Bitcoin: A new kind of ‘low’ after BTC’s correlation with tech stock hits fever pitch

After days of clinging to the $40k mark for dear life, it appears that Bitcoin is finally making a recovery. As if on cue, most of the top 30 cryptos also found their way into greener pastures. At press time, the king coin was trading at $41,325.34 after rising by 1.17% in 24 hours and rallying by 3.03% over the past week.

A love triangle: Bitcoin/tech stock/gold

This is good news for bulls, without a doubt, but one disclaimer applies. A report from Arcane Research urged investors to remember that Bitcoin’s 30-day-correlation to tech stocks had increased to a level last seen in the summer of 2020. In fact, Bitcoin’s 30-day-correlation to Nasdaq was 0.70. This means that obstacles in the tech sector since the winter of last year have influenced the crypto-market as well. However, the report noted that such a high level of correlation is not likely to last.

On the other hand, Bitcoin’s correlation to gold fell sharply and it is now, in fact, close to all-time-lows. The 30-day correlation clocked in at -0.45.

Get a grip, BTC

So, what do the following days have in store for the flagship coin? According to TradingView’s Relative Volatility Index [RVI], volatility is on the upside. This is a good sign for those who want to see Bitcoin turn its current resistance levels into support.

Despite this though, investors might not exactly be watching the king coin’s movements with bated breath. Santiment data suggested that Bitcoin’s social volume is being pressed down as BTC continuously moves within the $38,000 and $42,000 range.

Social volume for $BTC has flatlined as price momentum has faded

Data by @santimentfeed pic.twitter.com/ttcAOHNPcx

— web3analysis.eth (@web3analysis) April 20, 2022

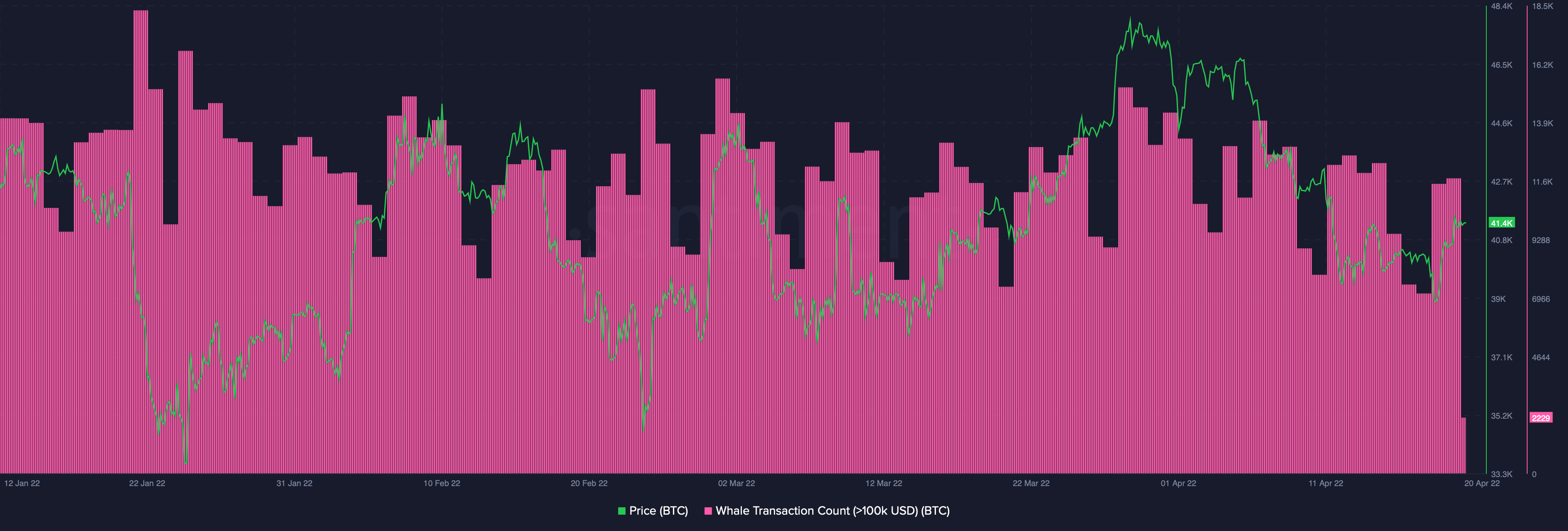

On that note, what are the most influential investors – or whales – getting up to? When looking at whale transactions worth over $100,000, these have been slowly declining since late March 2022. For the moment, it seems activity is on a downtrend.

Source: Santiment

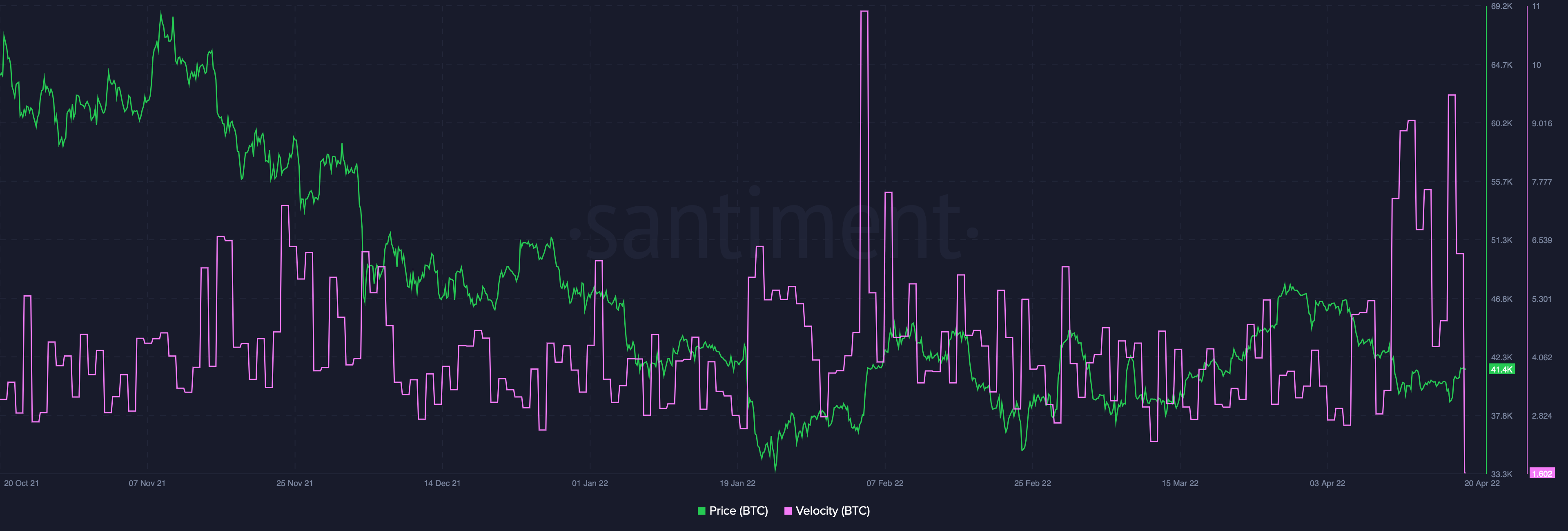

Indeed, this appears to be the trend across the Bitcoin market as velocity hit a startling low of 1.602. This is a sign of sharp decline in coin-related activity.

Source: Santiment

Bitcoin, meet Marmite

That being said, the current circumstances could soon change as Australia is reportedly due to get its first Bitcoin ETF. This development might come as soon as next week.

Interestingly, the Australian Financial Review reported that the ETF belonging to Cosmos Asset Management is planning to instead invest in Canada’s first Bitcoin spot ETF – the Purpose Bitcoin ETF – launched in 2021.