Bitcoin: Assessing the odds of BTC investors surviving the ‘long winter’

- BTC held by the exchange was at an all-year low

- MVRV Ratio and weighted sentiments were up

Elon Musk recently posted a tweet regarding Bitcoin [BTC], wherein he mentioned that “BTC will make it, but might be a long winter.”

BTC will make it, but might be a long winter

— Elon Musk (@elonmusk) November 14, 2022

In line with the above-mentioned tweet, Bitcoin’s latest price action was not that promising, as the king coin failed to register major upticks. According to CoinMarketCap, BTC’s price was down by over 14% in the last seven days, and at press time, it was trading at $16,774.72 with a market capitalization of over $321.9 billion.

Wenry, an analyst and author at CryptoQuant, recently posted an analysis that revealed some interesting information regarding Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Can BTC recover soon?

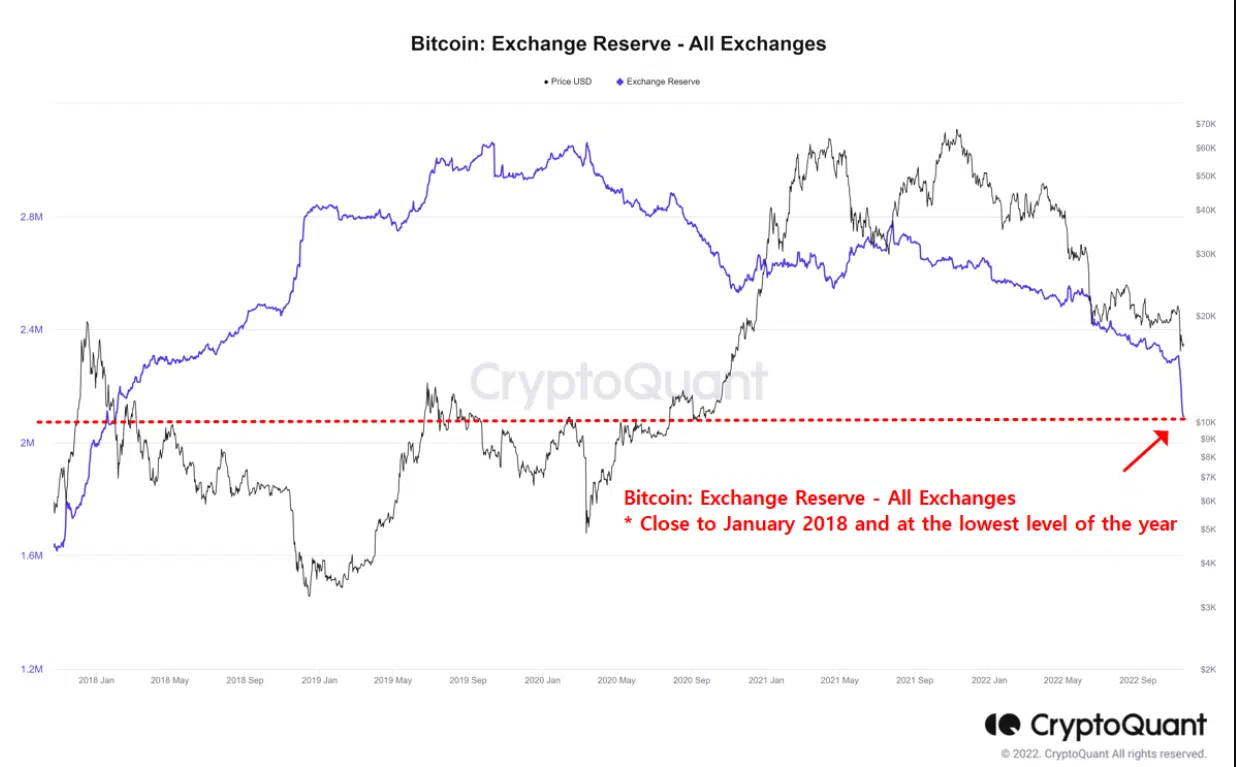

In the analysis, Wenry mentioned that the amount of BTC held by exchanges was at an all-year low and was close to the level of January 2018. When trade holdings decline, the selling pressure usually weakens.

However, this time, market mistrust witnessed growth, which might have a different influence. Therefore, the current scenario, along with the recent bankruptcy of FTX, made it difficult to accurately predict which way BTC was headed.

Though the weekly chart was mostly red, at the time of writing, BTC’s price had increased by over 4% in the last 24 hours. This gave investors some hope for a further price surge in the coming days.

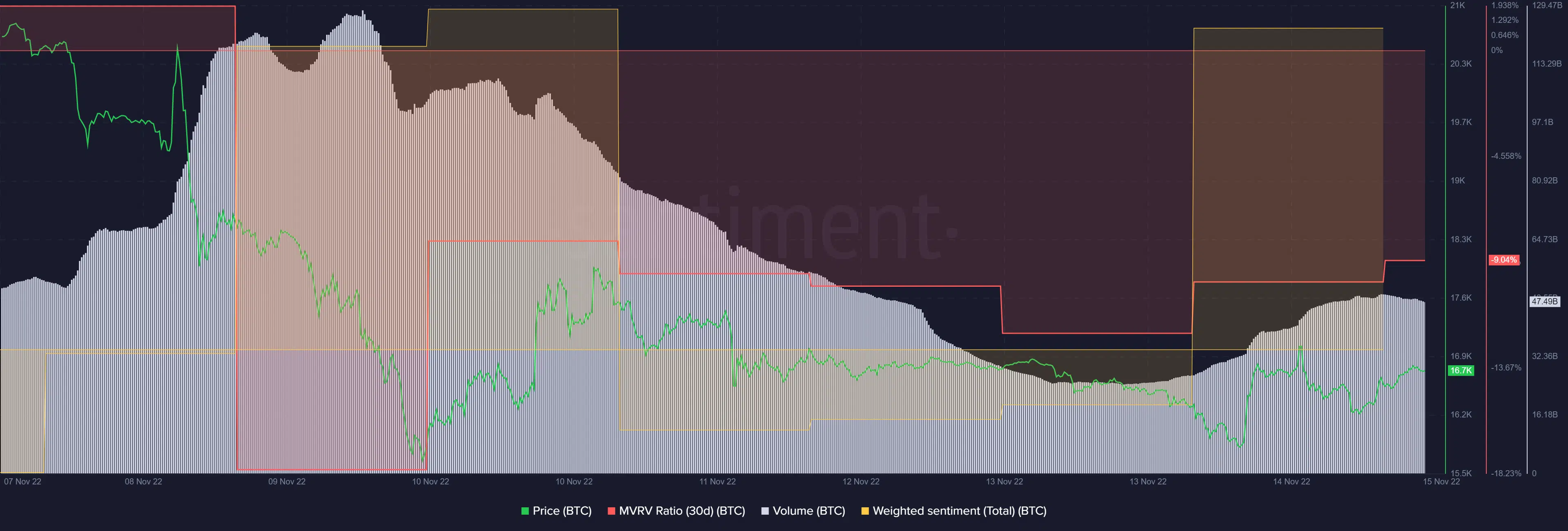

Several on-chain metrics were also supportive of a price surge. For instance, BTC’s Market Value to Realized Value (MVRV) Ratio registered an uptick lately. This could be considered as a positive signal. After witnessing a decline, BTC’s volume increased over the last two days.

Furthermore, BTC’s weighted sentiment also went up, indicating higher popularity of the coin in the crypto community. Not only this, but CryptoQuant data revealed that BTC’s Puell Multiple was green. This could be an indication that the price was undervalued, further increasing the chances of a northbound movement.

Bears were still winning

A look at BTC’s daily chart revealed that the bulls were struggling to beat the bears as the latter had a massive upper hand in the market. The Exponential Moving Average (EMA) Ribbon’s data showed that the 20-day EMA was way below the 55-day EMA. This reflected a sellers’ advantage.

The Moving Average Convergence Divergence’s (MACD) finding also flashed bearish signs. The Chaikin Money Flow (CMF) was considerably below the neutral mark, which might restrict Bitcoin’s price from going up.