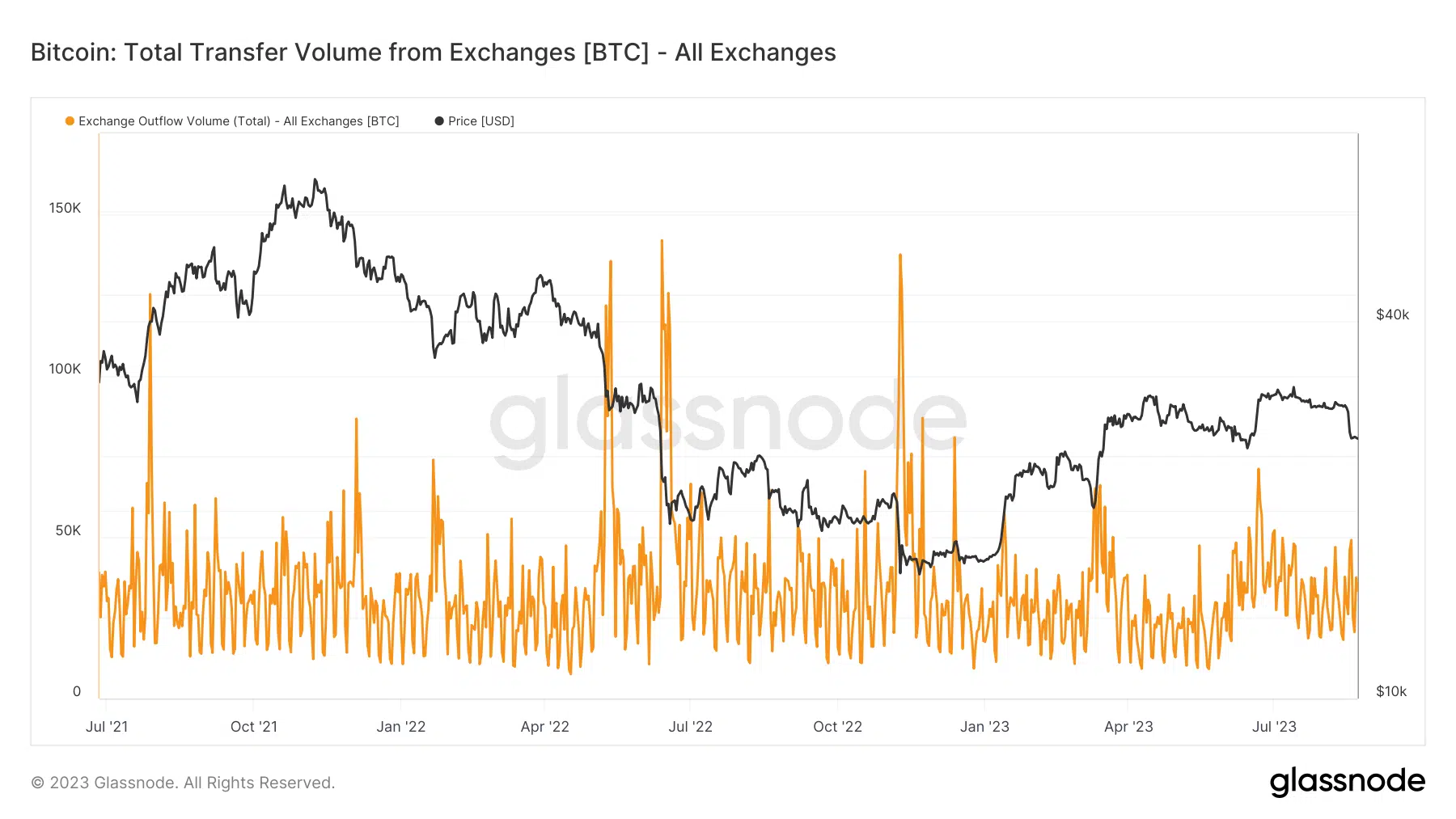

However, gaining a more comprehensive perspective required examining the outflow volume. According to the outflow volume data from Glassnode, as of this writing, the outflow exceeded 33,000.

This signified a minor upturn in the outflow in comparison to the inflow. The implication here is that there appeared to be a state of equilibrium between the inflow and outflow presently, debunking the narrative of a widespread sell-off.

Analyzing the Bitcoin netflow

Examining the netflow chart provided by Glassnode offered a more distinct insight into the dynamics of the Bitcoin movement throughout all exchanges. The chart displayed a prevailing pattern of BTC outflow starting from approximately 18 August.

This observation pointed out that, despite the ongoing downward trend, more BTC were departing from the exchanges daily than the amount deposited.

This breakdown of the initially assessed total inflow and outflow volumes verified the lack of a frantic selling scenario, at least for now.

BTC hits four-month RSI low

Examining the daily timeframe chart of Bitcoin revealed an ongoing downtrend that displayed no signs of abating. Bitcoin has experienced nine consecutive days of declining prices as of this writing. Its current trading value hovered around $26,130, with the price decrease registering at less than 1%.

How much are 1,10,100 BTCs worth today

Also, the Relative Strength Index (RSI) indicated an oversold status as of this writing. Notably, this marked the first instance in over four months that BTC had reached such a level on its RSI.

Despite the challenging circumstances, a silver lining emerged in the present price level, which offered a potential price correction opportunity.