Bitcoin [BTC] Futures: Key metric touches historic low as traders shift from volatility

![Bitcoin [BTC] Futures: Key metric touches historic low as traders shift from crypto Volatility](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_A_teetering_stack_of_Bitcoin_futures_contracts_symbol_246e7499-5501-4b7f-b431-559ff91a0b13.png.webp)

- Bitcoin futures market experiences mixed reception post-FTX crash, impacting price volatility and utility.

- Recent data showed a decline in crypto-margined collateral, improving derivative collateral structure.

Ever since the dramatic FTX crash, Bitcoin [BTC] has been on a rollercoaster ride of price volatility. This has impacted its utility in the futures market significantly. According to the most recent data, Bitcoin’s reception in the futures market is a bit of a mixed bag. Also, it has made traders’ interaction with it cautious.

Read Bitcoin (BTC) Price Prediction 2023-24

According to recent data, Bitcoin’s reception in the futures market was a bit of a mixed bag. Also, it has made traders cautious.

Bitcoin Futures collateralization decline

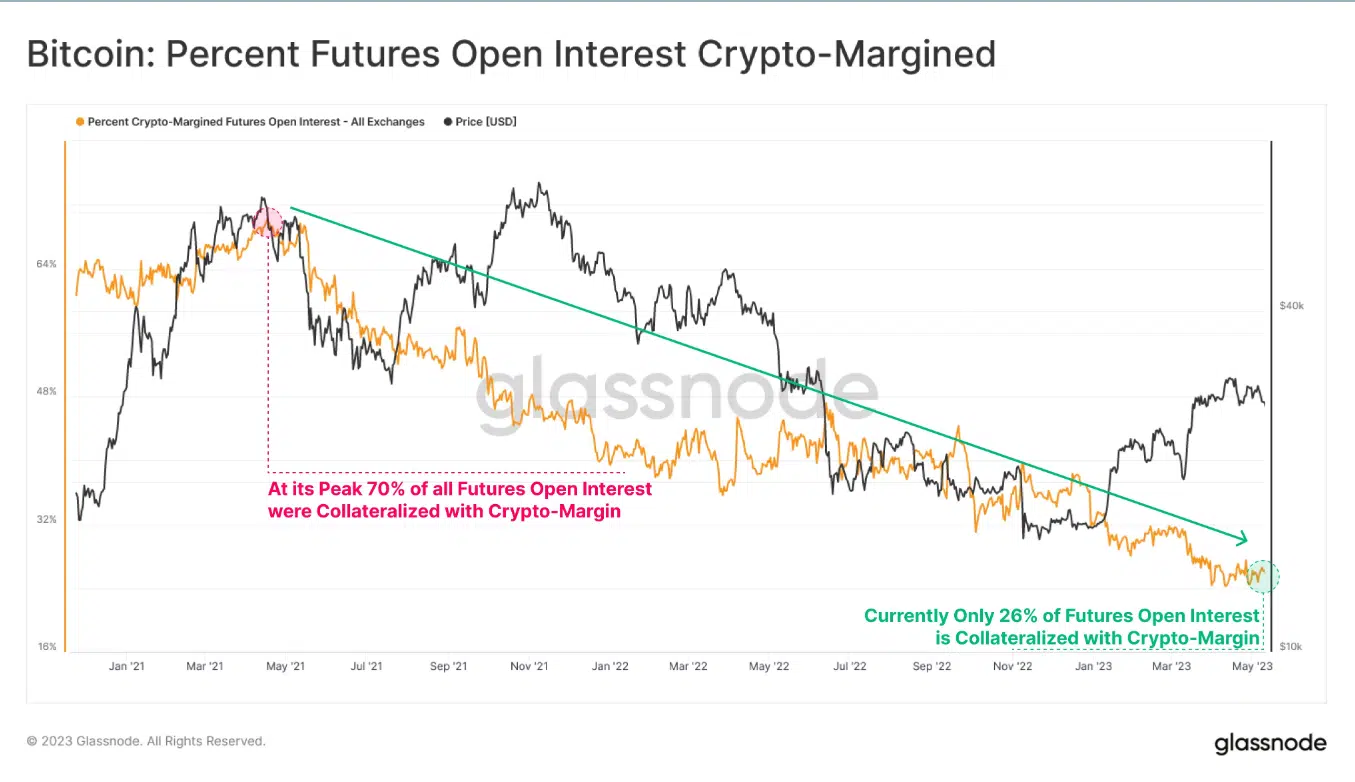

Data from Glassnode indicated that there was a cautious approach towards Bitcoin (BTC) in the derivative market. The Bitcoin Percent Futures Open Interest with Crypto-margined metric revealed a notable decline, reaching a historic low.

Analyzing the chart, it became apparent that at its peak, approximately 70% of all Futures Open Interest relied on Crypto-Margin collateral. However, according to the current data, this percentage dwindled to around 26%.

Collateral in the form of cryptocurrencies like Bitcoin or Ethereum [ETH] is inherently more volatile. Also, fluctuations in their underlying value could magnify deleveraging events.

The reduction in Crypto-Margined collateral significantly improved the overall health of the derivative collateral structure per Glassnode.

The Percent Crypto-Margined Futures Open Interest Metric represents the percentage of futures contracts’ open interest that is backed by cryptocurrencies instead of conventional fiat currencies.

This metric provides insights into the proportion of traders who choose to utilize cryptocurrencies as collateral or margin for their futures positions.

Current Bitcoin Futures Open Interest stats

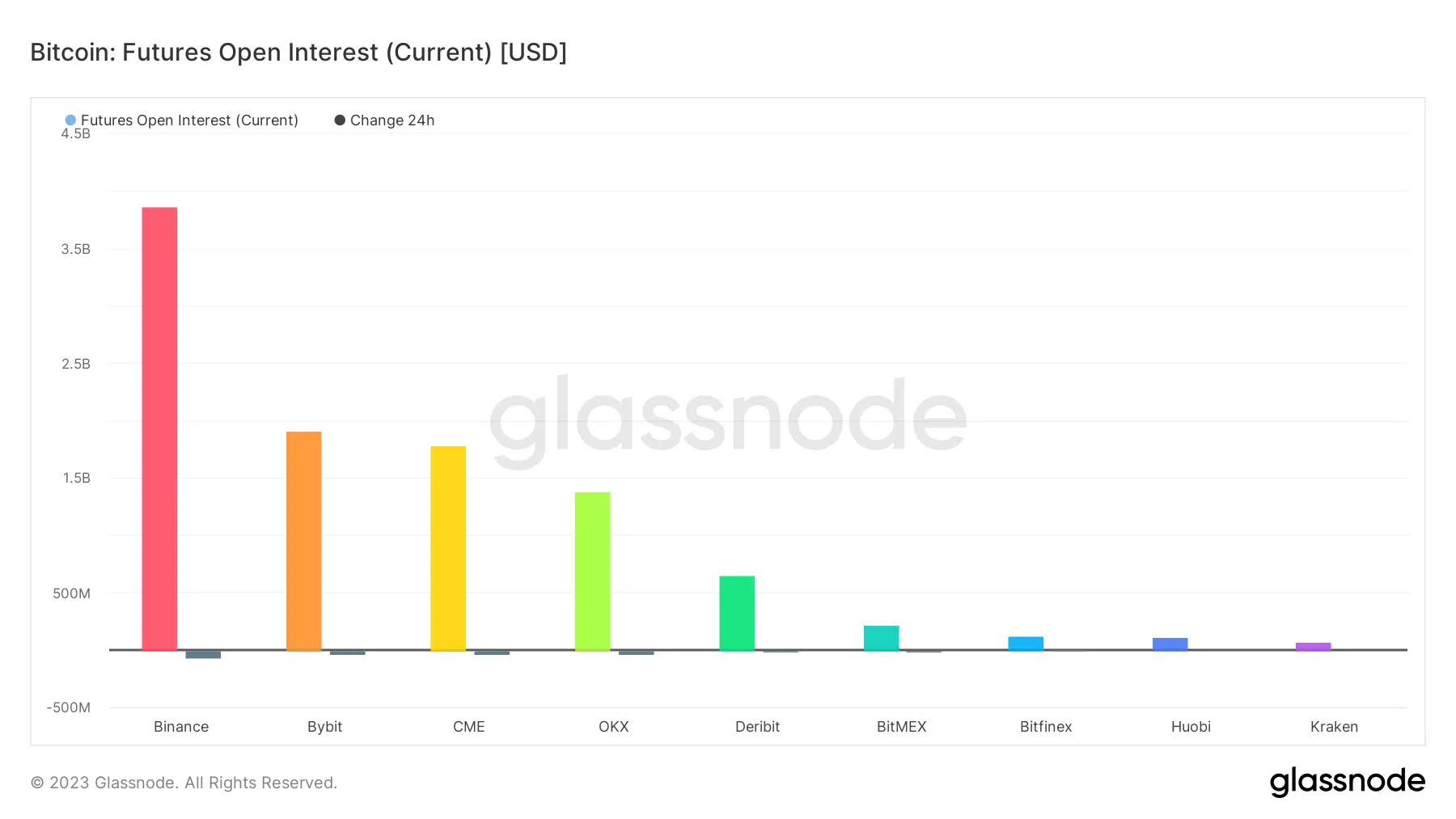

Upon examining the Bitcoin Futures Open Interest chart on Glassnode, it became apparent that it remained relatively stable around the $10 billion mark in recent weeks.

In April, the Open Interest hovered around $12 billion and $11 billion but eventually decreased to $10 billion.

As of this writing, the Futures Open Interest stood just above $10 billion. Additionally, a closer look at the current Futures Open Interest revealed that Binance was leading the pack in terms of Open Interest.

It had a value that exceeded $3.8 billion. Bybit followed closely behind with a figure surpassing $1 billion.

How much are 1,10,100 BTCs worth today

Liquidation state examined

Based on data from Coinglass, the 24-hour liquidation amount for Bitcoin was currently reported at $32.49 million. Analyzing the distribution of liquidations, it could be observed that long positions and short positions were almost balanced at the moment.

The liquidation amount for long positions stood at $4.04 million, while for short positions it was $5.26 million. As of this writing, BTC was trading at around $26,800, showing a slight gain on the daily timeframe.