Binance Coin [BNB] may disappoint traders in Q4 based on these reasons

Binance Coin’s [BNB] performance in the month of September was anything but noteworthy. However, despite its standing on crypto charts, the exchange token still managed to perform well on other fronts as per a new report.

According to BNBburn, the number of tokens burned in the third quarter (Q3) surpassed the entire record of the second quarter. At press time, BNB tokens burned in Q3 was 2,040,503.56 BNB, as compared to 1,976,739.87 BNB in Q2.

Interestingly, all of these events occurred despite a lower average trading price registered in Q3. As expected, this led to a significant difference in the worth of the BNB burned. The Q2 value amounted to $626,356,129.623 while Q3’s worth stood at $562,592,435.15.

In dire need of a helping hand

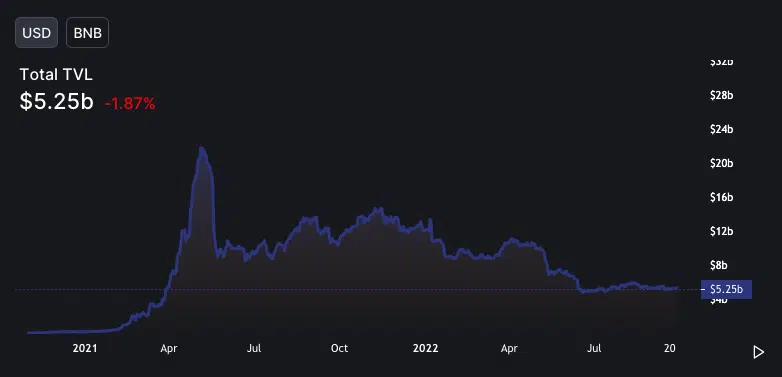

Despite the increase in burned tokens, it may seem that BNB could need some help. Details from DeFi Llama showed that the Total Value Locked (TVL) on the Binance Smart Chain (BSC) was worth less than it was on 27 September.

According to DeFi Llama, BNB’s TVL was $5.25 billion at press time, representing a 1.87% decline from the previous day.

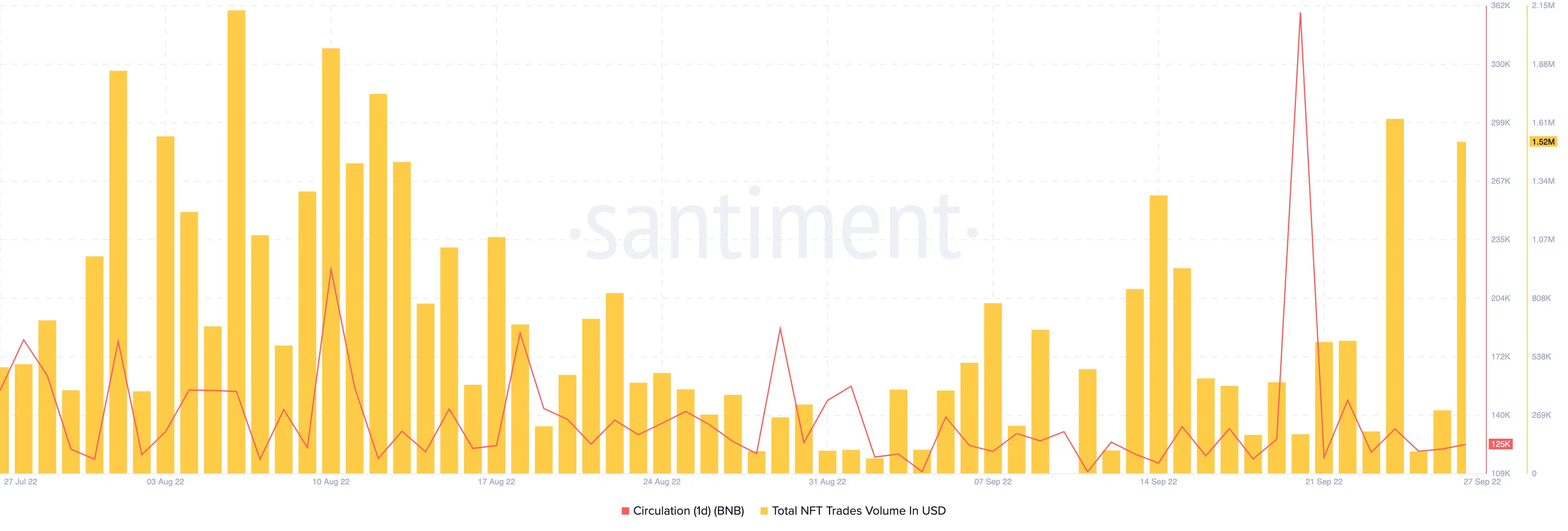

Additionally, it was not only the BNB price that experienced a decline. A look at its one-day circulation also showed that it was nowhere near impressive. Furthermore, Santiment data showed that the uptick on 20 September to 358,000 had reduced to 125,000.

Fortunately, it seemed that traders were most active in the NFT sector of the BNB chain. The on-chain data platforms also showed that BNB NFT trades stood at a value of $1.52 million at the time of this writing.

A quick look at the price trajectory may indicate…

A few days ago, it was observed that the burning effect did not drive BNB towards the $300 mark. Furthermore, around the same time, BNB was trading a little above its press time price. So, has the momentum changed since then?

The Awesome Oscillator (AO) showed that BNB’s momentum was currently bearish with its value at -4.3. Furthermore, the AO also showed that there was a bearish twin peak, indicating that a bullish momentum was unlikely in the short term.

It was a similar result with the Relative Strength Index (RSI). Based on the four-hour chart, the RSI had succumbed to the overbought pressure it experienced earlier.

With BNB failing to hold on support and resistance repeatedly, the expectations of a price rise in the fourth quarter may well be at an extremely low point. Still, assuming that there would be less profits could sound too hasty as Bitcoin [BTC] cannot be considered anywhere near recovery. And in most cases, BNB follows the same trend.