Deciphering the link between Bitcoin’s [BTC] block sizes and miner fees

![Deciphering the link between Bitcoin's [BTC] block sizes and miner fees](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_three_bulding_blocks_with_each_bigger_than_the_last_w_4cc3870d-30bd-4a69-b3f3-2c5b6e98f1af.png)

- Block size growth driven by Ordinals inscriptions and BRC-20 impacts the Bitcoin network.

- Bitcoin mining fees witnessed a historic rise as mining difficulty increased.

In recent days, the rise of Ordinals inscriptions and BRC-20 showed a significant impact on the Bitcoin’s [BTC] network, even down to its block size. The latest data revealed that the block size has increased and could grow further. This begs the question: what implications does this have for the network’s miners?

Read Bitcoin (BTC) Price Prediction 2023-24

Bitcoin block size projections

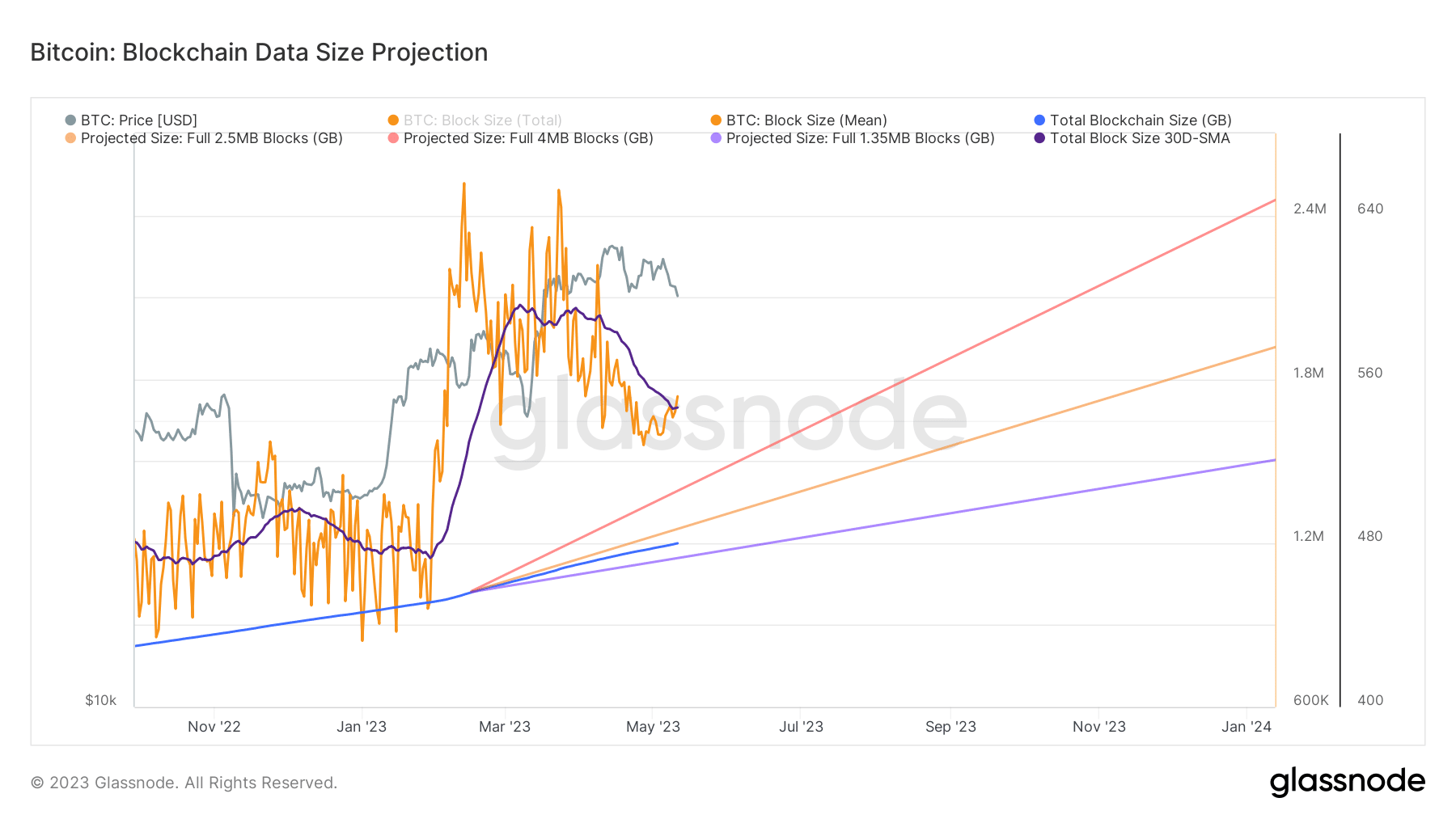

Glassnode’s data indicated a notable surge in the size of the Bitcoin blockchain, growth of approximately 24GB. This expansion can be attributed to the increasing popularity of Ordinals inscriptions, which require more block space on the network.

As of this writing, the blockchain’s size stood at 479.9 GB. However, the duration of this inscription trend remains uncertain, though there are projections concerning the potential future size of the blockchain.

These projections hinge on whether a full 4MB, 2.5MB, or 1.35MB will be consistently added to the blockchain. Regardless of the specific projection, a larger block size raises concerns for the miners operating within the network.

Some effects of increased block size on Bitcoin mining

Miners play a crucial role in the Bitcoin network, but the growing size of the blockchain presents several challenges for them.

Firstly, miners must store a complete copy of the blockchain on their computers. As the blockchain expands, it demands more storage space, which can pose difficulties for miners with limited capacity or running on resource-constrained devices.

Moreover, miners rely on transmitting and receiving blocks and transactions across the network. With a larger blockchain, the volume of data that needs to be transmitted increases.

Miners operating with slower internet connections or limited bandwidth may encounter delays in downloading and propagating blocks, potentially impacting their participation efficiency.

Additionally, when a miner receives a new block, they must validate its transactions and ensure their accuracy before adding it to their local copy of the blockchain.

As the blockchain grows in size, the validation process naturally takes longer due to the increased volume of data to be verified.

This prolonged validation period can affect the speed at which miners confirm transactions and add new blocks to the blockchain, potentially influencing the overall network efficiency.

Current state of miners fees and difficulty

Recently, the Bitcoin network experienced significant growth, leading to a notable surge in mining fees for network participants.

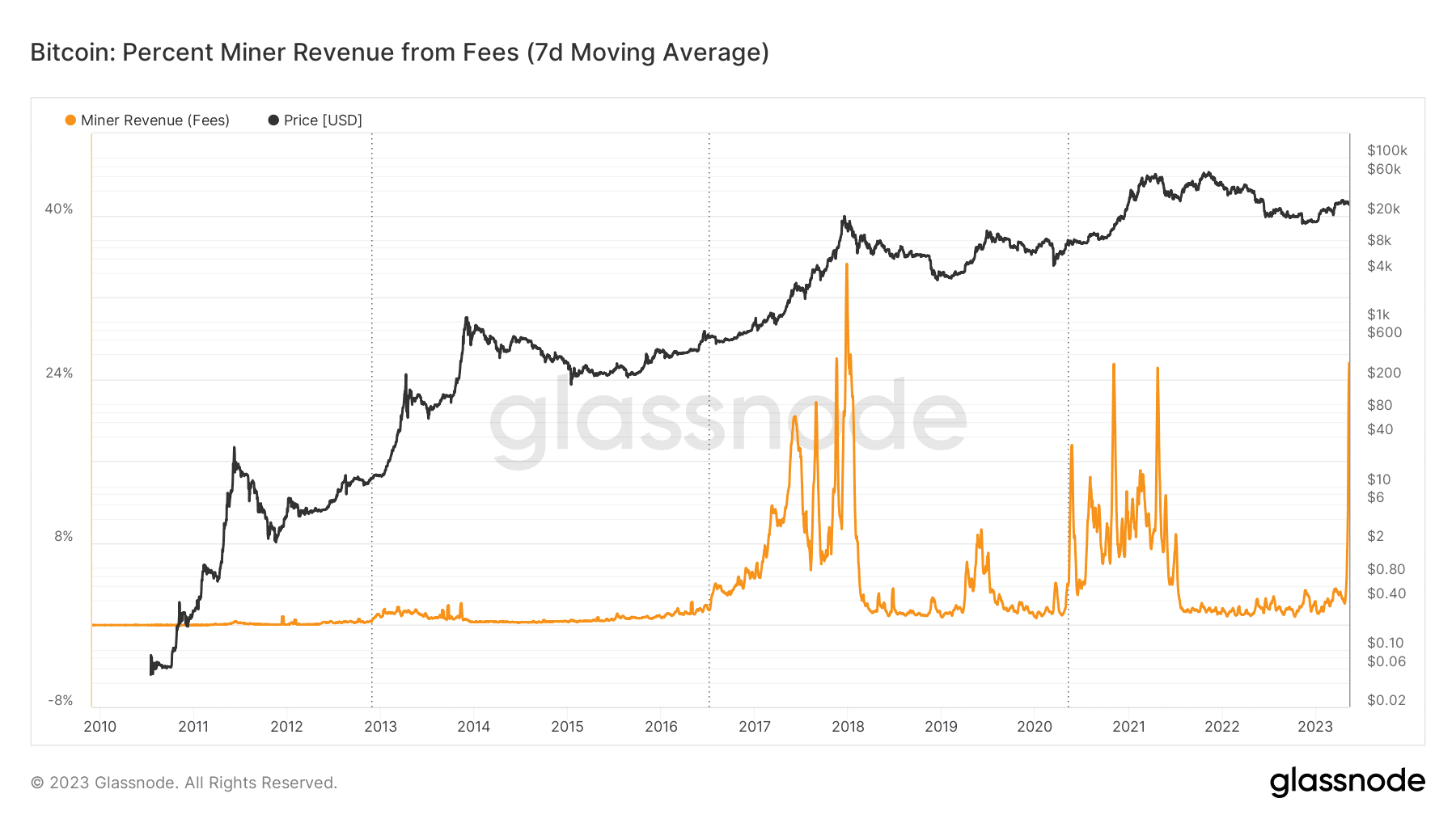

The value of mining fees reached historic levels, representing a remarkable milestone. According to data provided by Glassnode, the mining revenue spiked to approximately 25.59%.

The current level marked the third-highest mining fee since the inception of Bitcoin. The two previous instances where the mining fee reached higher levels were observed in 2017, peaking at 35.07% and 25.8%, respectively.

Furthermore, Bitcoin’s mining difficulty had a noticeable upward trend. Particularly since the beginning of this year, the mining difficulty has consistently reached new all-time highs.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Several techniques and optimizations have been proposed and implemented within the Bitcoin network to address the growing blockchain size.

One notable development is the Lightning Network, which strives to alleviate the transactional load on the main blockchain. Also, considering the current state of the Bitcoin network, there is a potential for the emergence of other L2 solutions.