Bitcoin at $50K: Just a brief crash, or are bears here to stay?

- Bitcoin extended its downside, leading to concerns that bears are back in full swing.

- Exchange flows revealed limited impact, but there’s something more underneath the surface.

Bitcoin [BTC] just concluded a bearish week, followed by additional aggressive sell pressure during the weekend. The result was a FUD fest that got many wondering whether the cycle top was in.

Investors and traders had previously compared Bitcoin’s March and June tops to the double top observed at the peak of the previous bull run.

As such, the latest outcome, combined with Bitcoin’s failed breakout attempt in July, may have further eroded the market sentiment.

The sentiment shift was evident in the fear and greed index, which shifted quickly from greed to fear. As a consequence, Bitcoin’s performance this week delivered the sharpest pullback since June 2022.

This has many wondering if this could be the end of the current bullish season.

Can Bitcoin bounce back from the weekend depths?

Our expectation for Bitcoin was that there was a significant probability of a bounce back between the $59,500 and $62,000 range.

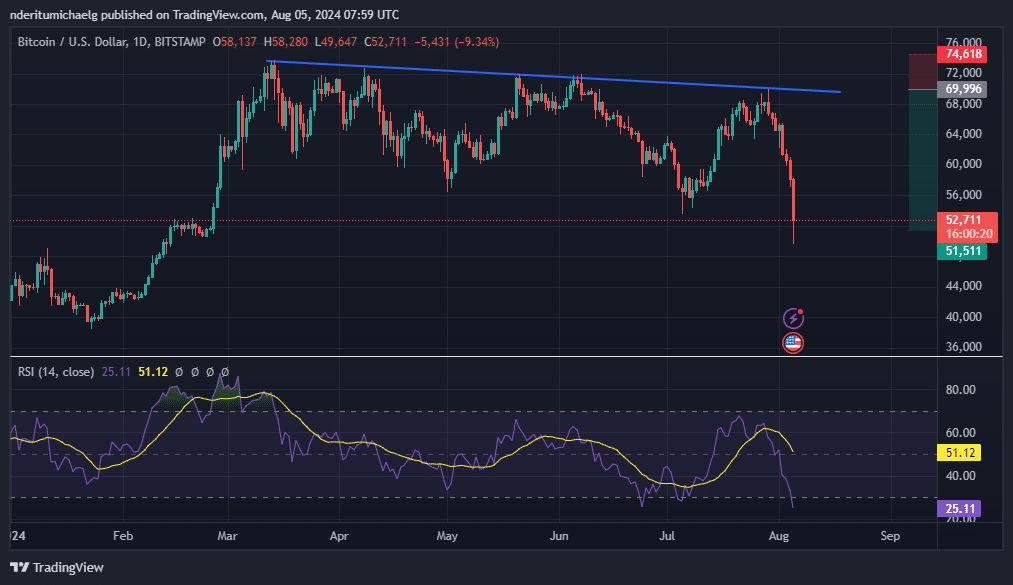

This was based on Fibonacci retracement. However, the sell pressure pushed below that range. The price recently bottomed out at $49,647 before experiencing a pullback to $52,688 at press time.

BTC’s RSI was deeply oversold at the time of observation. This suggested lower downside risks, which may explain why price pulled back slightly.

However, there was still a significant risk of more downside. The level of dip buying may indicate whether the market is ready for a recovery or still fearful that the price will keep sliding.

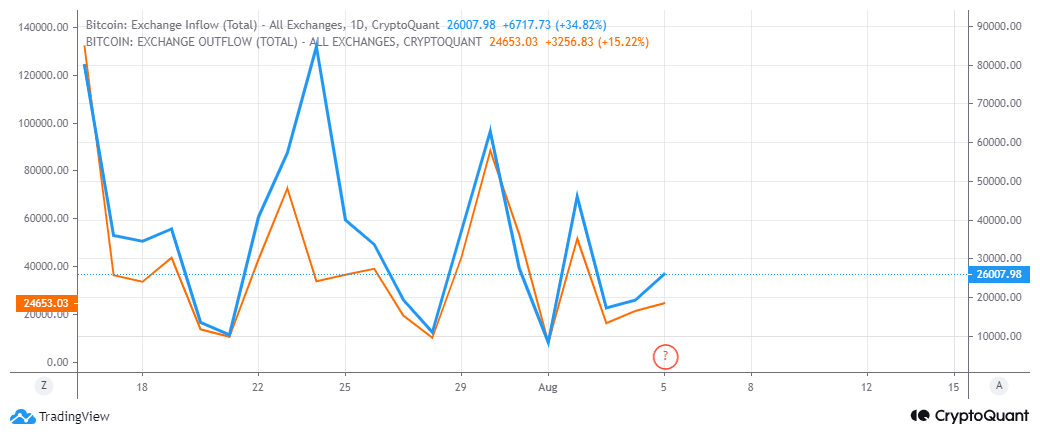

Bitcoin exchange flows have been on an overall decline since mid-July. The last two spikes were characterized by higher outflows than inflows.

However, the latest spike in the last 24 hours had higher exchange inflows than outflows.

One would think that Bitcoin exchange reserves would have gone up significantly, especially considering the intense selloff that we observed in the last few days.

However, the low exchange flows suggested that the amount on exchanges was low enough to trigger a pronounced price reaction based on a wave of sell pressure.

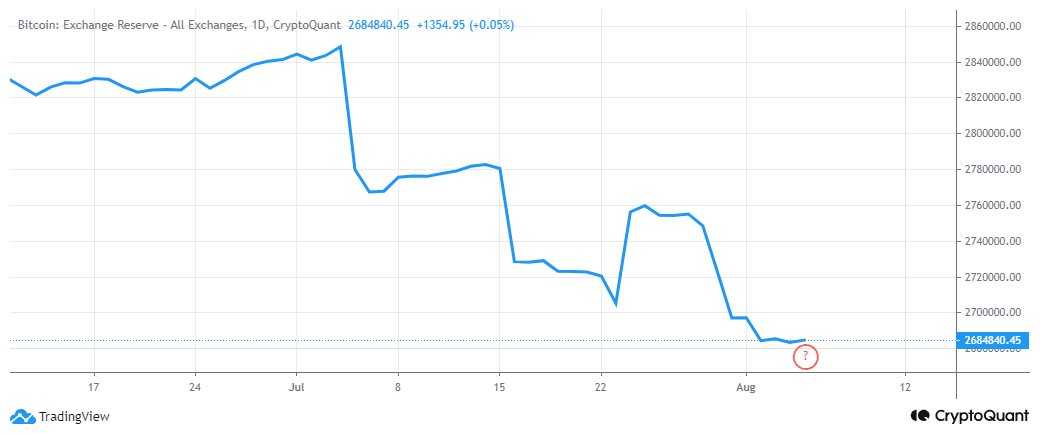

In addition, Bitcoin exchange reserves have remained low despite the selloff. We did however observe that it leveled out slightly, after previously experiencing a decline in July.

Although the market has experienced a lot of sell pressure, these metrics signaled that buyers were also quite active.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Now that Bitcoin is exposed to the institutional class, through Bitcoin ETFs, the probability is that a dip may also be limited. Discounted prices will attract a lot of buying.

Nevertheless, the impact of the latest bearish outcome cannot be overstated. Market conditions may impact liquidity flows and limit inflows into Bitcoin.