Bitcoin: Analyst points out “unmistakable sign” of sell pressure

- The movement of whales’ holdings to exchanges reflected selling pressure.

- The whale count has surged since the interest shown by TradFi giants.

Bitcoin [BTC] has wobbled in a tight trading range since last month’s market rally, dashing the broader market’s hopes of an extended bull run.

Read Bitcoin’s [BTC] Price Prediction 2023-24

After touching yearly peaks of $31,000 in June, the momentum has plateaued with the king coin oscillating between $29000 and $31,000, data from CoinMarketCap highlighted.

In cases like these, it becomes handy to track the behavior of addresses holding large stashes of Bitcoins, popularly referred to as ” whales” in crypto circles. Most organizations that track on-chain activity define whales as wallets that store more than 1000 coins at any particular time.

These influential investors, by virtue of holding a large chunk of BTC’s circulating supply, contribute significantly to price fluctuations through their transaction activity. Whale movements have thus become the subject of intense analysis over the years, assisting traders and analysts to spot periods of bull and bear market.

Whales preparing to dump?

Recently, an analyst from prominent blockchain analytics firm CryptoQuant drew attention to an intriguing whale behavior that could have implications for the market in the coming days.

The analyst tracked the 72-hour Exchange Whale Ratio for BTC and found that the metric has steadily increased over the last week, something he termed an “unmistakable sign” of selling pressure.

Exchange Whale Ratio is basically the relative size of the top 10 inflow transactions to total inflows on an exchange. When whales begin transferring coins in large quantities to exchanges, it introduces excess supply into the market and has typically been seen as a sell signal.

The Exchange Whale Ratio stays below 85% in a bullish market, while when bears are dominant, this indicator trends above 85%. In the aforementioned example, the ratio has been moving in the 85%-90% for almost a week now, a giveaway that price drops could be around the corner.

While the sell pressure was high, the analyst stated that if sellers were exhausted quickly, it might pave the way for a new wave of demand, culminating in higher prices for BTC.

Institutional interest attracts whales’ attention

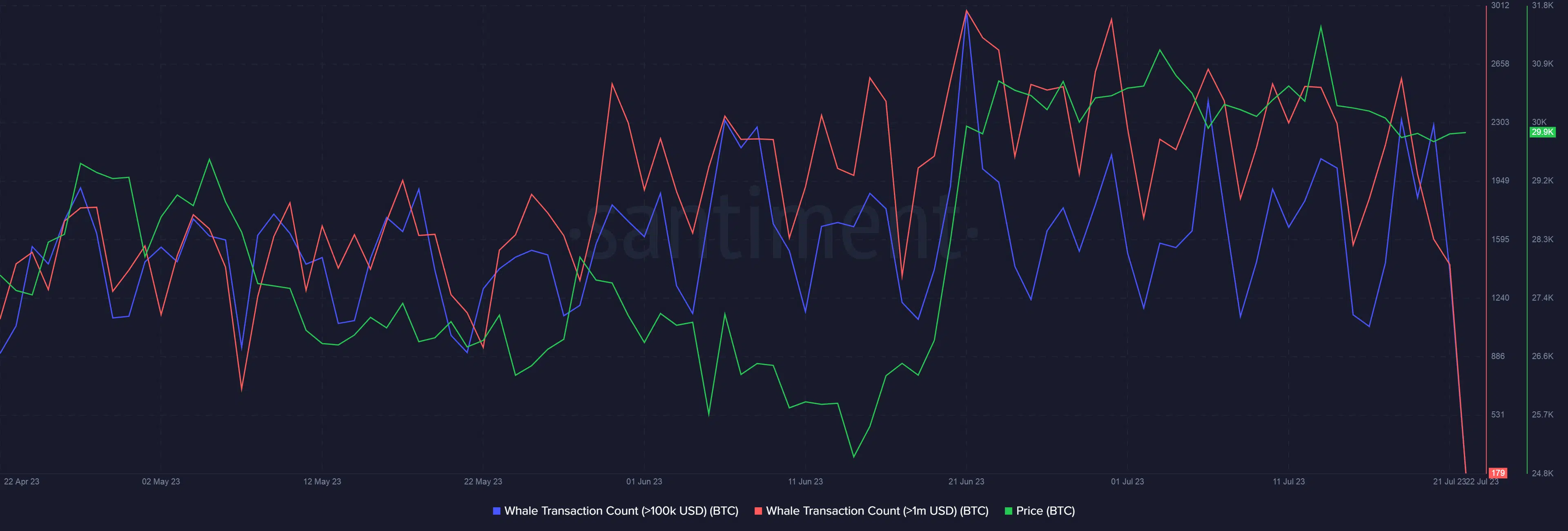

The interest shown by TradFi giants in the potential of Bitcoin has undoubtedly piqued the interest of whale investors. Since the announcement of BlackRock’s application for a spot Bitcoin ETF, whale transactions worth more than $1 million have risen significantly, according to data from Santiment.

Last month’s rally saw the transaction count jump to its yearly highs of 2983. Since the price of BTC rose, the movement could be construed as buying pressure from whales’ side. However, spikes in transaction counts in July have led to a dip in prices, indicative of selling pressure.

As investors increased their holdings, the total number of whale addresses, i.e. wallets with more than 1k BTC coins, shot up. The whale count reached 1,686 on 7 July, the highest since FTX’s implosion of November 2o22. But the number has dipped owing to the latest wave of sell-offs.

At the time of writing, there were around 1,678 whales in the market, according to Glassnode – up more than 2% since last month.

Dormant addresses return to life

Bitcoin whales have started to make big moves lately. An address, which has been inactive for the last 11 years, woke up from slumber to transfer about $31 million worth of BTC to another wallet, according to Lookonchain.

A BTC whale that has been dormant for 11 years transferred all 1,037.42 $BTC($37.8M) to a new address”bc1qtl” an hour ago.

The whale received 1,037.42 $BTC($5,107 at that time) on Apr 11, 2012, when the price was $4.92.https://t.co/k8ZmO5vc8X pic.twitter.com/xBaw2dQfY8

— Lookonchain (@lookonchain) July 22, 2023

However, it should be noted that movement alone isn’t enough to conclude that a whale was cashing out. In many instances, whales transfer funds from one wallet to another, or from one exchange to another. In this case, it was unclear at the time of writing.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Opportunity for potential buyers?

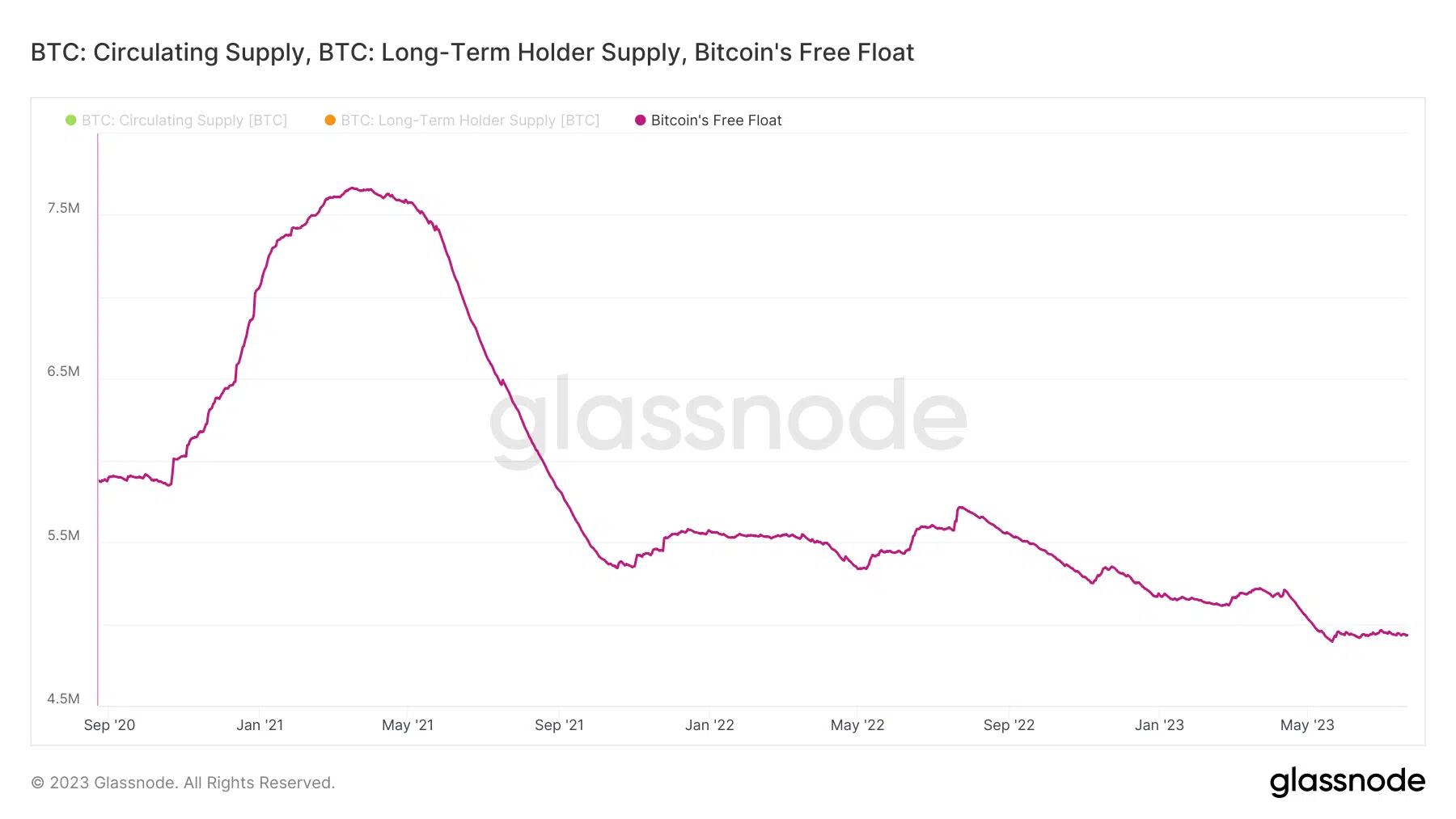

With the important halving event being less than a year away and indications of greater institutional interest, more investors are being drawn towards the bullish capabilities of BTC and are looking for opportunities to grab the king coin.

However, as the amount of BTC available for purchase has dropped to record lows, the event of whale sell-offs will be looked up with interest by these potential buyers.