Bitcoin [BTC] investors should take this into consideration before going long

![Bitcoin [BTC] investors should take this into consideration before going long](https://ambcrypto.com/wp-content/uploads/2022/10/pamplona-2313470_1280-1-e1666819656527.jpg)

Bitcoin [BTC] bulls are finally charging after what seemed like the longest wait. It delivered an impressive upside, especially over the last 2 days, confirming the return of volatility, contrary to the outcome over the last few weeks.

Here’s AMBCrypto’s price prediction for Bitcoin (BTC) for 2022-23

Bitcoin’s mid-week bounce might entice many traders to buy back in anticipation of bullish action. One of the reasons for the latest rally might also be a double-edged sword that investors should also be wary of. The low volumes and unfavourable market conditions encouraged a bearish outlook, with many investors expecting more downside.

Leveraged short liquidations trigger more sell pressure

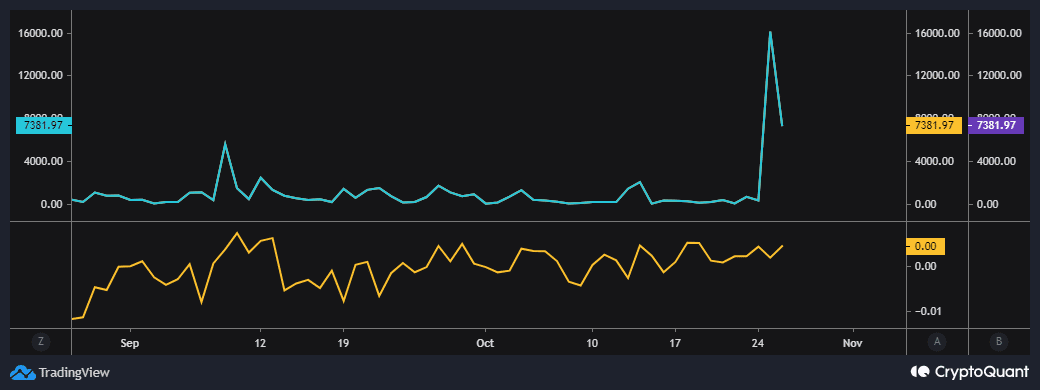

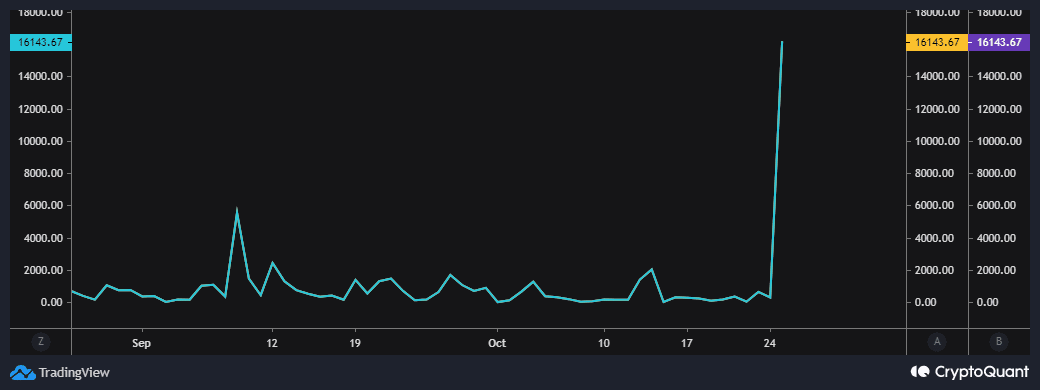

A week ago, we observed higher demand in the derivatives market than in the spot market. One of the potential reasons for this was higher leveraged positions. Since most traders expected more downside, most of the leveraged positions were short sellers. As a result, Bitcoin’s upside in the last two days resulted in severe liquidation of leveraged short positions.

More than 16,000 leveraged short positions were liquidated in the last 24 hours, at press time. Interestingly, Bitcoin funding rates dropped during the same period, suggesting that most of the BTC demand was for short positions. Hence, the drop when the price started rallying.

The same metrics revealed a drop in leveraged shorts liquidations, confirming that traders are exiting their positions. Bitcoin’s estimated leverage ratio remains high despite the liquidations. A confirmation that investors are now switching to long trades.

The switch to leveraged longs underscores the same reasons for which the market has seen an increase in mid-week volatility. Highly leveraged positions lead to more price sensitivity. A move against the expected direction leads to heavy liquidations.

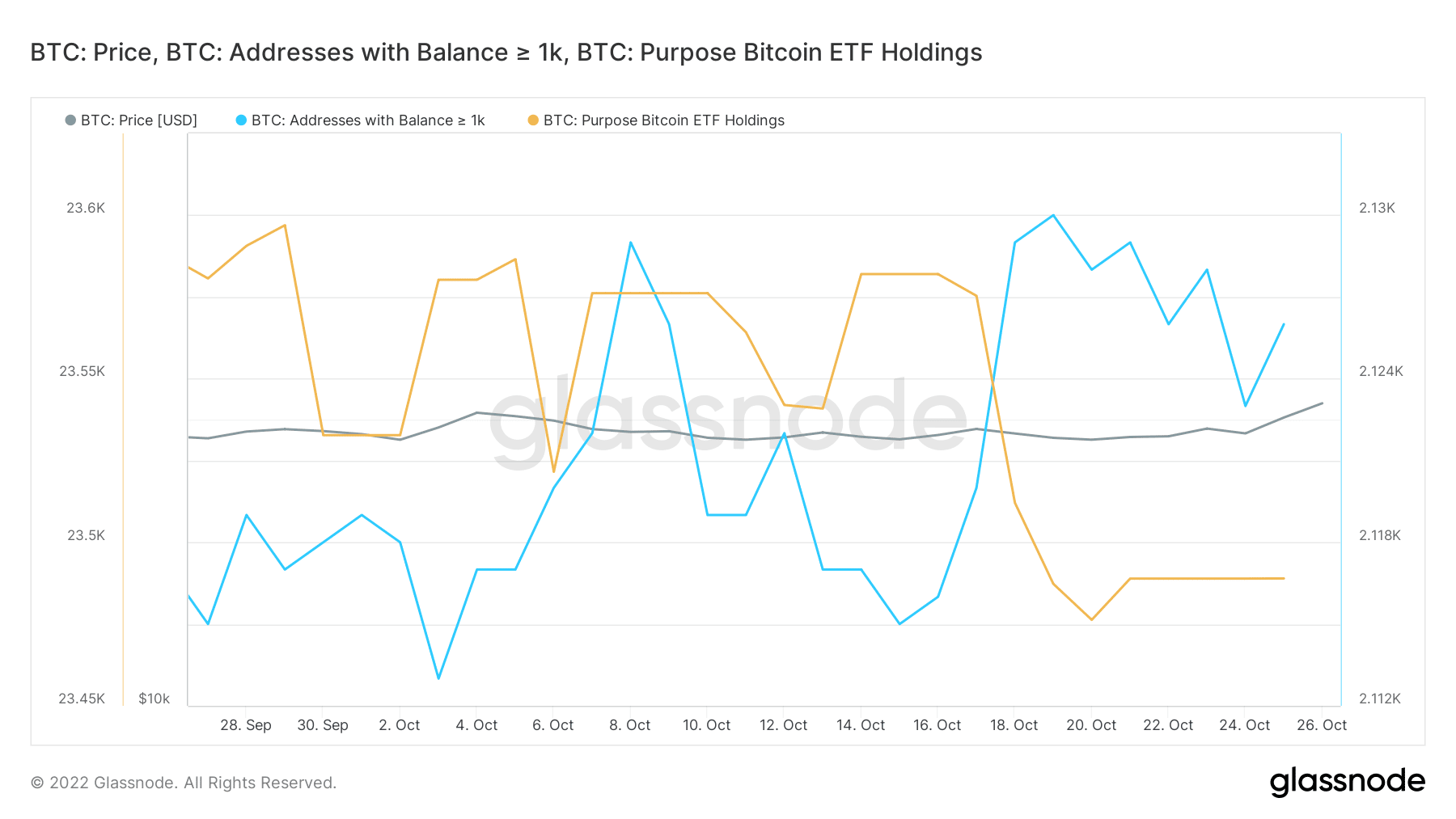

A look at Bitcoin’s spot demand also revealed that whales have been accumulating, but demand is still low. Addresses holding more than 100 BTC and those with more than 1000 BTC demonstrated a slight uptick over the last 2 days.

Despite this upside, however, the Purpose Bitcoin ETF, one of the most important institutional indicators, did not register much upside. This, combined with the relatively low demand by whales, suggests a significant likelihood that the latest upside might be limited.

What of Bitcoin’s price action?

Bitcoin is bound to experience a sell-off sometime soon as investors start taking profit. Bitcoin was trading at $20,909, at press time, after an 8% upside in the last 24 hours.

Source: TradingView

Earlier in the week, we highlighted the potential for a breakout or breakdown from its wedge pattern. The outcome has favoured the bulls, but the price is now approaching the overbought zone. This means we might see the return of selling pressure, but that will likely be above the $22,000-range.

Conclusion

Bitcoin investors should proceed with caution, especially considering that the market is characterized by low institutional and whale demand. A high leverage ratio may subject Bitcoin to more sensitivity towards sell pressure.