Bitcoin: As Coinbase outflows increase, how has it impacted price?

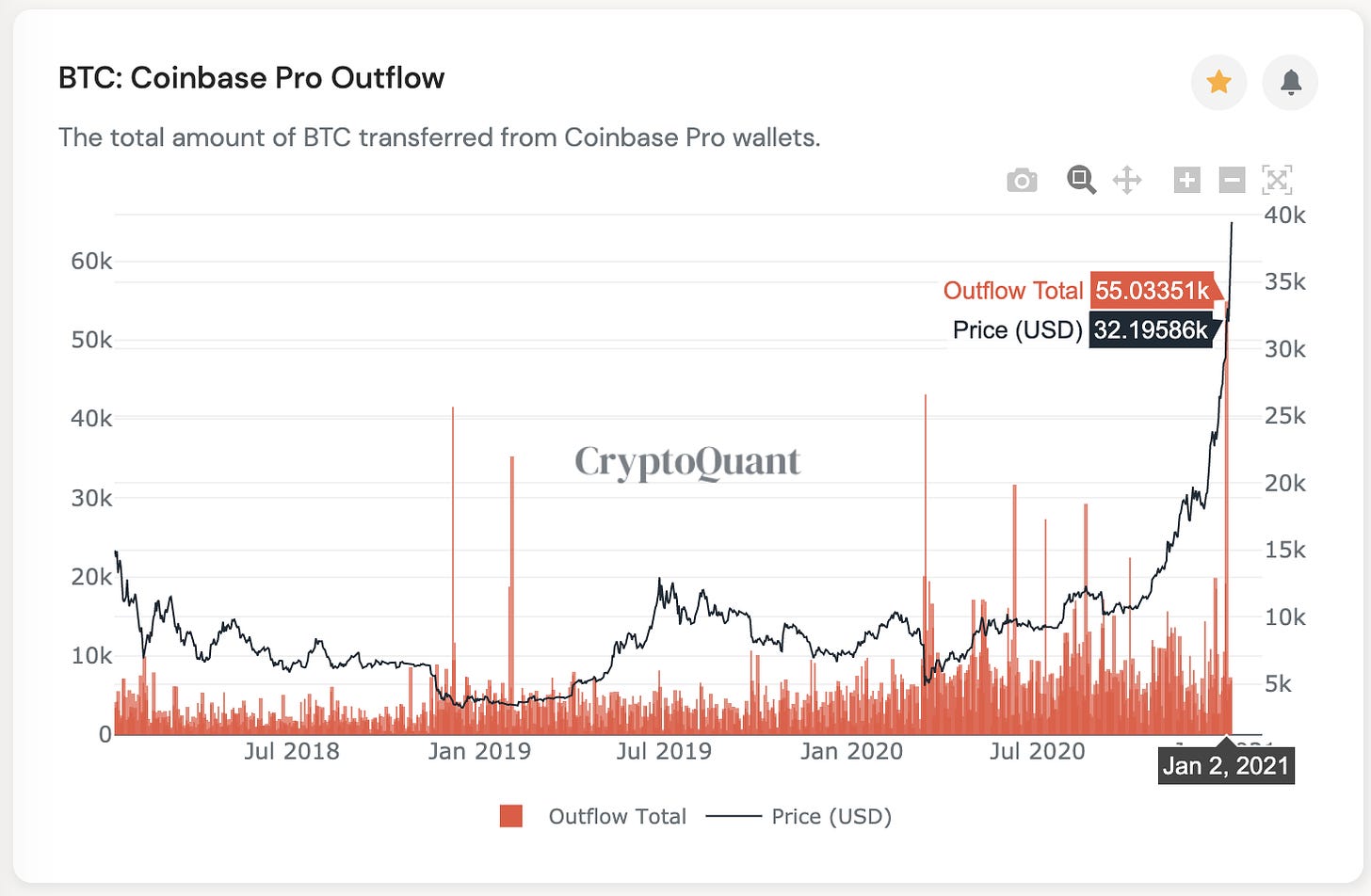

As the value of Bitcoin marked new all-time highs almost every day, we’ve been witnessing BTC outflows also increasing from Coinbase.

On 2 January, when the value of the largest digital asset reached $30k, the outflows from Coinbase also reported an all-time high. It was highlighted that the massive BTC outflows were probably ending up in the exchange’s cold wallets. However, the impact of these outflows was disputed.

Since the Coinbase Custody is integrated directly with its OTC desk, some massive outflows were signaled to be over-the-counter deals. Thus, when on 2 January the outflows marked an ATH, there were multiple large transactions witnessed within the same block time frame, as highlighted by CryptoQuant CEO, Ki Young Ju.

Source: Our Network

The above chart highlighted the increased outflow since July 2020. But, how do we understand the impact of these outflows on BTC?

Since the price is eventually determined on exchanges, massive non-exchange transaction volume is considered to a bullish signal in the market. These non-exchange transactions included OTC deals. Currently, only 5% of the network transactions are being used for exchange deposits/withdrawals, as highlighted by the Fund Flow Ratio.

This is the ratio of network transaction volume of exchanges compared to the entire cryptocurrency transferred on the network. A lower number means fewer transactions are done on exchanges and are instead conducted outside exchanges such as over-the-counter. Thus, currently, there were more non-exchange deals taking place in the market which was a bullish signal for BTC.

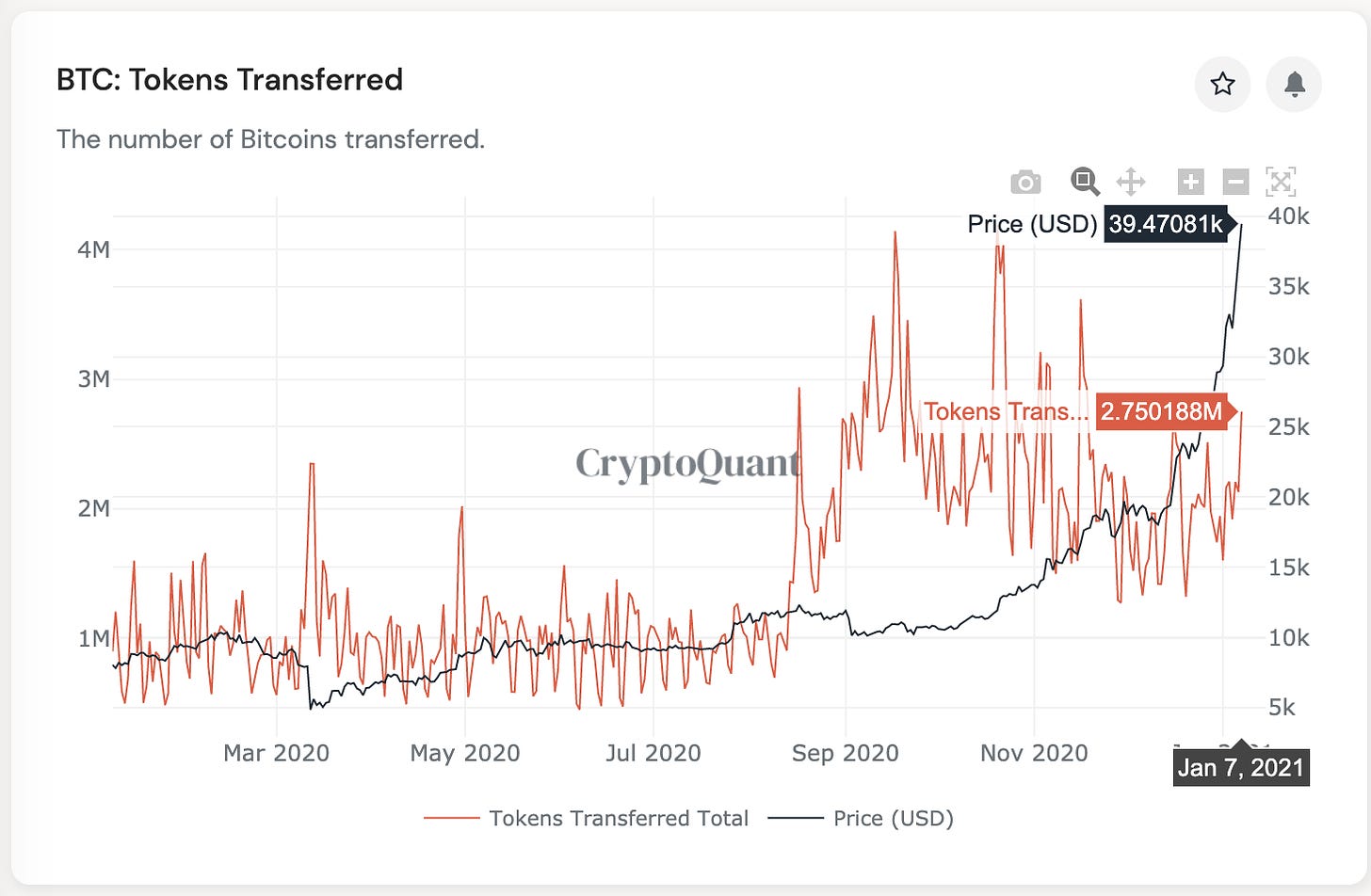

Another metric confirming the OTC deals was the Token Transferred. It is the number of BTC transferred. If the value of this metric goes up, while the fund flow ratio for all exchanges goes down, it implied that huge OTC deals are going on in the market.

Source: Our Network

The above chart noted a sharp rise when 2.75 million BTC was moved yesterday.

As Bitcoin moves forward into unchartered territory, the current trends signaled a continued bullish trend for the digital asset. However, if the Fund Flow ratio for all exchanges rises it will be an indicator for the incoming of bears.